-

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

July 23 -

The London interbank offered rate will phase out in a matter of months, and lawmakers have to step in to prevent a legal fiasco. They need to make Secured Overnight Financing Rate the sole fallback benchmark.

July 23 Alternative Reference Rates Committee

Alternative Reference Rates Committee -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

The goal is to add customers and prop up borrowing until business travel rebounds and consumers burn through their excess cash, CEO Roger Hochschild says.

July 22 -

The retail consolidation in Midwestern markets will also support the bank’s branch expansion in Atlanta, Charlotte and other fast-growing cities across the Southeast.

July 22 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

Tech companies that help banks detect money laundering have raised hundreds of millions of dollars in recent months because of advances in their products. Observers suggest the vendors will have to diversify their offerings to survive in a crowded field.

July 21 -

The London interbank offered rate was a flawed benchmark, but it was nonetheless a centerpiece of finance for decades. Congress should ensure it doesn't replace one interest rate monoculture with another as Libor winds down.

July 21 Willkie, Farr & Gallagher LLP

Willkie, Farr & Gallagher LLP -

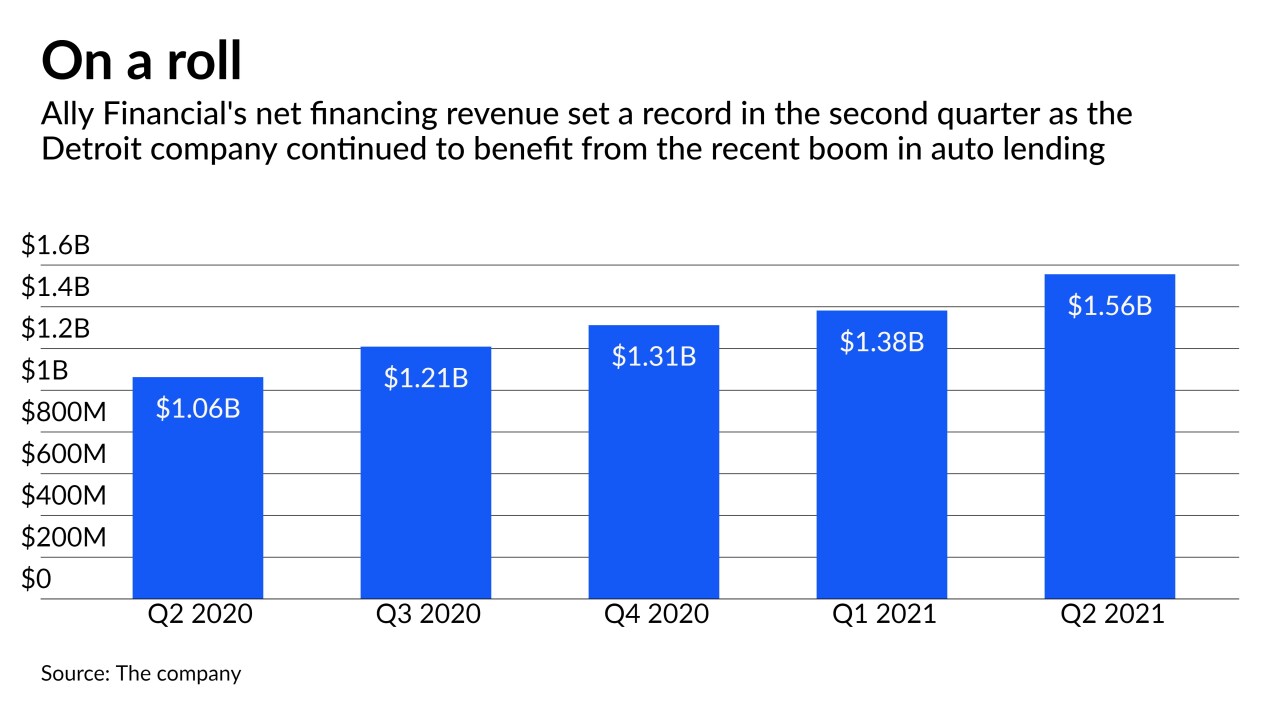

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Pittsburgh company offset relatively flat revenue and lending in the second quarter with strong service charges, wealth management fees and a $1.1 million reserve release.

July 20 -

Commercial and industrial loans fell 14.3% in the second quarter. But CEO Chris Gorman says green shoots are emerging, pointing in particular to recent stability in credit line utilization rates.

July 20 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

July 20 -

President Biden nominated Judith D. Pryor as first vice president of the Export-Import Bank of the U.S., the nation’s official export-credit agency.

July 19 -

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

July 19 -

The Tennessee company said merger costs tied to its Iberiabank acquisition are up $40 million from previous estimates. However, savings from additional branch closings and unexpected revenue gains should soften the blow.

July 16 -

The Minneapolis company recently advised a nonprofit on a $30 million issuance that will provide financing to developers building multifamily housing and community facilities. It includes a framework, which the bank intends to deploy again, for informing investors on how the money is being used.

July 16 -

A strong showing by the North Carolina bank’s insurance arm helped to overcome lower interest rates and sluggish lending in the second quarter.

July 15 -

The Minneapolis company benefited as business for airlines and hotels picked up sooner than expected. The rebound helped fee income in the bank’s payments business approach prepandemic levels.

July 15 -

Revolut raised $800 million from investors including SoftBank Group’s Vision Fund 2 and Tiger Global Management at a $33 billion valuation, the latest sign of investor demand for fintechs.

July 15