-

Pine Labs has raised $285 million in its latest funding round, including participation from Singapore’s sovereign fund Temasek, to continue its geographic and product expansion.

May 17 -

The company said it will increase access to affordable products, expand financial-education offerings and launch a National Unbanked Advisory Task Force.

May 17 -

The Federal Reserve Bank of Atlanta is enlisting banks, payment companies, retailers and universities to address problems that digital commerce creates for cash-reliant consumers.

May 14 -

The best-performing banks' revenue rose at nearly twice the rate of expenses thanks to mortgage refinancing and the Paycheck Protection Program.

May 14 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

May 12 -

The San Francisco-based technology provider raised $70 million in a Series C round this week, bringing its total funding to $114 million.

May 11 -

Despite strong payment volume and revenue, Affirm's earnings suffered due to stock compensation and an adjustment on its purchase of PayBright in January.

May 10 -

The Mojaloop Foundation's Adama Diallo and Paul Hunter argue open, affordable real-time payments systems have the potential to include all and help turn underserved women into the newly served, enabling them to become economically active.

May 10 Mojaloop Foundation

Mojaloop Foundation -

Now that Western Union has begun its deployment at the big-box retailer, where MoneyGram has long had a presence, the incumbent is watching for signs of pricing pressure.

May 7 -

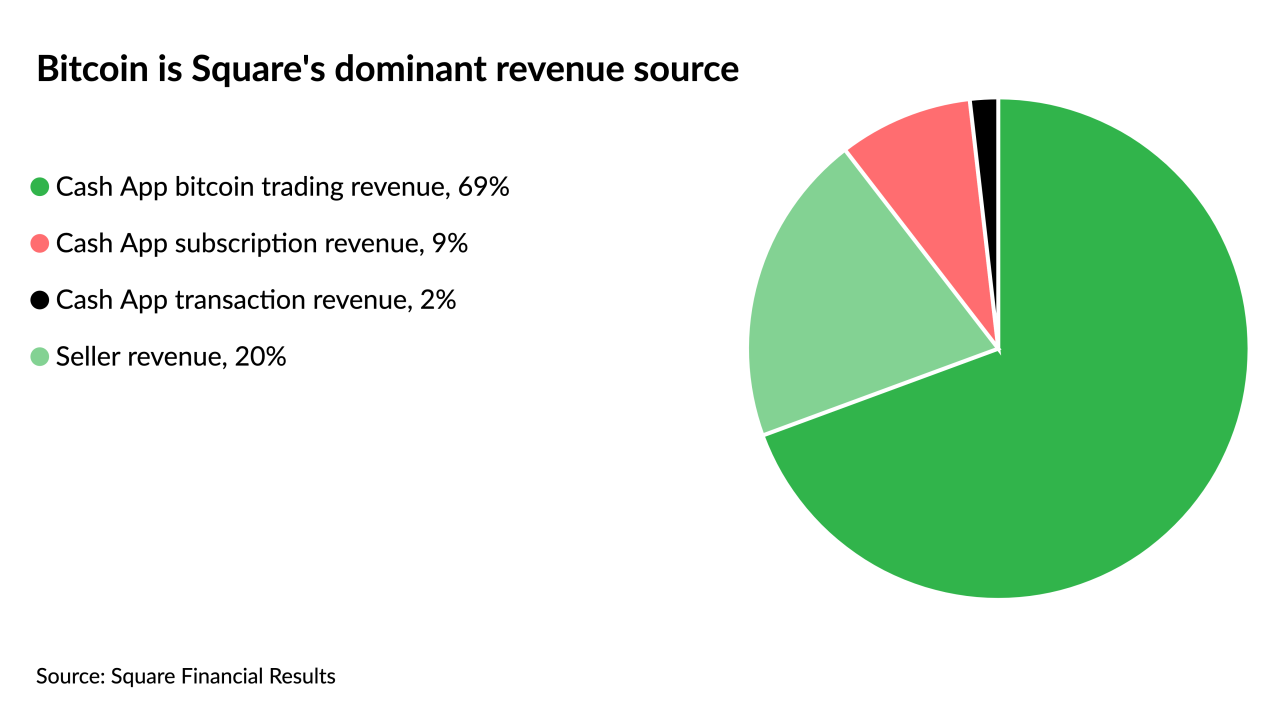

Cryptocurrency rally enabled the company's Cash App to generate the bulk of its revenue.

May 7 -

Cryptocurrency rally enabled the company's Cash App to generate the bulk of its revenue.

May 6 -

It's "powerful … to be able to use the word ‘bank’ in our marketing because we are a legitimate financial institution," CEO Dan Henry said Wednesday. Its rival Chime recently agreed to stop referring to itself as a bank in a settlement with California regulators.

May 6 -

It's "powerful … to be able to use the word ‘bank’ in our marketing because we are a legitimate financial institution," CEO Dan Henry said Wednesday. Its rival Chime recently agreed to stop referring to itself as a bank in a settlement with California regulators.

May 6 -

FIS is planning to follow the integration of its Worldpay acquisition by adding hundreds of new sales people to bring the combined companies' technology to a wider market.

May 6 -

PayPal saw account openings and payment volumes soar as the world shifted away from cash. And as economies reopen, PayPal must determine whether consumers will continue their aggressive use of digital payments — or return to their old habits.

May 5 -

The company hopes to someday return to 2019 levels of in-person money transfer activity, and its recent pact with Walmart is a big part of that strategy.

May 4 -

The $925 million deal would bring Zego's real estate management and payments software to Global Payments, which views real estate as a $6.5 billion market.

May 4 -

The purchases of Truck Insurance Specialists and Hometown Insurance are expected to help the company expand its dealings in transportation and agriculture.

May 4 -

Bank of America and JPMorgan Chase struck the first swaps trade tied to the Bloomberg Short Term Bank Yield index Friday, as Wall Street tests new benchmarks meant to help replace Libor.

May 3 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

April 29