-

CEO Corbat says “thousands” of call center jobs may be lost; Barclays shareholder sells all stock in the bank and Deutsche’s biggest slashes its stake.

February 19 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Wymar Federal Credit Union in Louisiana has also distributed a bonus to members.

February 14 -

Stripe’s large and quickly expanding valuation enable it to forge connections among many sources of innovation, placing even more pressure on traditional technology providers and financial institutions.

February 14 -

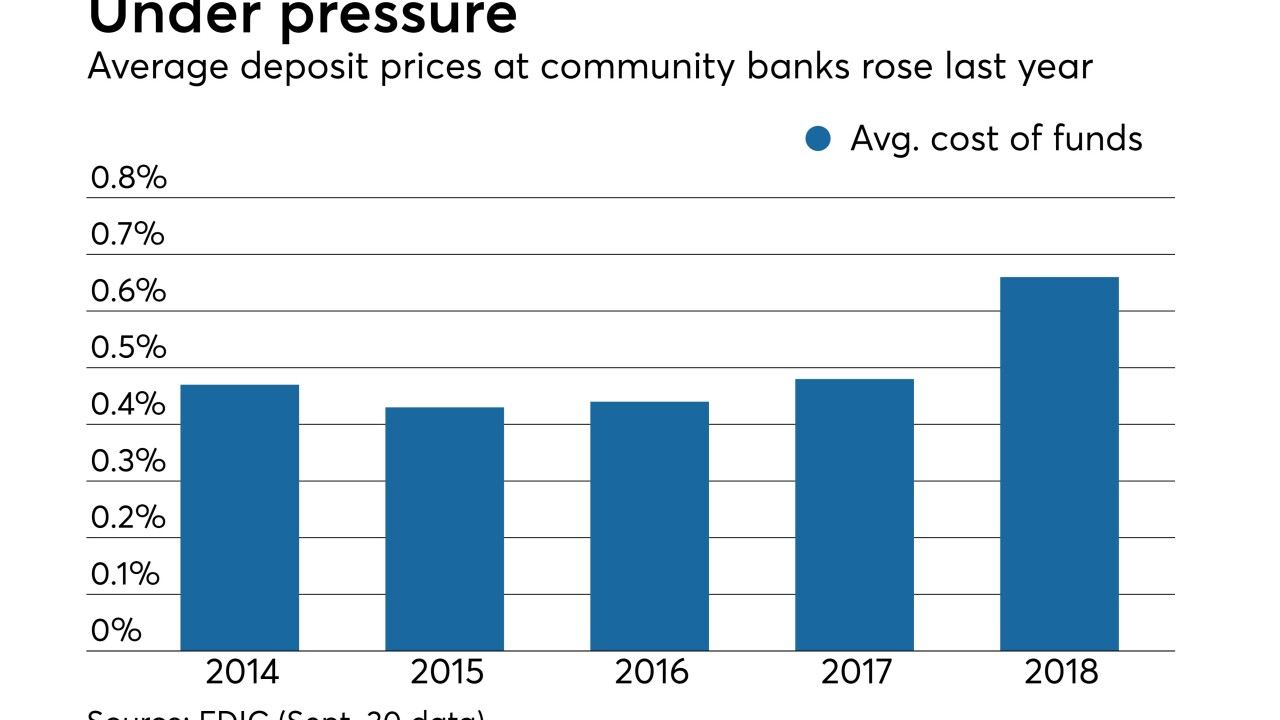

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

It often takes an underlying development, such as a major executive change or the launch of a new product or partnership to excite investors, but Diebold Nixdorf stock prices jumped Wednesday in the wake of a solid, but not outstanding, fourth quarter earnings report.

February 13 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

As robotic process automation expands into day-to-day lending operations, IBM is teaming up with UiPath, a startup that specializes in the new technology.

February 12