-

The Florida bank sold $344 million of taxi-medallion and other loans in the fourth quarter, saying it was positioning itself for the future.

January 23 -

Double-digit gains in net interest income more than offset sluggish growth in fee income at the Salt Lake City company.

January 23 -

A recent high-profile news story doesn't paint the National Credit Union Administration chairman in a good light, but some in the industry say it could also lead to positive changes on the board.

January 23 -

The Florida company's earnings increased after it completed a big acquisition and produced strong year-over-year loan production.

January 22 -

The McLean, Va., company also reported a decline in charge-offs on credit card loans.

January 22 -

CEO Greg Carmichael says the Cincinnati bank will hire bankers in Denver, Dallas and Houston as part of a broader expansion into fast-growing markets that are home to lots of midsize firms. It is also interested in buying more fee-based businesses.

January 22 -

The consent order against California Check Cashing Stores is part of a broader crackdown by the Department of Business Oversight on small-dollar lenders trying to skirt interest rate limits.

January 22 -

The Virginia company cautioned that it expects lending to slow down this year.

January 22 -

The fingerprint biometric firm Zwipe raised approximately US$ 14 million (Norwegian Krone 120 million) in its latest Series B funding round.

January 22 -

The low-cost deposits it gained in its purchase of 52 Wells Fargo branches, combined with higher interest rates, lifted Flagstar's net interest margin.

January 22 -

The company will top $1 billion in assets after it buys the parent of F&M Bank in Tomah, Wis.

January 22 -

Many government employees are turning to alternative lenders to bridge the gap between paychecks; the average pay at the biggest U.S. banks rose by just 3% last year, well below the CEO rate.

January 22 -

Fintechs are developing data-crunching, automated products that seek to help banks precisely calibrate capital levels. The banks' goal is to pass stress tests while maximizing returns to investors.

January 20 -

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

The Tennessee company is pleased with loan growth. It has also been able to reduce its dependence on brokered deposits as it brings in new customers following its purchase of Capital Bank.

January 18 -

The company has filed a request with a federal judge in Pennsylvania for a summary judgment in two counts against it, accusing the bureau of failing to provide evidence.

January 18 -

Strong demand for commercial loans helped offset weaker growth in consumer lending and a decline in fee income.

January 18 -

Even though American Express received pre-approval to provide transaction settlement services in China more than a year ago, it is playing the waiting game to get those wheels in motion amid a fiery political climate.

January 18 -

A spike in charge-offs in the third quarter stoked concerns about commercial real estate exposure. Shares in the Arkansas company rose after it reported its fourth-quarter results.

January 18 -

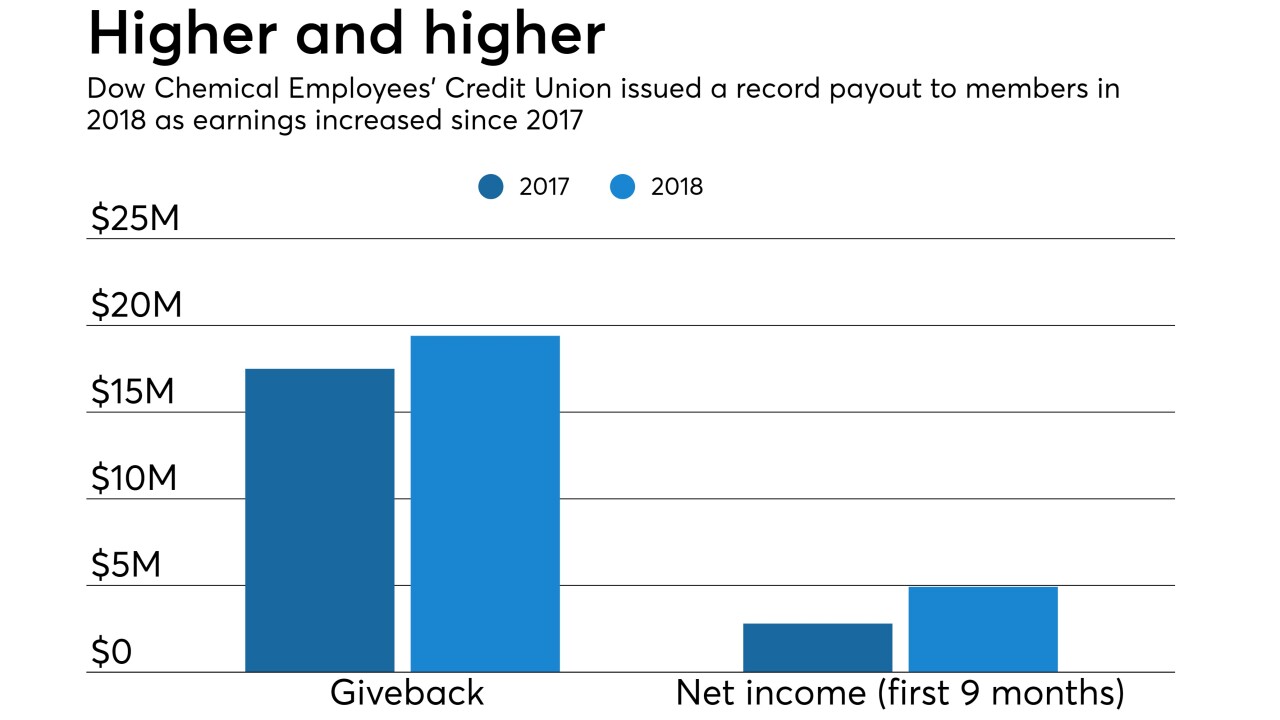

The Midland, Mich.-based institution returned $19.4 million to members for 2018 through rewards and dividends.

January 18