-

Democratic proposals to offer free accounts, restrict overdraft fees and cap interest rates have zero chance of passage. But analysts say lawmakers’ push for products that help consumers is influencing some banks’ decisions to institute reforms on their own.

July 28 -

Flagstar’s main business is lending to nonbank mortgage lenders, and New York Community Bancorp CEO Thomas Cangemi has a plan for tapping those borrowers to drive loan and deposit growth.

July 28 -

Banco Santander SA said it’s on track to beat a key profitability metric for the year with earnings from the U.S. and U.K. fueling the Spanish lender’s resurgence after historic losses linked to the pandemic.

July 28 -

The pandemic created a new expectation that banks should show empathy for customers in crisis. Let’s keep it that way.

July 28

-

The card brand's recent deals to buy Tink and Currencycloud for a combined $3 billion are meant to give it a stronger presence in fast-growing fintech markets.

July 27 -

States have the option of adopting the oversight framework issued by the Conference of State Bank Supervisors, which resembles capital and liquidity plan proposed by the Federal Housing Finance Agency.

July 27 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

CEO Stephen Squeri told analysts a fresh crop of rivals, possibly including Wells Fargo, will be quick to fill the void created by Citi's departure from the high-end market.

July 23 -

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

July 23 -

The London interbank offered rate will phase out in a matter of months, and lawmakers have to step in to prevent a legal fiasco. They need to make Secured Overnight Financing Rate the sole fallback benchmark.

July 23 Alternative Reference Rates Committee

Alternative Reference Rates Committee -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

The goal is to add customers and prop up borrowing until business travel rebounds and consumers burn through their excess cash, CEO Roger Hochschild says.

July 22 -

The retail consolidation in Midwestern markets will also support the bank’s branch expansion in Atlanta, Charlotte and other fast-growing cities across the Southeast.

July 22 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

Tech companies that help banks detect money laundering have raised hundreds of millions of dollars in recent months because of advances in their products. Observers suggest the vendors will have to diversify their offerings to survive in a crowded field.

July 21 -

The London interbank offered rate was a flawed benchmark, but it was nonetheless a centerpiece of finance for decades. Congress should ensure it doesn't replace one interest rate monoculture with another as Libor winds down.

July 21 Willkie, Farr & Gallagher LLP

Willkie, Farr & Gallagher LLP -

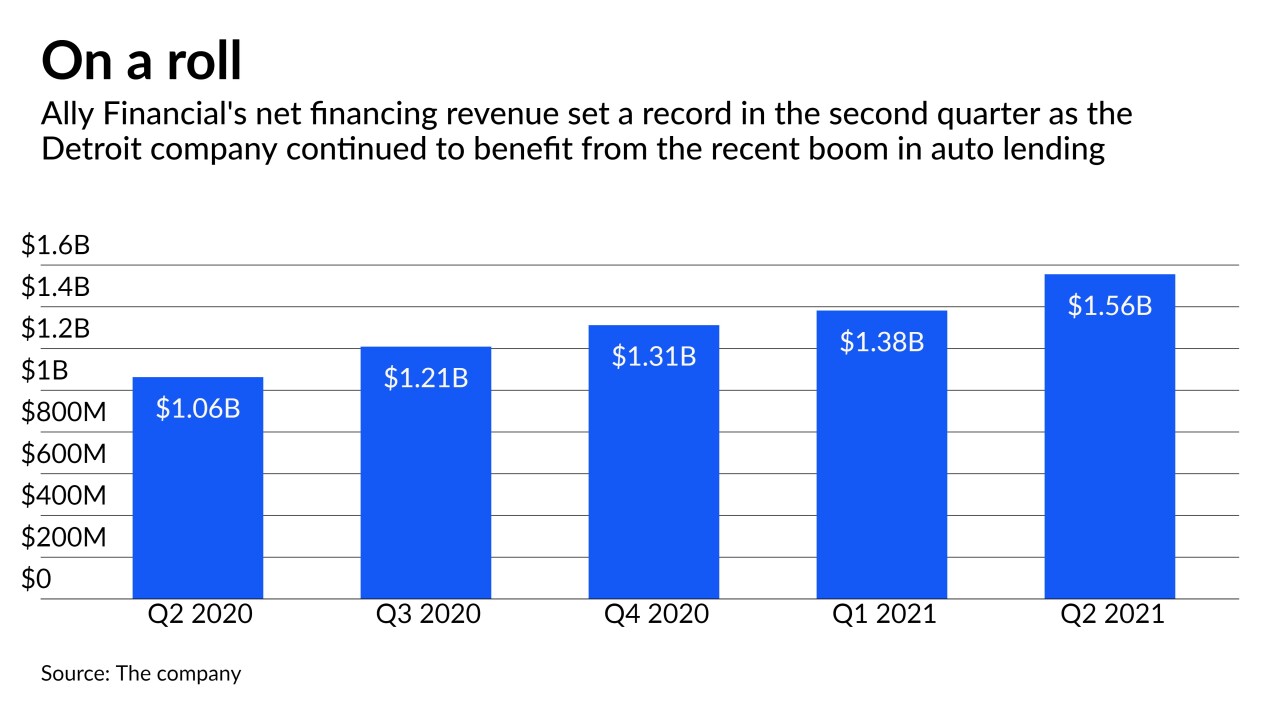

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

The Pittsburgh company offset relatively flat revenue and lending in the second quarter with strong service charges, wealth management fees and a $1.1 million reserve release.

July 20 -

Commercial and industrial loans fell 14.3% in the second quarter. But CEO Chris Gorman says green shoots are emerging, pointing in particular to recent stability in credit line utilization rates.

July 20 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20