-

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

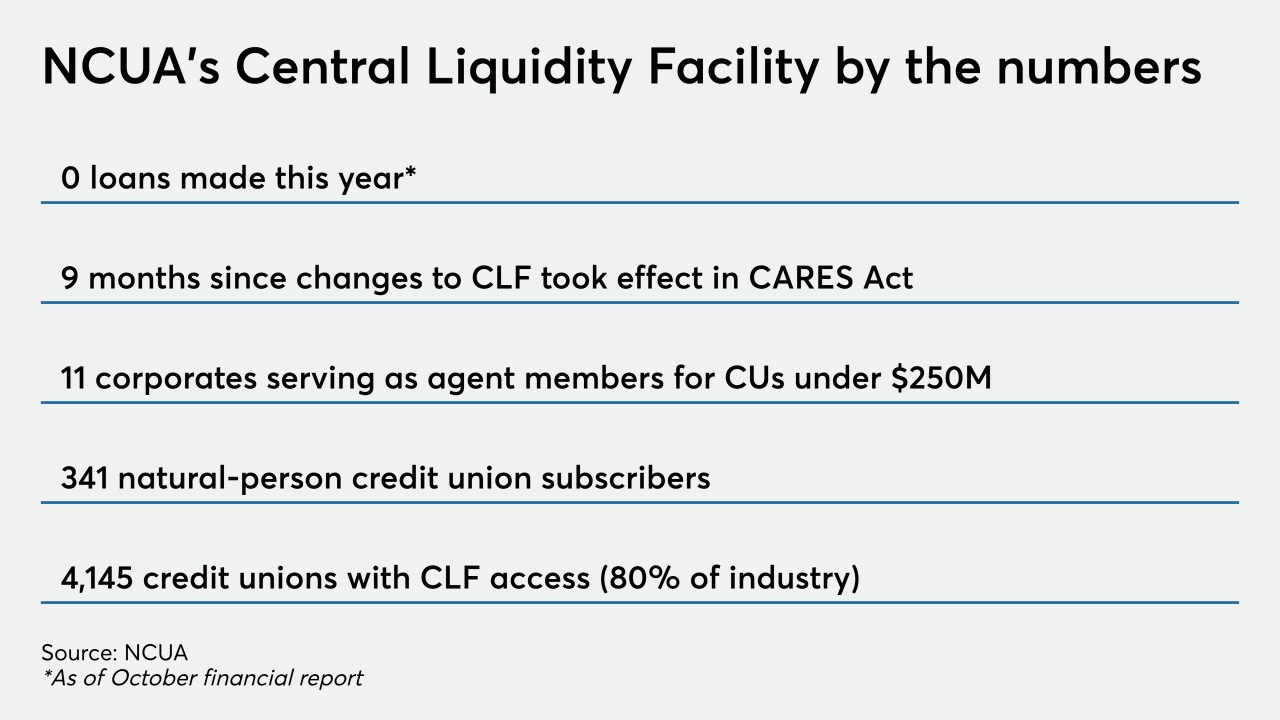

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

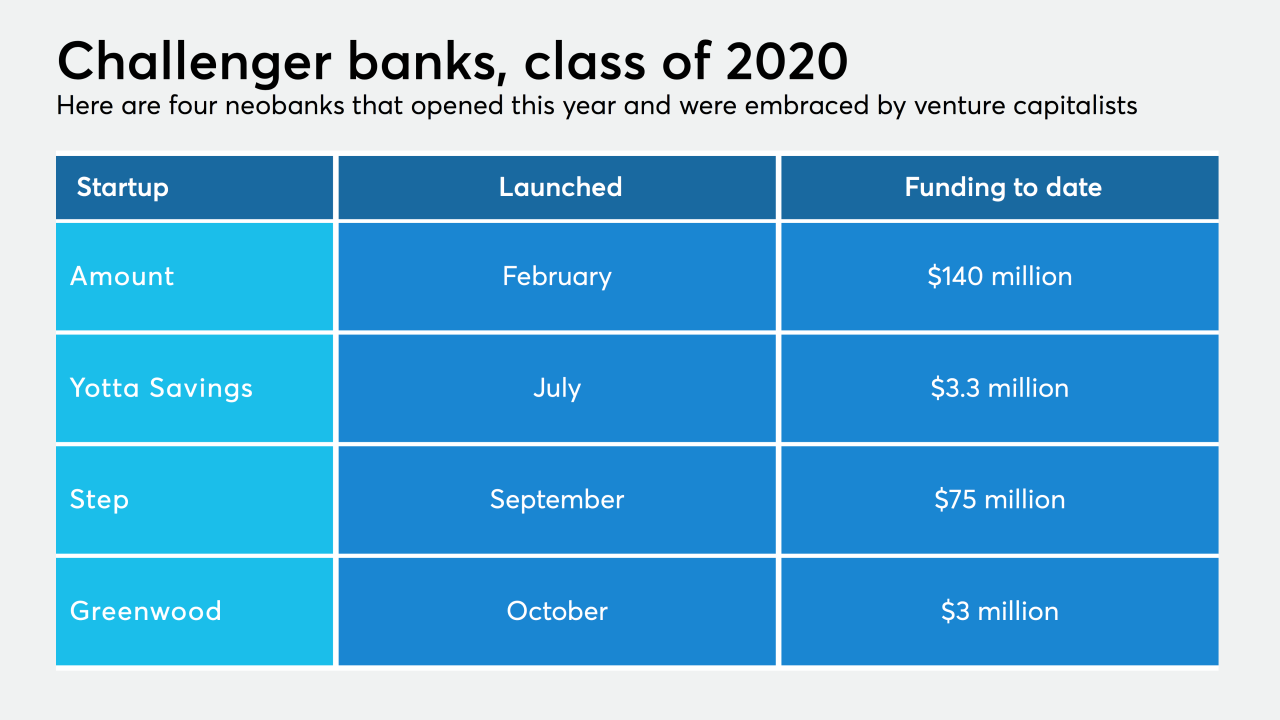

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

E-commerce and digital finance are expanding quickly due to the pandemic, economic downturn and plans for recovery — providing opportunities for VCs that back technology that powers faster, more digital payments.

December 7 -

-

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

The company is looking to shutter 10 of its 63 branches over coming months, reflecting a shift in customer preferences.

December 4 -

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

December 3 -

London-based crypto payments app Ziglu, launched by Starling Bank co-founder Mark Hipperson, has raised £6 million (about $8 million) on the Seedrs equity crowdfunding platform.

December 2 -

First Horizon, TCF and Webster are among the banks eyeing efficiency initiatives that could include more branch closings, layoffs and reduction of office space. Expect others to follow suit as low rates and tepid loan demand tied to the pandemic pressure revenue.

December 1 -

The Federal Deposit Insurance Corp.’s latest report on the industry’s health had positive news about the earnings recovery last quarter, but it also showed that low interest rates amid continuing economic uncertainty are putting downward pressure on asset yields.

December 1 -

Marketplace payments technology provider ConnexPay has secured additional funding from investors to reach $15 million, and it will use its funding to increase product offerings in the travel industry and expand in other e-commerce sectors.

December 1 -

Stripe Inc. is in talks to raise a new funding round valuing it higher than its last private valuation of $36 billion, according to people familiar with the matter.

November 25 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

Democrats called the decision by Treasury Secretary Steve Mnuchin "misguided," arguing that it's too soon to shutter the Federal Reserve's emergency-lending programs. Republicans say the programs have run their course and should expire a the end of the year.

November 20 -

The pandemic has highlighted massive inequalities in American life but the financial services industry can play a role in reducing these divisions.

November 20

-

Joseph Lebel's promotion follows a third-quarter loss as the New Jersey company company looks to get ahead of credit issues by selling high-risk loans.

November 20 -

E-commerce fraud prevention provider Forter has raised $125 million in a Series E funding round, pushing the New York-based company's valuation to more than $1.3 billion.

November 19 -

Community development financial institutions, which tend to be less digitally savvy than traditional banks and credit unions, are developing online-lending platforms and automating backroom processes with investments and technical assistance from big banks, high-tech firms and other sources.

November 19 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17