Fintech

Fintech

-

LendingClub and Varo Money are making inroads into the traditional financial system, but other fintechs still face long odds.

February 20 -

Some institutions say the combination of chatbots and social media could entice new borrowers, but burdensome legacy systems may limit their effectiveness.

February 20 -

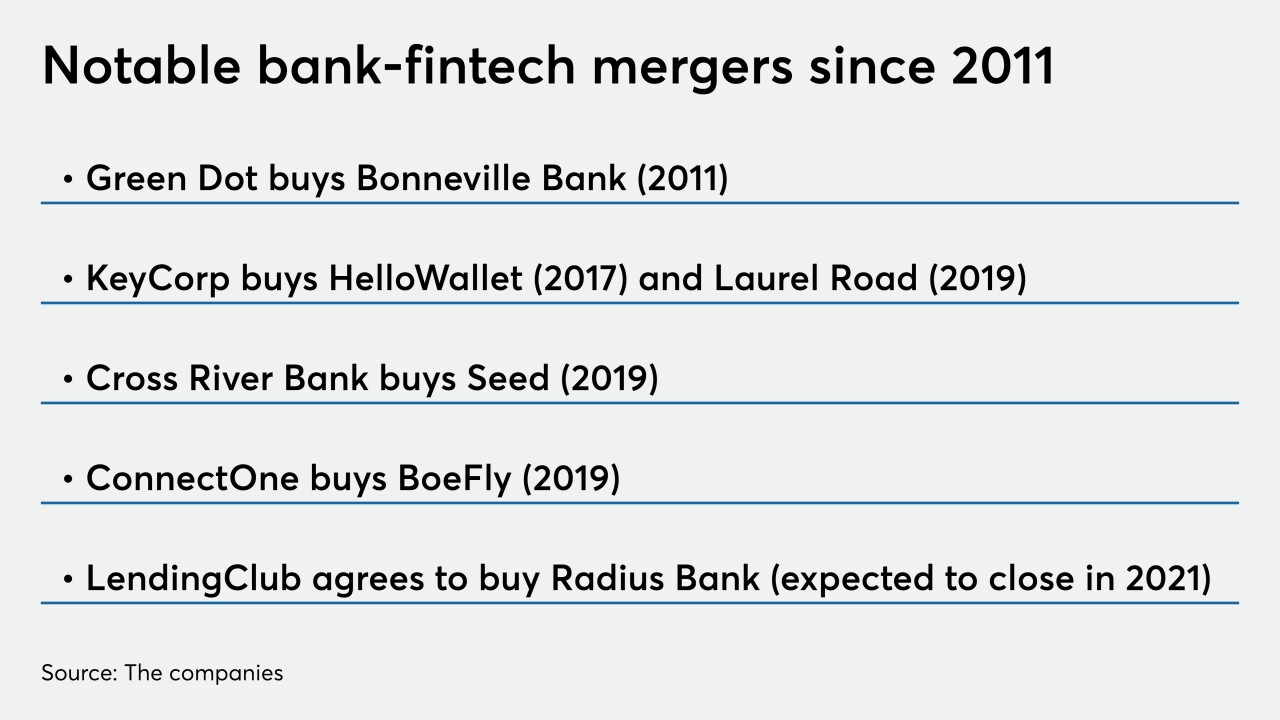

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

February 19 - AB - Technology

The move comes as the fintech tries to shake off criticism that its main products are payday loans by another name.

February 19 -

When established card networks such as Visa, American Express and Mastercard start investing in fintech lending platforms such as Divido and ChargeAfter — as well as in the fintech lenders themselves such as Klarna and Vyze — it’s a clear signal that the future of unsecured personal loans may not be delivered by banks.

February 19 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 -

Clearer standards make it easier for shareholders to boost their stakes in banks without having to file for bank holding company status.

February 18 -

The deal for Boston-based Radius would be the first in history in which an online lender buys a mainstream bank.

February 18 -

Long-term success in the adoption of cloud technology requires a focus and integration of cloud within the broader business transformation plan, says Unisys' Maria Allen.

February 18 -

As well-funded rivals pounce, Dwolla founder and CEO Ben Milne is looking for new leadership and a new strategy.

February 14