Fintech

Fintech

-

In underbanked markets, app-based firms can't live on digital alone, says dLocal's Michel Golffed.

February 27 -

One platform under development will let financial technology startups use a single portal to obtain licenses from multiple states, and another will let states collaborate on examinations.

February 26 -

Fintechs like LendingClub and Varo Money illustrate how the traditional financial system is changing. Banks that don’t rapidly evolve with technology will be obsolete.

February 26 -

Mastercard wants to build confidence in open banking by addressing regulatory compliance, liability, and technology integration issues on behalf of its issuers and fintechs.

February 26 -

In every segment except people older than 64, a majority would consider banking with Apple, Google, Amazon or Facebook, a new survey finds.

February 25 -

Payments firm announces leadership changes; the bank will place restrictions on fossil fuel lending while adding to sustainable projects.

February 25 -

WSFS, in an effort to catch up with bigger rivals, plans to upgrade digital channels in three years instead of five.

February 24 -

Observers speculate that Intuit simply wants to enhance revenue and protect its tax software business, but the CEOs of each company say the deal would also give consumers more control of their overall finances.

February 24 -

Mastercard will expand its European Technology Hub in Dublin over the next three to five years, as the card network plans to create more than 1,500 tech jobs at the site.

February 24 -

Intuit’s reportedly nearing a $7 billion deal to acquire Credit Karma, giving it an offering that could empower fintechs to more closely encroach on bank territory.

February 24 -

B2B payments can thrive in the uncertain regulatory environment with the help of APIs, says Become's Eden Amirav.

February 24 -

Intuit has agreed to buy Credit Karma for $7.1 billion. The move is seen as a way for Intuit to get access to more consumer behavior data, generate new sources of income and potentially protect a key business.

February 24 - Finance and investment-related court cases

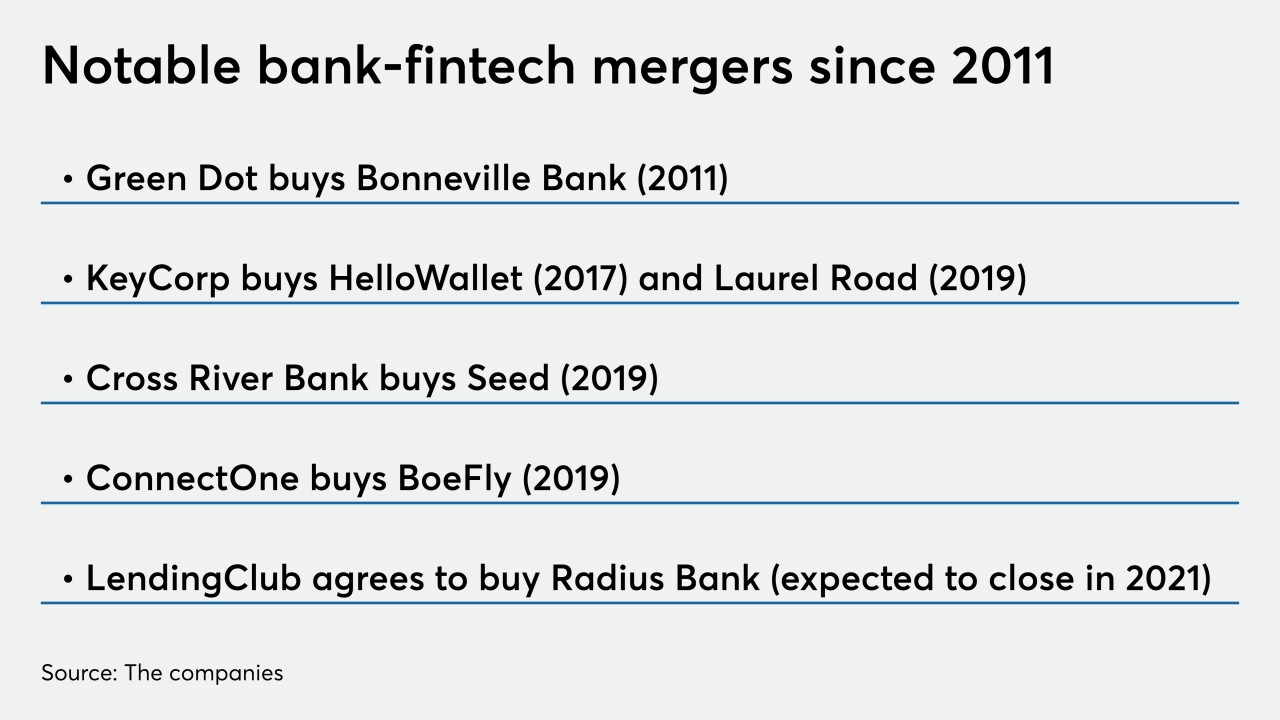

Tech firm accuses PNC of stealing trade secrets; online lender LendingClub agrees to acquire Radius Bank; questions arise whether regulators are turning more partisan; and more from this week's most-read stories.

February 21 -

The heads of the two companies explain how the deal came about, what hurdles they face and how they plan to mash up their very different operations.

February 20 -

Under the partnership with Fundation, Fifth Third will offer loans and credit lines up to $100,000 that can be funded in as little as a day.

February 20 -

Akoya has been building a data-sharing network that gives fintechs access to bank account data through application programming interfaces as an alternative to screen scraping. JPMorgan Chase, Bank of America and Capital One are among its new owners.

February 20 -

LendingClub and Varo Money are making inroads into the traditional financial system, but other fintechs still face long odds.

February 20 -

Some institutions say the combination of chatbots and social media could entice new borrowers, but burdensome legacy systems may limit their effectiveness.

February 20 -

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

February 19 - AB - Technology

The move comes as the fintech tries to shake off criticism that its main products are payday loans by another name.

February 19