-

Members of Ocean Spray Employees FCU will vote next month on whether to merge into MVCU, which absorbed Bridgewater Credit Union earlier this year.

November 20 -

Ana Botin, the Spanish banking giant's chairman, is counting on Santander's new digital platform to help drive expansion in the U.S. and Latin America.

November 20 -

This is the second time in five years the California-based credit union has issued a giveback, for a total of $38 million.

November 20 -

The deal is Seacoast's third acquisition of a bank with operations in Palm Beach County.

November 20 -

The regulators approved the deal after nine months of consideration, but the Fed hit SunTrust with a consent order tied to "unfair and deceptive" business practices from 2013 to 2017.

November 19 -

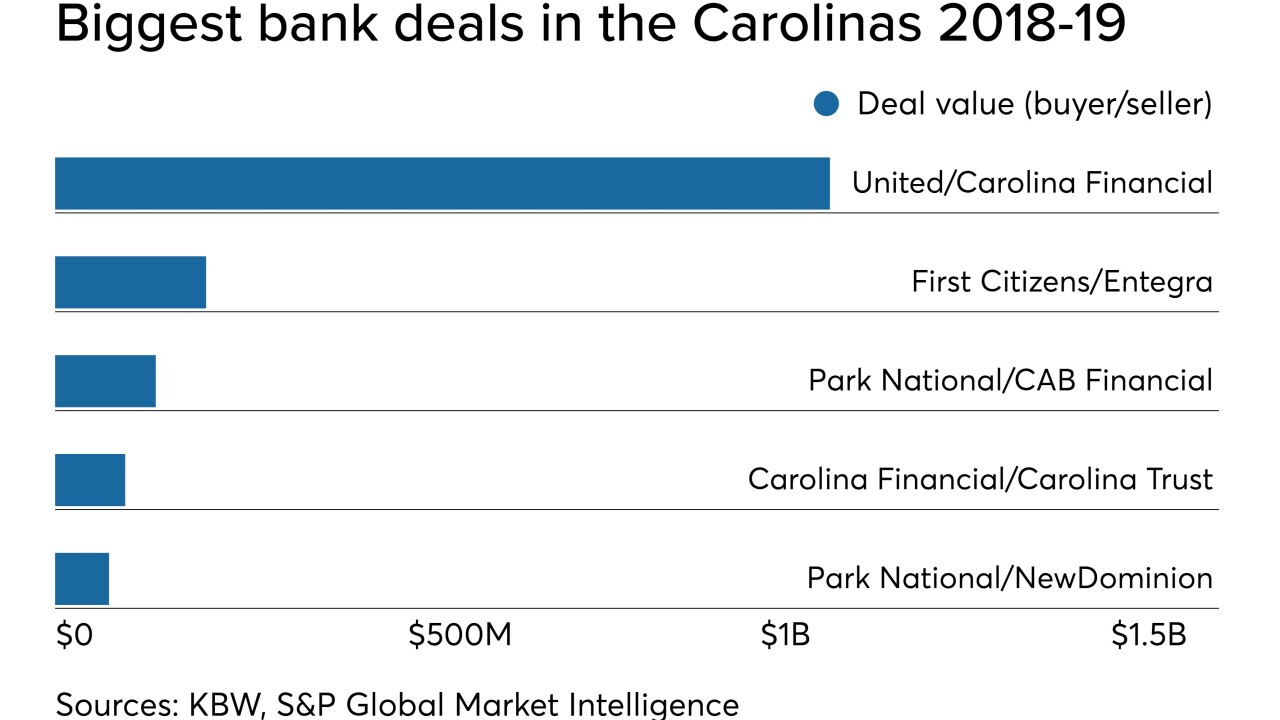

United Bankshares in West Virginia was willing to pay a healthy premium for Carolina Financial, one of a dwindling number of available banks with more than $4 billion in assets.

November 18 -

The Bakersfield, Calif.-based institution has applied to convert to a state charter.

November 18 -

The company will pay $1.1 billion for Carolina Financial in Charleston, S.C., in a deal that will add nearly $5 billion in assets.

November 18 -

More banks in the state are considering acquisitions to cut costs and combat margin pressure.

November 15 -

The Wisconsin-based institution has returned more than $11.7 million to members over the past six years.

November 14 -

The Louisiana company's willingness to combine with First Horizon without a big initial payday is fueling talk that other banks could be keen on selling at relatively inexpensive prices.

November 12 -

Dealmaking through early November is slightly ahead of last year's clip thanks to a recent flurry of merger announcements. However, excluding BB&T-SunTrust, values and multiples are shrinking.

November 11 -

Politicians' grand plans to reform the college funding process won't come to fruition anytime soon, so credit unions shouldn't ignore the opportunties presented by student lending.

November 8

-

Whitefish Credit Union has surpassed $1.5 billion in total assets thanks to growth in consumer loans brought on by an increased digital marketing presence.

November 6 -

One organization's findings reveal that financial counseling, when done right, can also help boost institutions' lending and brand recognition.

November 5 Inclusiv

Inclusiv -

Tri County Financial will pay an undisclosed amount for H.F. Gehant Bancorp.

November 4 -

First Horizon and Iberiabank solidified their resolve after BB&T and SunTrust announced their merger. Bryan Jordan, First Horizon's CEO, says he's convinced the earlier deal is having a similar influence at other regional banks.

November 4 -

Credit unions and banks in the Great Lakes State could soon offer driver's license renewal and related services.

November 4 -

The Brunswick, Maine-based institution can now serve the residents of Androscoggin County in addition to three other counties.

November 4 -

The deal will create a Southeastern regional with $75 billion in assets across 11 states.

November 4