-

The Germantown, Md.-based institution can now serve residents throughout the Washington, D.C., region.

January 29 -

The Las Vegas-based institution has returned more than $63 million to members in the last 19 years.

January 29 -

Credit unions in the Gopher State have pledged at least $3.5 million to the Credit Union National Association's awareness effort.

January 29 -

Both banks' need for scale started the conversation and the lifting of the SIFI threshold helped seal the deal. Here are five takeaways from one of the industry's biggest recent mergers.

January 28 -

A new report from Cornerstone Advisors finds credit union executives aren't all that bullish on the year ahead, while banker optimism is back on the rise.

January 28 -

The new facility in San Antonio will house several management functions and create almost 600 jobs.

January 28 -

After a nearly $100,000 loss in 2018, $30 million-asset Alliance Blackstone Valley Federal Credit Union is set to merge into Rhode Island CU and its network of branches across the state.

January 28 -

John Ciulla, one year in as CEO of Webster Financial, discusses how he is preparing for the next downturn, picking his spots in tech spending, and remaining cautious about M&A.

January 27 -

Bank First's deal for Partnership is the third Wisconsin bank merger announced this week.

January 23 -

Industry groups and lawmakers have joined bankers in insisting the agency develop a plan to resolve the paperwork problem before the partial government shutdown ends.

January 23 -

The company will pay $93 million for Kinderhook Bank, which has a concentration of branches around Albany.

January 22 -

Most bigger banks aren't interested in buying out their smaller counterparts, but these institutions are of interest to credit unions looking to grow.

January 22 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

The company will top $1 billion in assets after it buys the parent of F&M Bank in Tomah, Wis.

January 22 -

Greenwoods Financial will have $270 million in assets when it buys Fox River Financial.

January 21 -

The Chicago-area credit union can now accept members who live or work in a variety of Illinois counties.

January 18 -

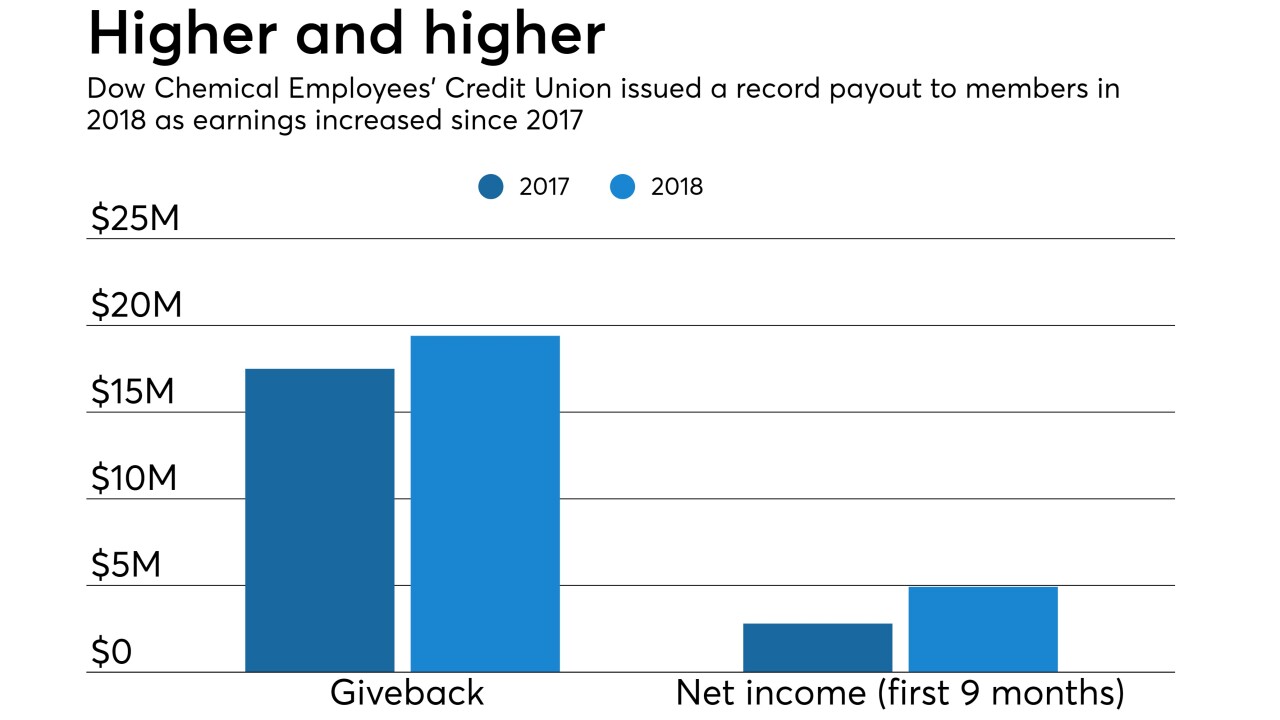

The Midland, Mich.-based institution returned $19.4 million to members for 2018 through rewards and dividends.

January 18 -

John Milleson, who has led the company for 20 years, will retire after his successor is in place.

January 17 -

The Indiana-based institution's distribution for 2018 was up more than 60 percent from the previous year.

January 17 -

The Montana company will more than double its assets in Utah when it buys FNB Bancorp.

January 17 -

The Iowa company will pay $94 million for a bank with five branches and $727 million in loans.

January 16