-

Pinnacle Bank chief Terry Turner never lacks specifics. He wants to expand inside a triangular zone that connects three Southern and mid-Atlantic cities, aims to enter five particular markets, and speaks bluntly about his plans for hiring alums of BB&T and SunTrust.

May 8 -

The Mile High City has been disrupted by a number of big bank mergers, which could increase competitive pressures on CUs across the state.

May 7 -

Sound Bank has new management as part of the transaction. It will also get a new name and expand into higher-growth markets.

May 7 -

Banco Bradesco said it will use the acquired bank to expand its investment offerings in the United States.

May 6 -

Profitability improved significantly last year for banks with less than $2 billion of assets, but not because of anything they did. Some troubling trends lurk beneath those big gains too.

May 5 -

The National Credit Union Administration and the Small Business Administration have established a program to boost SBA lending by credit unions, which was very light last year. It is sure to irk bankers, who have raised competitive concerns.

May 3 -

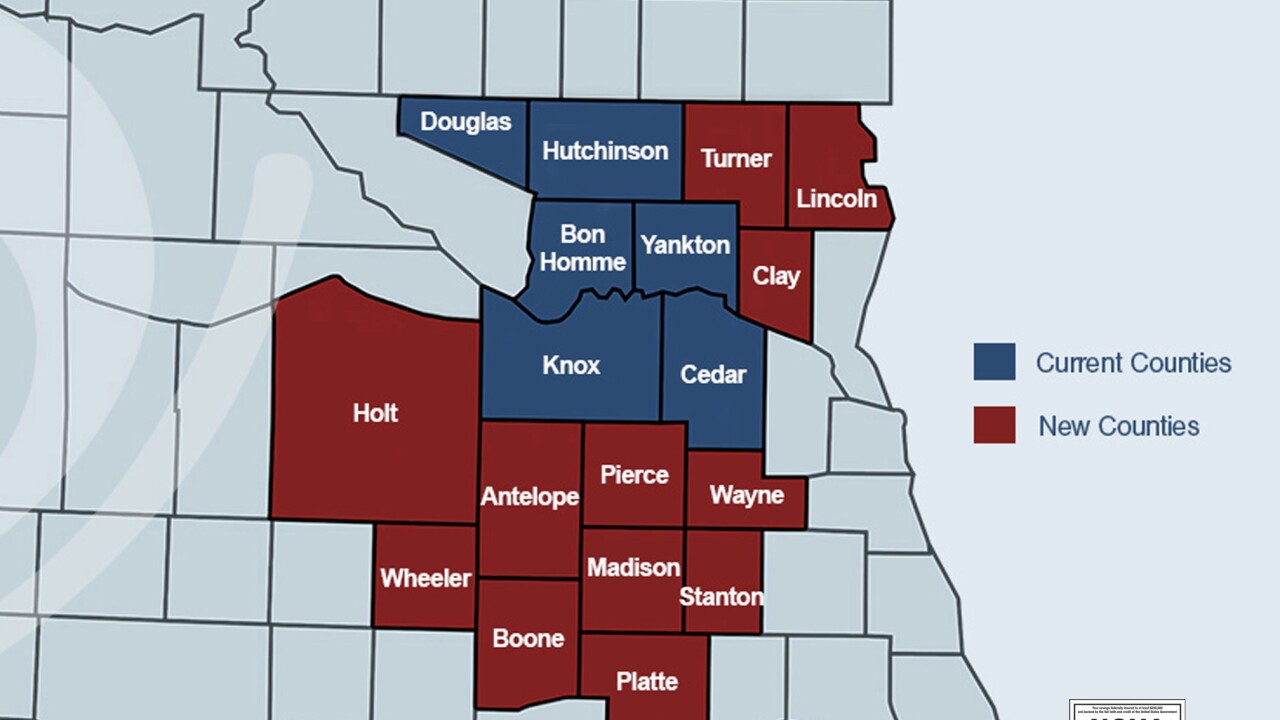

The Yankton, S.D.-based institution can now serve 18 counties across two states.

May 3 -

Two attorneys told a credit union audience the growing wave of marijuana legalization could have just as big an impact on financial institutions that don't serve the cannabis industry as those that do.

May 3 -

Over the past two years, Uma Wilson's strategy took a program that had been losing customers on a year-over-year basis and transformed it into the fastest-growing issuer of Visa cards in the region.

May 2 -

The Capitola, Calif.-based institution reached the milestone a few months after acquiring another credit union.

May 2 -

The Honolulu-based credit union said its earnings dropped by more than 37% from a year earlier.

May 2 -

Hudson Valley Federal Credit Union wants to eventually add eight counties to the four it currently serves.

May 2 -

Erika Marquez discovered an anomaly that was causing Sumitomo Mitsui Banking Corp. to treat some loans as though they required significantly more regulatory capital than they actually did.

May 1 -

The Springfield, Vt.-based institution is the latest CU to cross a neighboring border, as a number of other institutions have looked to expand their reach

May 1 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

Innovation is part of Emily Girsch's daily routine. That's why the chief financial officer at Lincoln Savings Bank in Cedar Falls, Iowa, spends a lot of time thinking about the need to modernize bank regulations for the digital age.

April 30 -

MidSouth had spent the last two years improving credit quality by reducing its exposure to energy credits.

April 30 -

The NCUA is letting Union Yes in California raise capital by turning to temporary funding sources, which banks have complained is an example of the regulator's overreach.

April 29 -

The NCUA is letting Union Yes in California raise capital by turning to temporary funding sources, which banks have complained is an example of the regulator's overreach.

April 29 -

Banks from the North and South are converging on the city, spurred by a spike in deposits and employment numbers that trump national averages.

April 26