-

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but while some analysis shows they've been slow to borrow against this newfound wealth, credit union home equity lending was up significantly last year.

April 2 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing the risk for banks and credit unions.

January 2 -

They aren't creating new products, but some lenders are advising cash-strapped customers in high-tax states to tap home equity or other credit lines to prepay property taxes before the new tax law kicks in.

December 28 -

Any decline in home equity balances could be offset by higher demand for other types of consumer loans. The worry is that only borrowers with blemished credit will take out home equity loans, increasing banks’ risk.

December 26 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

One of the biggest challenges surrounding the ballot initiatives is voter turnout, which is often just 10 percent of registered voters in elections the year after a presidential contest.

October 27 -

Fed chair says post-crisis financial reforms have strengthened the banking system and the economy; consumers again comfortable borrowing against their home equity.

August 28 -

Lenders will not have to report data on open-ended home equity lines of credit in 2018 or 2019 if they originated fewer than 500 HELOCs the preceding year, the bureau said.

August 24 -

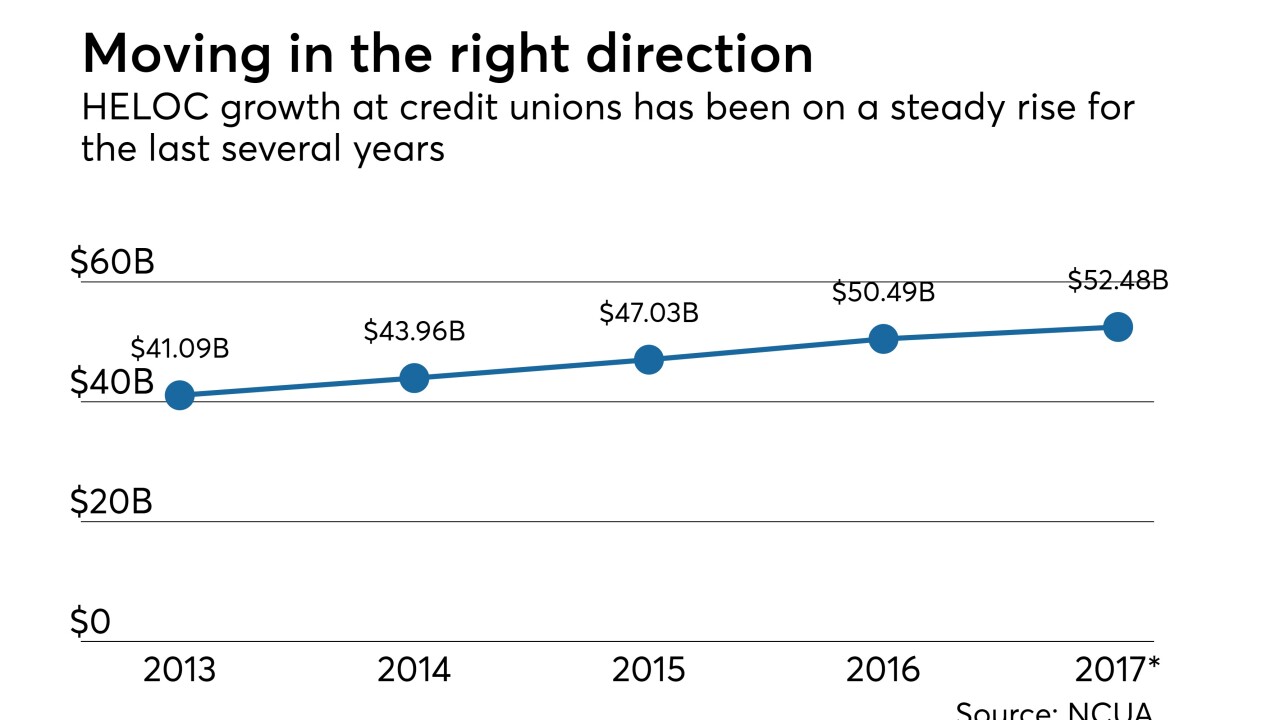

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

The U.S. population is aging, and one of the well-established components of the American dream — buying and owning a home — appears poised to aid in the baby boomers next phase of life.

July 27 Buckley Sandler LLP

Buckley Sandler LLP -

It’s a very large number for any bank, but Bank of America executives said the move makes good economic sense and promotes relationship-building with customers.

July 21 -

Trump’s nominee for head of bank supervision at the Fed may tackle Volcker Rule revision; rising home prices and improved job market give borrowers more options as lines of credit reset.

July 12 -

Some credit union advocates are praising the Consumer Financial Protection Bureau for a move that exempts select institutions from certain reporting requirements, but other say the bureau must still do more.

July 11 -

On March 31, 2017. Dollars in thousands

June 26 -

On March 31, 2017. Dollars in thousands

June 5 -

On Dec. 31, 2016. Dollars in thousands.

May 1