-

CEOs have been telling investors that if the Fed continues to cut interest rates, they will lower rates they are paying on deposits to minimize the hit to net interest margins. The danger is that if they lower rates too quickly or by too much, big depositors could go elsewhere.

September 17 -

Regulators have redefined a simplified capital measure for community banks following criticism that their 2018 proposal did not go far enough.

September 17 -

The popular program could go idle next month for the second time in less than a year if lawmakers are unable to approve a $99 million credit subsidy.

September 17 -

It's not a reaction to JPM Coin, the banks says, but a way to speed up international payments for corporate clients.

September 17 -

Travelex is rolling out a suite of B2B payment services through a new API-based platform and sandbox.

September 17 -

An executive from Visions Federal Credit Union was recognized for her advocacy work while credit unions announced personnel changes.

September 17 -

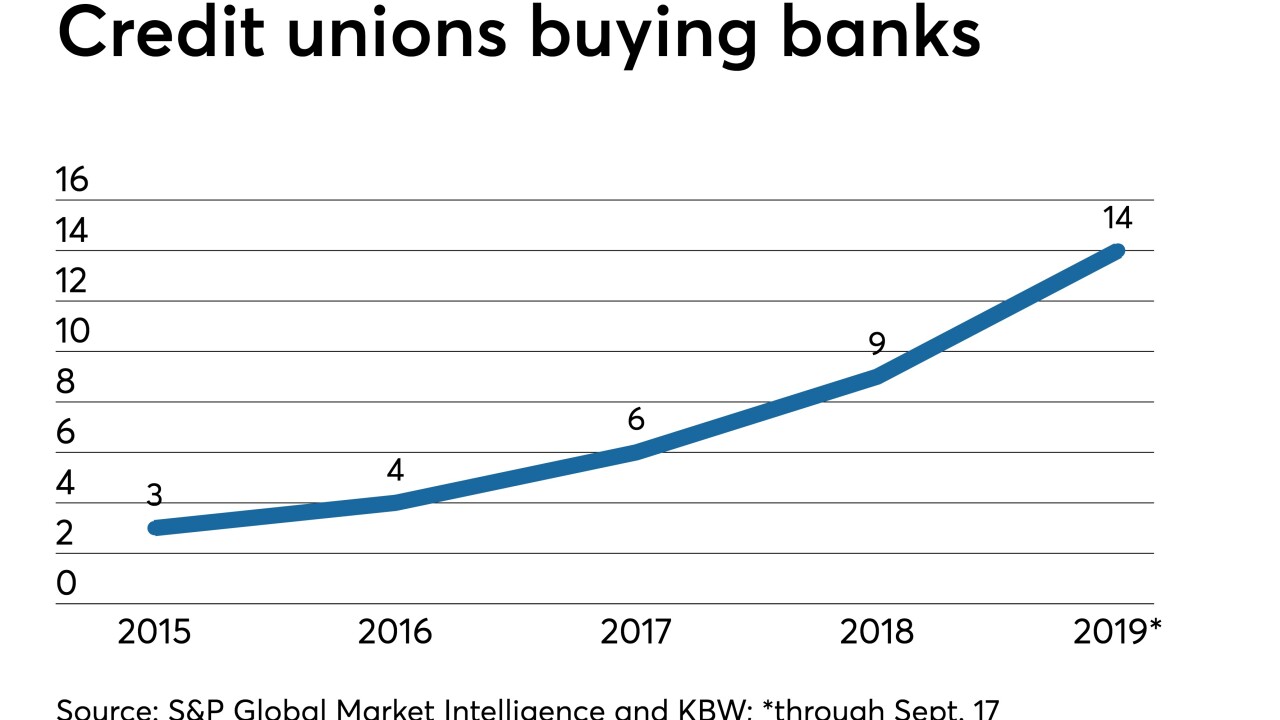

First Commerce Credit Union's agreement to buy Citizens Bank brings to 14 the number of deals this year in which a credit union is buying a bank.

September 17 -

First Commerce Credit Union's agreement to buy Citizens Bank is the 14th credit union-bank deal of the year.

September 17 -

To accommodate Asian tourists, Banco Santander has launched JCB merchant acquiring operations in Spain after obtaining a license with JCB International, the international operations unit of the Japanese global payment brand.

September 17 -

Giants like Facebook, JPMorgan Chase and Walmart are all pushing blockchain for myriad use cases, and now Wells Fargo has joined the fray with its own spin on the distributed ledger technology.

September 17