-

The agency is still moving forward on key regulations dealing with payday lending and mortgage underwriting despite new demands posed by the crisis.

April 15 -

The two large banks are holding off for a month on collecting on negative balances to ensure that customers receive the full amount of government payments deposited into their accounts.

April 15 -

Quick forbearance actions averted an immediate hit to asset quality, but executives warned that a spike in unemployment and a looming recession will cause long-term problems.

April 15 -

OCBC Bank has integrated Google Pay into its P2P transfer service, thereby expanding its customers’ options for reducing their cash usage during the coronavirus crisis.

April 15 -

The biggest lenders seem to have handled the corporate rush for cash heading into the economic shutdown caused by the coronavirus pandemic. But their ability to collect is as uncertain as the economic outlook for the next year.

April 15 -

Many credit union employees are currently working from home to slow the spread of COVID-19 but this can invite more attacks from cyber criminals.

April 15 -

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

April 15 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

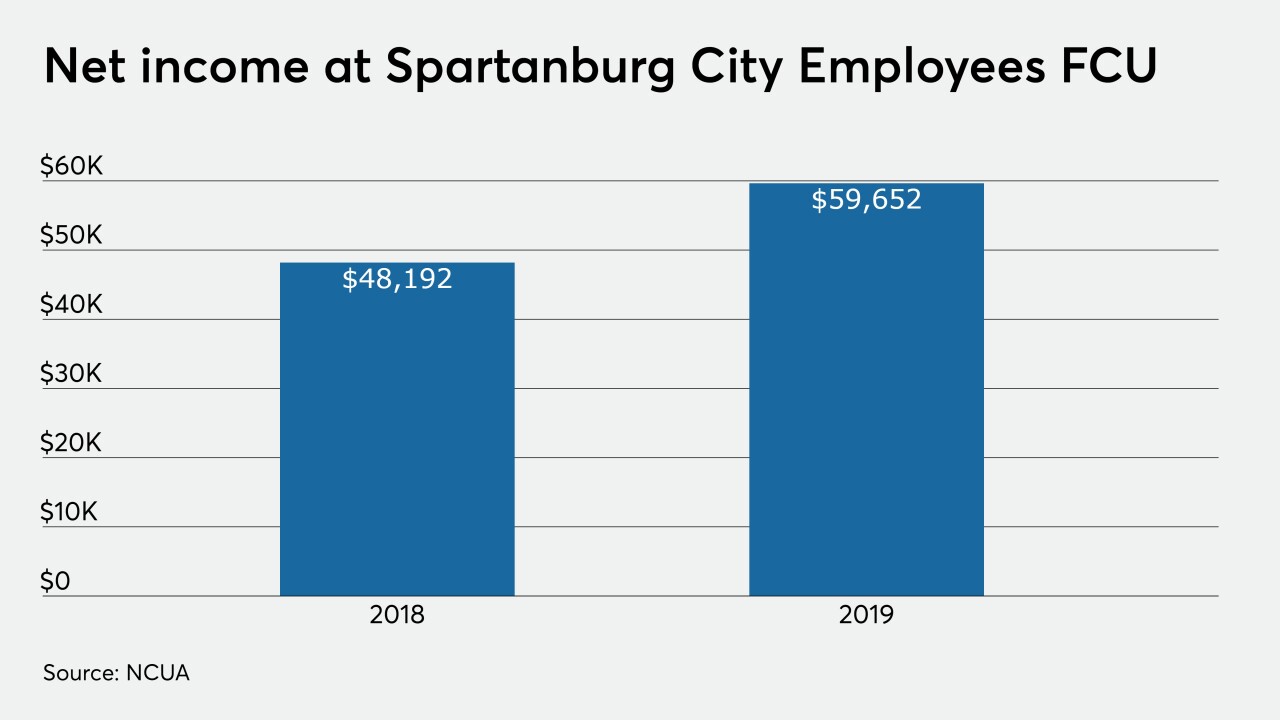

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15 -

Gov. Brad Little recently signed legislation into law clarifying matters related to lending, investments and fixed assets.

April 15