-

Many countries are positioning themselves as a destination for fintechs seeking EU-wide licenses as the U.K. leaves the EU. Following Brexit, U.K. electronic money and payments institution licenses across the EU won’t be passportable across the EU.

November 24 -

As COVID-19 infections break records nationwide, some banks are once again closing lobbies. But many others are maintaining the status quo after instituting a host of safety protocols that didn’t exist in the spring.

November 23 -

The California company, which filed an application Monday with the Office of the Comptroller of the Currency, is following a path charted by Varo Money and SoFi.

November 23 -

Yellen, the former head of the Federal Reserve, would become the first woman to hold the nation’s top economic policy job just as the coronavirus pandemic threatens another downturn.

November 23 -

The agency said federal thrifts must abide by the same rules as national banks pertaining to membership in payment systems and codified policies on acceptable derivatives practices among a slew of technical changes.

November 23 -

The megabank and community bank recently announced they're offering accounts through the payment app. Both gave similar reasons: They need big tech to help them attract new customers.

November 23 -

PayPal Holdings Inc. employees will probably spend more time working from home even after the coronavirus pandemic is over.

November 23 -

HSBC for the first time is offering customers a way to send funds instantly across borders to other HSBC customers via a mobile device.

November 23 -

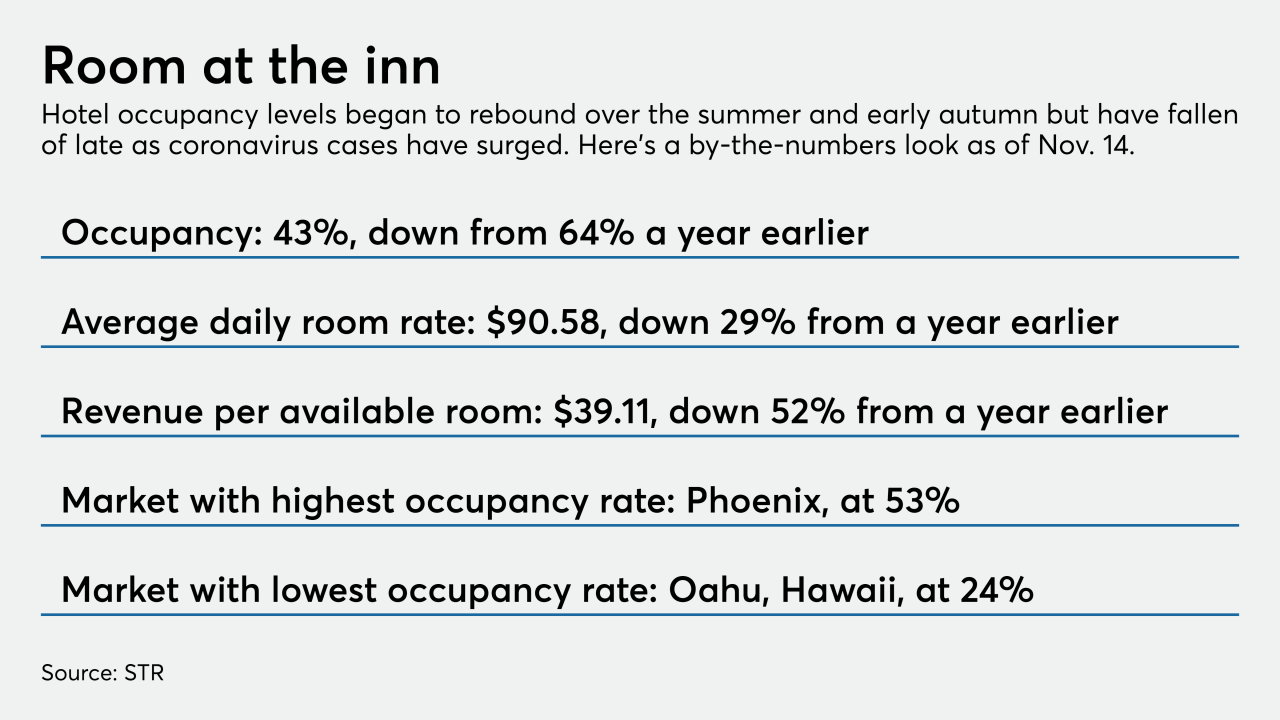

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

New analysis from CEO Advisory Group shows the asset size of merged institutions rising along with the number of mergers.

November 23