-

While financial institutions are encouraging customers to use their digital banking services rather than the branch or ATMs during the outbreak, attackers will also be looking to exploit this potential increased adoption of mobile banking and mobile payment apps, says OneSpan's Sam Bakken.

March 24 OneSpan

OneSpan -

Financial services personnel were among critical infrastructure groups that the Department of Homeland Security said were crucial for “public health and safety as well as community well-being” during the pandemic.

March 24 -

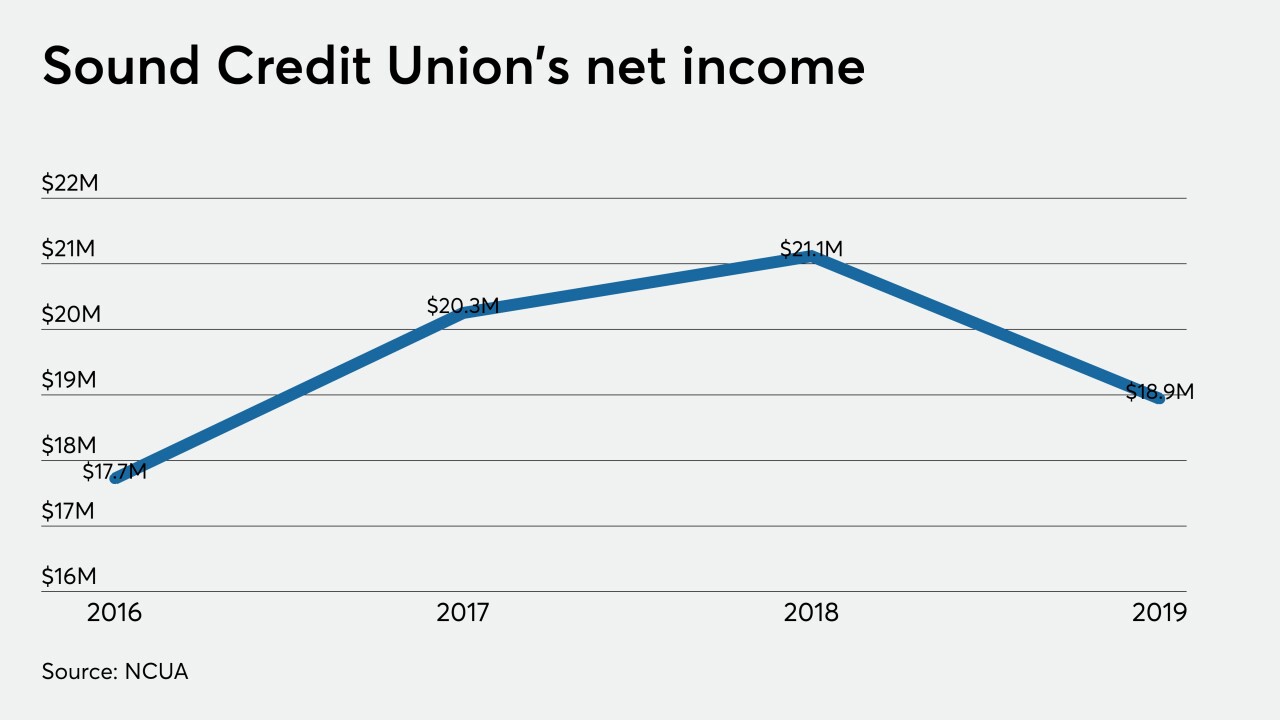

Fluke Employees Federal Credit Union has agreed to become part of Sound Credit Union and the transaction should close later this year.

March 24 -

The mobile-only bank offers many standard neobank features and some added payment options.

March 24 -

If the new accounting standard poses too many risks during an economic crisis, then it's probably not a good idea at all.

March 24 -

Anand Talwar, deposits and consumer strategy executive at Ally Bank, and Jody Bhagat, president of the Americas for Personetics, explain how their technology collaboration has evolved from a virtual assistant to customized, real-time "insights" for customers.

March 24 -

As coronavirus forces most shopping to occur online, merchants will likely see their product return policies tested by both good customers and the unsavory ones who abuse those policies for profit.

March 24 -

Member business loans have been on a roller coaster over the last year and as the pandemic impacts the economy, executives will need to closely monitor these portfolios to catch any problematic credits.

March 24 -

The impact of the virus and mitigation measures will contribute to an increase in payment disputes, says Chargebacks 911 and Global Risk Technologies' Monica Eaton-Cardone.

March 24 Chargebacks911

Chargebacks911 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23