-

Despite assurances by Director Kathy Kraninger that the agency is cracking down on discrimination, it hasn't sent a Department of Justice referral on a fair-lending violation in two years.

December 16 -

But some industry watchers are tempering expectations, saying that the language is too vague to know for sure if China is serious about introducing more foreign competition.

December 16 -

The Department of Business Oversight said TitleMax charged consumers fees to push loan amounts above the threshold at which the state's rate cap applies.

December 16 -

Chris Maher, CEO of OceanFirst Financial, shares how employees’ roles have already changed and his bank’s efforts to help them navigate AI and other emerging technologies.

-

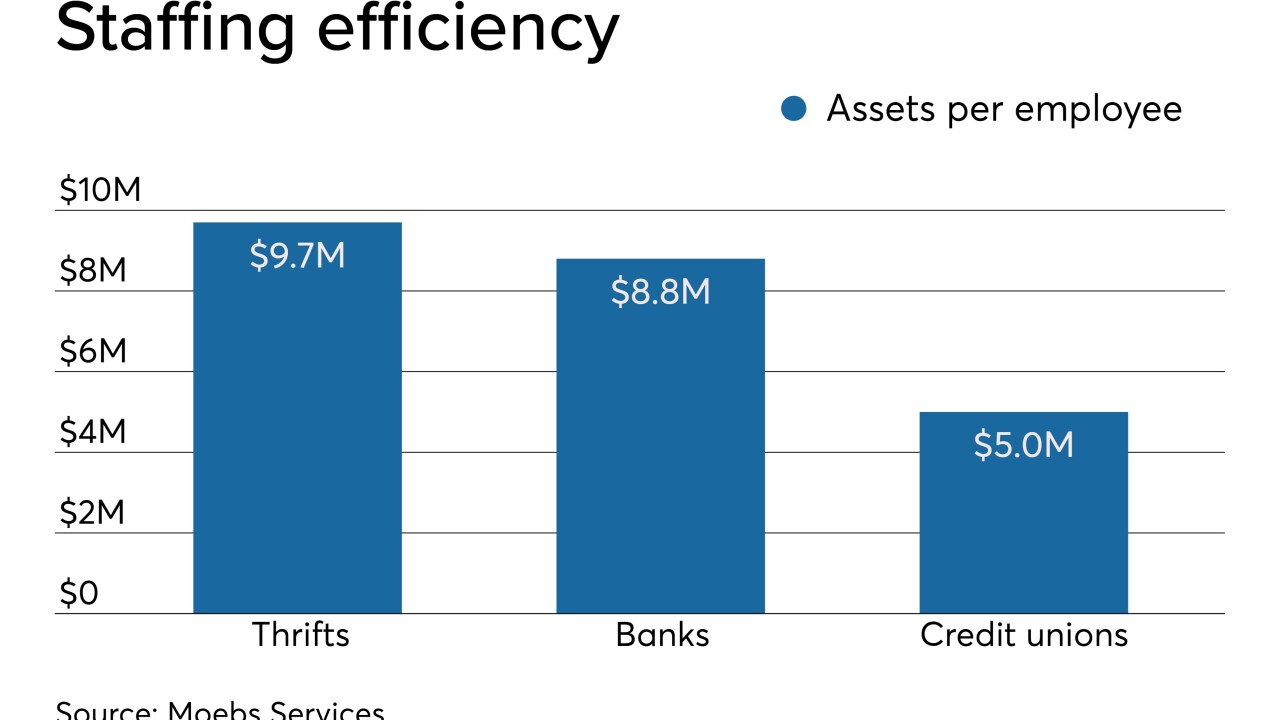

Savings institutions are aggressively cutting staff and shortening hours to be more competitive. As a result they have become more efficient than commercial banks.

December 16 -

Fresh off a public offering and shopping boost, Alibaba Group has entered into an agreement with Commercial Bank of China (ICBC) to build digital finance services in areas such as cross-border finance and electronic payment settlement.

December 16 -

Digital technology is increasingly connecting compensation and payment capabilities for contractors and creating an ability to share apps. It's a trend that’s brought Citi and PayPal together to offer flexibility and a network effect to counter fintechs.

December 16 -

Payments messaging standards provider Swift has opened its global Know Your Customer registry to all the corporations it connects to following a successful test.

December 16 -

WEX will begin managing the fuel card portfolio of Valero Energy Corp. next year, covering 5,000 U.S. fuel stations, as an extension of the partners’ existing card acceptance agreement.

December 16 -

As required by last year's reg relief law, the agency is planning to raise the asset threshold for organizations conducting a stress test from $10 billion to $250 billion.

December 16