-

By experimenting with palm-print hand wave transactions, Amazon is putting its resources behind another work-in-progress technology that traditional retailers will almost certainly have to invest in just to keep pace.

January 21 -

The OCC said Citigroup's main bank subsidiary violated the Flood Disaster Protection Act by not ensuring that borrowers with homes in flood hazard areas had insurance coverage.

January 21 -

The local payments acceptance technology of cross-border fintech dLocal is now available for Amazon users in Chile.

January 21 - Banking brands

Todd Hall takes the helm as president and CEO amid one of the credit union's biggest challenges in years: an ongoing lawsuit against Truist Financial.

January 21 -

After a decline, fraud has recently spiked. But there are measures companies can take to stay ahead of the crooks, says Nvoicepay's Alyssa Callahan.

January 21 Nvoicepay

Nvoicepay -

Ebanx isn't new to the payments technology game in Latin America, having focused on cross-border e-commerce technology a few years ago to allow consumers in that region to make purchases from international merchants.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

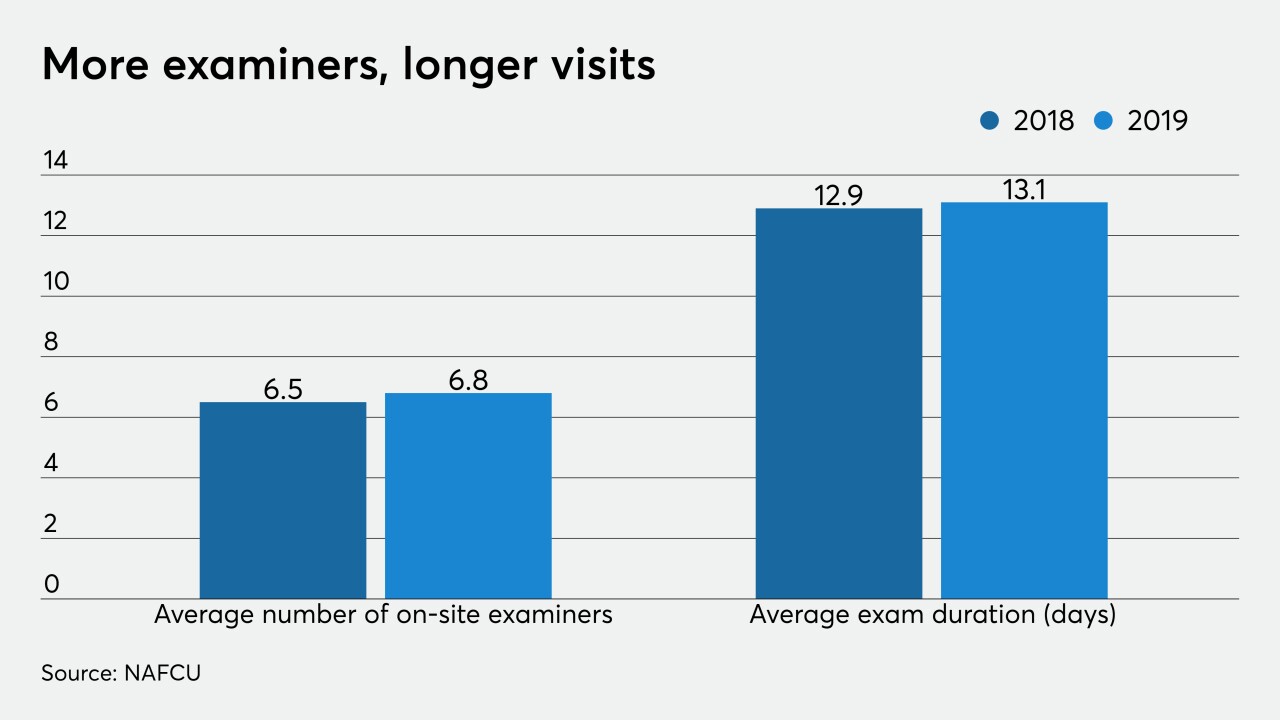

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

New smartphones have subtle differences that require more complex security solutions, says Fingerprints' Ted Hansson.

January 21 Fingerprints

Fingerprints