-

New data from CO-OP Financial Services shows the Christmas season could be a bright one for credit unions and their card portfolios.

December 11 -

Removing the checkout means removing a key bottleneck that retailers rely on to sell tabloids, gum and candy.

December 11 -

The Rakuten application has piqued interest in reviving legislation aimed at stopping commercial firms from owning banks. Yet Congress previously had the chance to enact such a measure and declined.

December 10 -

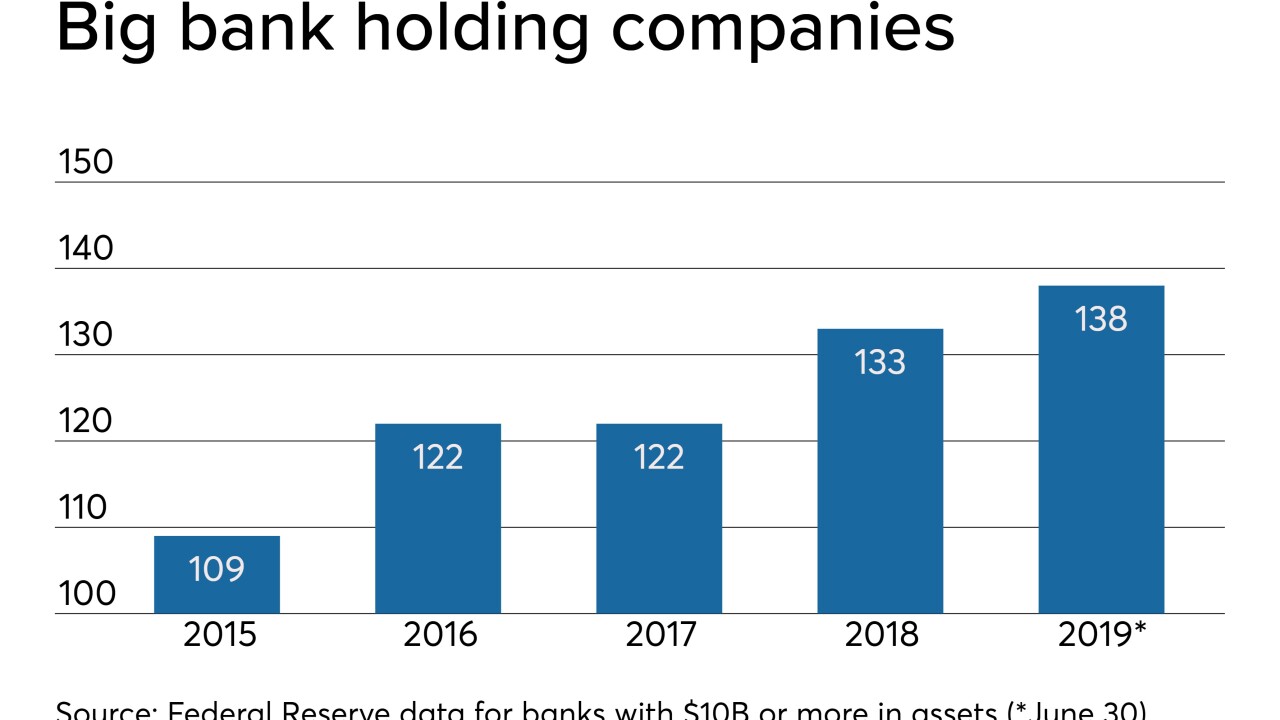

Several banks abandoned their BHCs two years ago to cut costs and reduce regulatory burden. But the strategy never really took hold as most bankers determined there were more benefits to having holding companies than eliminating them.

December 10 -

The startup Rho argues that small firms still have unmet needs, especially tracking cash flow in real time.

December 10 -

Brendan Coughlin will succeed Brad Conner as head of consumer banking, and Beth Johnson will be the bank's first chief experience officer.

December 10 -

More than 50 banks and banking groups responded to the National Credit Union Administration's call for public comment as it attempts to explain why a new field of membership provision won't permit redlining.

December 10 -

Dennis Nixon and Gerry Schwebel at International Bancshares share their views on the U.S.-Mexico-Canada trade deal, immigration policy, and a border wall.

December 10 -

BB&T and SunTrust showed that big-bank mergers are still possible, but top executives at other large regional banks say that a knee-jerk response would be a mistake.

December 10 -

European challenger bank N26 is adding a range of promotional incentives for using its debit card as it expands in the U.S.

December 10