New tech lets American Express instantly issue cards to immigrants

(Full story

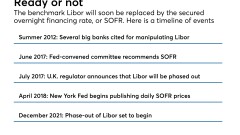

Is the end of Libor a threat to financial stability?

(Full story

Capital One's triple whammy

(Full story

Regulators shutter banks in Kentucky and Ohio

(Full story

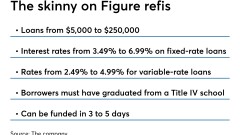

Home lending fintech Figure expands into student loan refis

(Full story

Capital One subpoenaed by N.Y., feds over taxi loans

(Full story

Nothing comes easy for CFPB in payday lending rule

(Full story

JPMorgan Chase plucks fintech specialists from rivals

(Full story

The changing shape of bank-fintech partnerships

(Full story

CFPB chief mentions payday 'research,' and heads turn

(Full story