BNY Mellon snags tech exec from Bank of America

(Full story

'It is an issue for all of us': Dissent spreads at CFPB over top aide's writings

(Full story

Top CFPB official yanks support for political appointee over past writings

(Full story

Lisa Stevens, key figure in Wells Fargo fake-accounts saga, is out

(Full story

Bank of America's Anne Finucane is ready for her next challenge

(Full story

CFPB official tries to defuse furor over his 'provocative' writings

(Full story

Three laws signed by California governor will hit lenders

(Full story

Smartphone brand can reflect creditworthiness: FDIC study

(Full story

Fifth Third shooting survivor: 'Every day has been better than the last'

(Full story

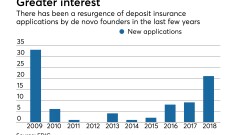

Floodgates open? De novo applications surge at FDIC

(Full story