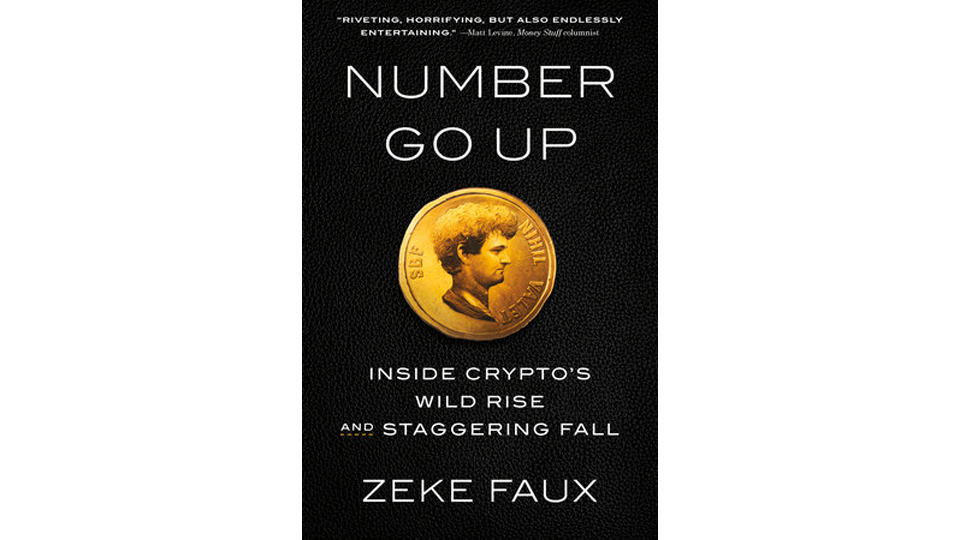

Sam Bankman-Fried, disgraced co-founder of the now-defunct cryptocurrency exchange FTX, was sentenced to 25 years in prison on Thursday for his part in defrauding customers of billions of dollars.

Lewis A. Kaplan, senior judge of the United States District Court for the Southern District of New York, delivered Bankman-Fried the sentence in federal court on Thursday, according to Bloomberg. This decision concludes what has arguably been the most prominent case in the crytpo industry — and its most notorious.

"I know a lot of people feel really let down," Bankman-Fried said at his sentencing hearing Thursday morning in lower Manhattan. "I'm sorry about that. ... I'm sorry about what happened at every stage."

Below are examples of American Banker and outside reporting detailing Bankman-Fried's impact on the banking industry.