House PPP forgiveness plan is better than nothing, bankers say

(Full story

Why some banks still lean on mainframes

(Full story

Fed's Wells Fargo review should consider forbearance snafu: Warren

(Full story

What's next for Goldman Sachs's Marcus

(Full story

'Solid reputation': Why regulators long deferred to Wells Fargo on sales abuses

(Full story

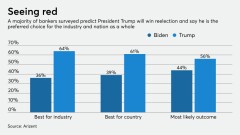

Bankers give Election 2020 edge to Trump

(Full story

Twitter veteran launches credit score that digs deep into cash flow

(Full story

'Fincen files' underscore urgency of AML reform

(Full story

Court case reveals new details of fake-account allegations at Fifth Third

(Full story

Government says it will start forgiving PPP loans within days

(Full story