The largest of the Best Banks to Work For are trying some new approaches to recruiting talent.

Several of the eight Best Banks with more than $10 billion of assets are looking to hire people outside of their market areas and broadening the types of candidates they are willing to consider instead of looking at only those with banking experience.

Enterprise Bank & Trust in St. Louis, Mo., for example, is recruiting talent in markets where it doesn’t have a physical presence, largely because executives there say they are now comfortable with employees working remotely.

Some of these banks are also ramping up their diversity efforts. First Busey in Champaign, Illinois, recently partnered with new human resources and recruiting platforms as a way to reach a broader pool of talent. It also sought out external search firms that prioritize diversity initiatives.

Another facet of its search for more diverse talent entails partnerships with other local institutions, such as the University of Illinois’ Disability Resources & Educational Services Department.

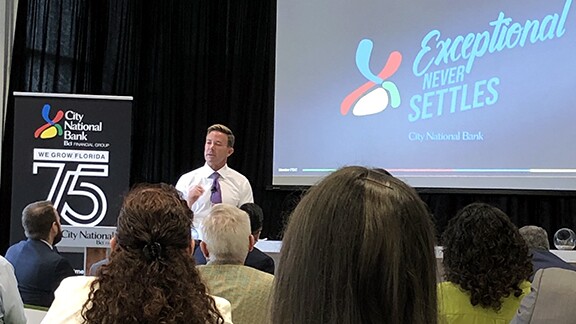

City National Bank of Florida, which is actively recruiting for roughly 100 jobs across its home state, has long been using partnerships with local organizations as part of its broader efforts to recruit and nurture the next generation of bankers.

The U.S. unit of Chile’s Banco de Credito e Inversiones has a 15-year partnership with the Center for Financial Training at Miami Dade College and CareerSource of South Florida. Together, they host the Future Bankers’ Camp, which offers hands-on experience for high school students interested in financial services careers.

Overall

Scroll through to see what other banks are on the list, where they rank compared to the others in this size category and what they are up to when it comes to workforce strategies.

More Best Banks coverage: