Wells Fargo was hit with more scandal. But does anyone care?

(Full story

CEO Calk conspired with Manafort to defraud his own bank: Prosecutors

(Full story

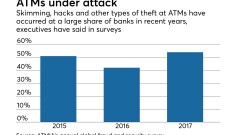

How worried should banks be about the FBI's ATM attack warning?

(Full story

Capital One mends fences with one aggregator, deepens relationship with another

(Full story

U.S. Bancorp promotes Jodi Richard to chief risk officer

(Full story

OCC's fintech charter is a mistake

(Full story

CFPB path to unwinding payday rule riddled with legal land mines

(Full story

WSFS broke the mold with its latest deal. Other banks should take note

(Full story

How next FHFA chief can reform Fannie, Freddie without Congress' help

(Full story

Why community banks should negotiate shorter fintech contracts

(Full story