-

The legislation, which takes effect in July, follows a 2019 law that modernized the state's credit union statutes.

April 23 -

The Las Vegas-based institution has joined a small group of credit unions whose assets top $1 billion, which make up less than 10% of the total industry.

April 23 -

The card brand has built a sizable business after receiving approval to operate in China eight months ago.

April 23 -

Now known as Alltrust Credit Union, the Fairhaven, Mass.-based institution serves more than 14,000 members across New England.

April 22 -

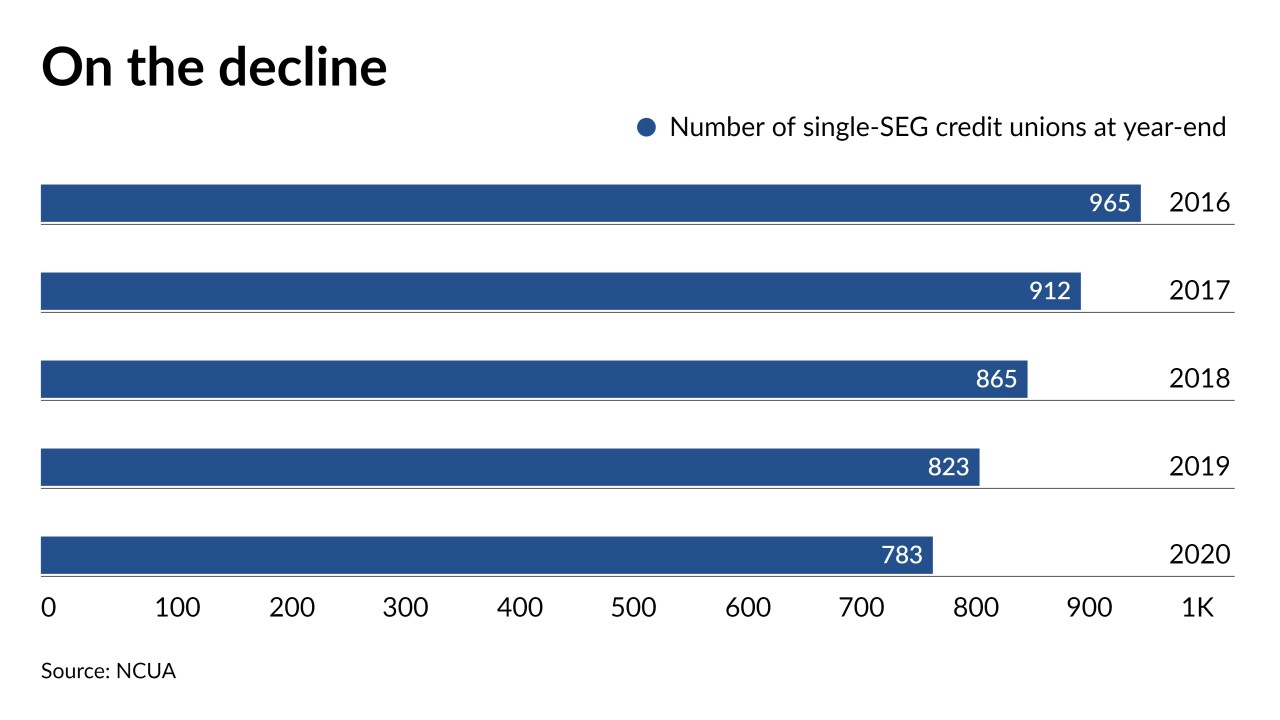

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

A European Union plan would require rigorous data-quality checks and testing of applications of artificial intelligence that it says violate consumers' privacy and other rights.

April 21 -

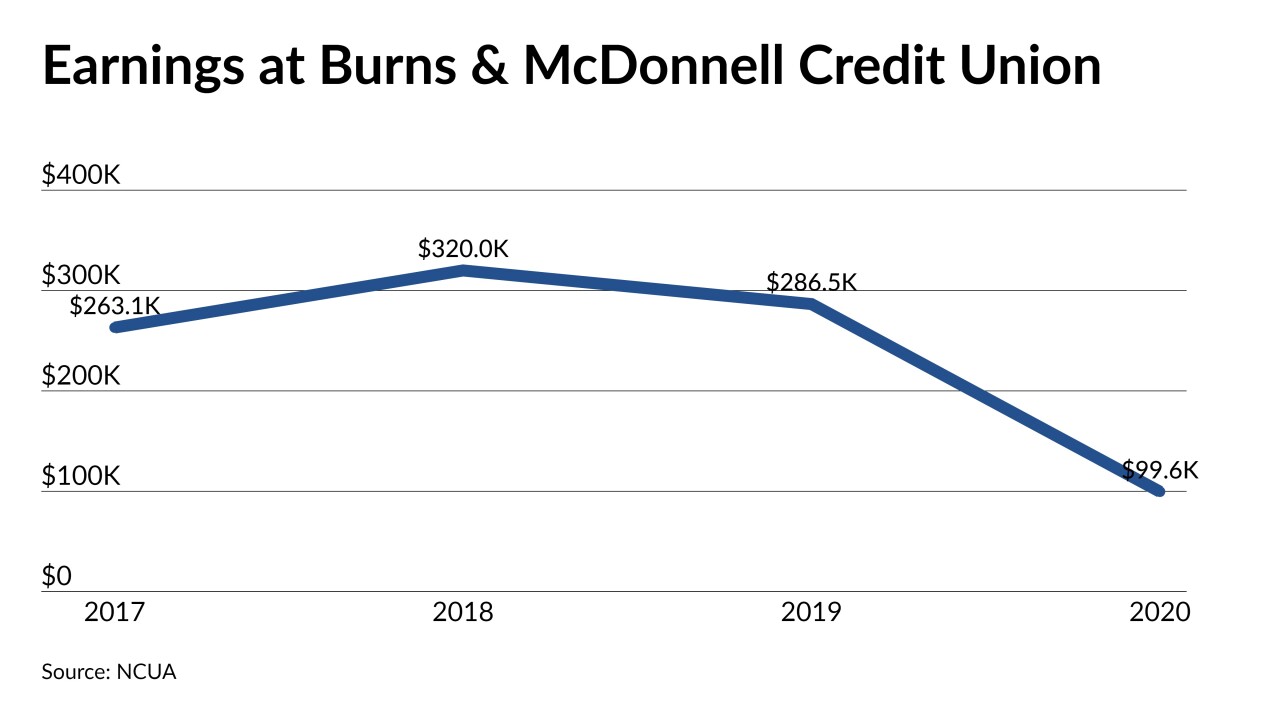

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

The Federal Reserve and other central banks deciding whether to compete with private cryptocurrencies should heed the financial stability risks, such as expanding the economic power of governments and altering longstanding payments models.

April 21

-

Rhonda Diefenderfer, who has led the Billings, Mont., credit unon for 20 years, will retire in May and be succeeded by the credit unions busines vice president of business lending.

April 20 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20 -

By taking its U.S. card issuing technology to more countries, the fintech is becoming a bigger threat to the acquiring banks that focus on B2B payments.

April 20 -

The Methuen, Mass.-based institution's newest CEO was born in the same town and has more than a decade of experience in the credit union industry.

April 19 -

By taking its U.S. card issuing technology to more countries, the fintech is becoming a bigger threat to the acquiring banks that focus on B2B payments.

April 19 -

Private businesses are beginning to embrace the Reserve Bank of India's plan to create competition in the country's retail digital payment space, seeking new licenses to develop alternatives to the state-owned National Payments Corp. of India system.

April 19 -

Calvin Philips led the credit union – which today operates as Neighborhood CU – from 1958 until he retired in 1988, and remained active on its board long after his retirement.

April 19 -

Britain’s Treasury and the Bank of England are weighing the potential creation of a central bank digital currency, joining authorities from China to Sweden exploring the next big step in the future of money.

April 19 -

The New York-based Citigroup is pushing ahead to set up new investment banking and trading operations in China after announcing it would be exiting retail banking in the world’s second-largest economy.

April 19 -

The retirement of the chief executive at Cincinnatio Ohio Police FCU has resulted in a new hire there and at nearby TruPartner Credit Union.

April 15 -

Janet Sanders has retired after 13 years at the helm of the $142 million-asset credit union. She is succeeded by the credit union's longtime executive vice president, Shelley Sanders. The two are not related.

April 15 -

The shutdown of the U.K. company's Pingit app demonstrates why even the most tech-savvy banks should collaborate with fintechs rather than go it alone.

April 14