-

Afterpay has found an opening in the U.S. by targeting the millennials who don't have a credit card to use at the point of sale.

February 28 -

From power outages to branch closures and even homeless kangaroos, rampant wildfires have presented credit unions in Australia with challenges they've rarely seen before.

January 14 -

EML has agreed to pay £226 million (US$290 million) to acquire Prepaid Financial Services, one of Europe’s largest e-money issuers.

November 13 -

Fintechs providing installment loans are attracting significant funding from investors who see opportunities in developed economies for consumer financing products, which are already well established in emerging markets.

September 9 -

Brexit seems more likely than ever, as the U.K.'s new prime minister, Boris Johnson, has committed to meeting the October 31 deadline for a deal to leave the EU. But despite the lingering uncertainty over how that will happen, Mastercard is not abandoning its bullish stance on Europe.

July 30 -

Transit systems are attracting contactless payment technology, but there are other options on the horizon that could make boarding easier than tapping a card or smartphone — provided riders are comfortable with an experience like something out of Minority Report.

July 18 -

The Australian API payments and rewards platform provider Verrency has closed on a $7 million (AU$10 million) Series A funding round, bringing the total funds raised to-date to $14 million (AU$20 million).

June 11 -

National Australia Bank is utilizing the end-to-end transaction tracking system through Swift's Global Payments Innovation system, making it the first bank in Australia to allow business customers to track international payments through one click on an account platform.

April 9 -

The speed of technological change is forcing Britain’s retail payments authority Pay.UK to redesign its core infrastructure.

April 5 -

Despite some significant advancements in the past two years, rifts are already developing in the U.S. move to faster payments.

March 22 -

The installment loan provider Splitit, which recently raised A$12 million on the Australian Securities Exchange to fund its Asia-Pacific expansion, faces strong competition from Australian incumbents — and the prospect of stiffer regulation.

February 13 -

As perhaps the world's most wide-reaching, comprehensive data protection rule, the General Data Protection Regulation is having a ripple effect that almost seemed inevitable.

January 2 -

The Australian government is evaluating a set of proposals to radically reform its payments industry, including abolishing interchange and opening up access for new entrants to core infrastructure.

November 28 -

Ant Financial’s push to expand global acceptance of its Alipay mobile wallet to wherever Chinese tourists go continues in Australia through Tyro, a fintech payments operation that obtained a banking license in 2015.

November 1 -

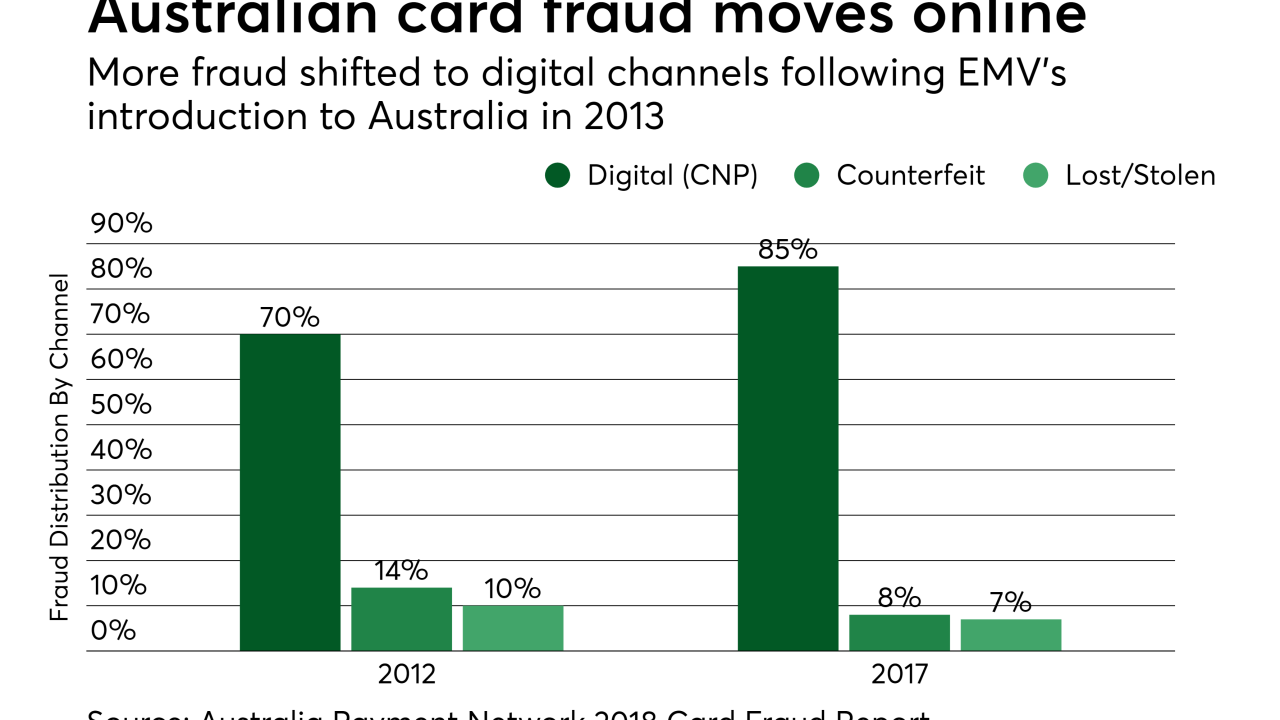

The vast majority of card fraud in post-EMV Australia affects digital payments, a trend that has prompted government action, expedited security projects, and financial pressure on banks from retailers.

October 18 -

Fleet card and corporate payment provider WEX has partnered with Melbourne, Australia-based fintech Payment Logic to support automated vehicle registration for fleet operators in Australia.

October 10 -

Angela Clark will be CEO of Beem It, which launched in May and has the backing of National Australia Bank, Westpac and Commonwealth Bank.

October 9 -

Australians' love for contactless payments is driving the Australia and New Zealand Banking Group to incorporate mobile withdrawal technology to its ATM network.

September 28 -

Electronic payments processor Mobile Credit Payment has launched an app that allows small businesses to invoice customers through social media channels and accept various payment methods.

September 13 -

Contactless card and mobile payments are set to see significant uptake in Australia, already a world leader in contactless card acceptance, as the country starts to implement open transit payments.

July 18