-

The company, which recently shared a three-year plan to bring in more lower-cost deposits and commercial loans, seems ready to play offense a year after the ouster of its CEO.

February 14 -

The California-based CU says its 2018 emphasis will be on member retention and expansion.

February 13 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

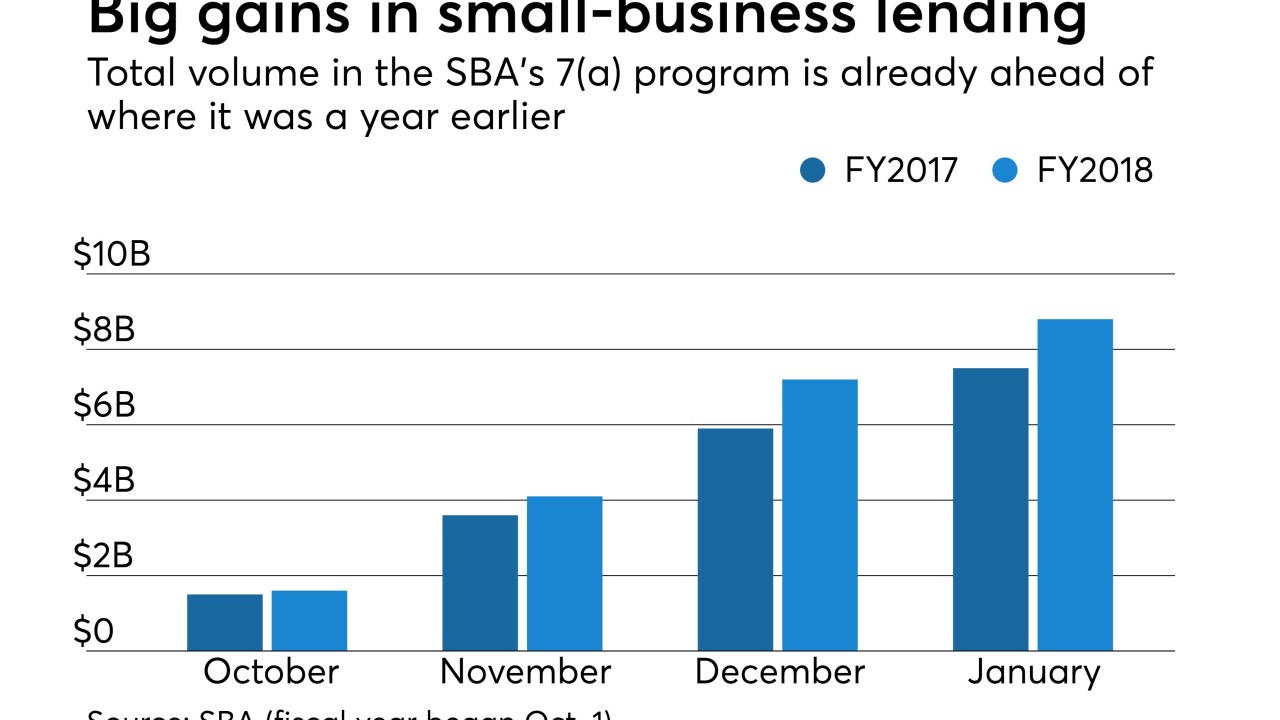

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

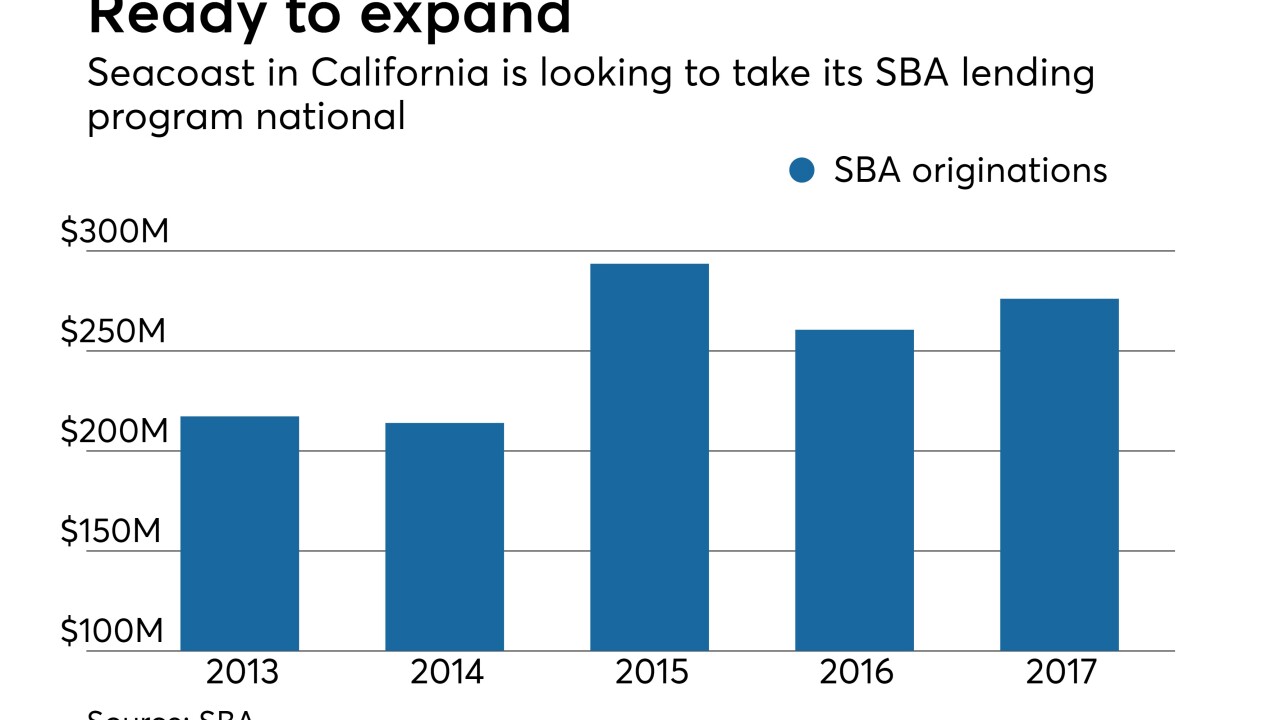

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

San Diego-based CU is the first new owner of the CUSO in 2018.

February 1 -

Nano Financial will offer new technology to Commerce Bank's commercial customers as it considers ways to license it to other financial institutions.

January 25 -

It's the 13th year in a row that the CUSO has been able to give money back to its CU shareholders, capping a record-setting year for indirect auto loan growth driven by the firm.

January 24 -

The client groups aim to take an active role in shaping the future of payments.

January 23 -

Attorney General Jeff Sessions did not keep the rest of Washington apprised of his plan to rescind an Obama-era memo on pot. Now Fincen and other federal banking agencies are dealing with the backlash from that decision.

January 18 -

Which large and midcap bank stocks have the most momentum? These 12 banks started the year off with the biggest bang, as measured by gains in stock price.

January 17 -

Endeavor Bank, which raised nearly $27 million, will become the second new bank to open in California in the past year when it debuts next week.

January 17 -

An economist for the California and Nevada Credit Union Leagues says trends are positive, but there are concerns that things could change in 2018.

January 12 -

If Congress doesn’t take the lead on protecting consumers from data breaches, states are more than ready to offer their own fixes. Bankers will also be keeping close tabs on bills related to marijuana, PACE loans and elder financial abuse.

January 11 -

The company has agreed to pay more than $50 million for United American Bank.

January 11 -

Attorney General Jeff Sessions’ decision to rescind an Obama-era directive that helped foster the marijuana sector’s growth raises new risks for banks and credit unions that do business with growers and dispensaries.

January 4 -

Attorney General Jeff Sessions’ decision to rescind an Obama-era directive that helped foster the marijuana sector’s growth raises new risks for banks and credit unions that do business with growers and dispensaries.

January 4 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

Doug Bowers contends that last year’s leadership shake-up, job cuts and corporate governance overhaul will make the company more competitive in its home state.

January 2 -

Acquirers announced deals in California, Missouri and Pennsylvania on the last business day of 2017, raising the year's final tally to 245 transactions.

January 2