-

The Los Angeles bank is taking its wealth management and entertainment financing businesses to Miami and Long Island as part of its effort to expand nationally.

October 24 -

The $32 million merger will create a bank with nearly $1 billion in assets.

October 22 -

Malaga Financial has no intention of diversifying its portfolio despite heavier competition and potential funding challenges.

October 20 -

Northern California utility company PG&E recently shut off power to more than 2 million consumers, meaning some insitutions had to move quickly to minimize the outages' impact on operations.

October 16 -

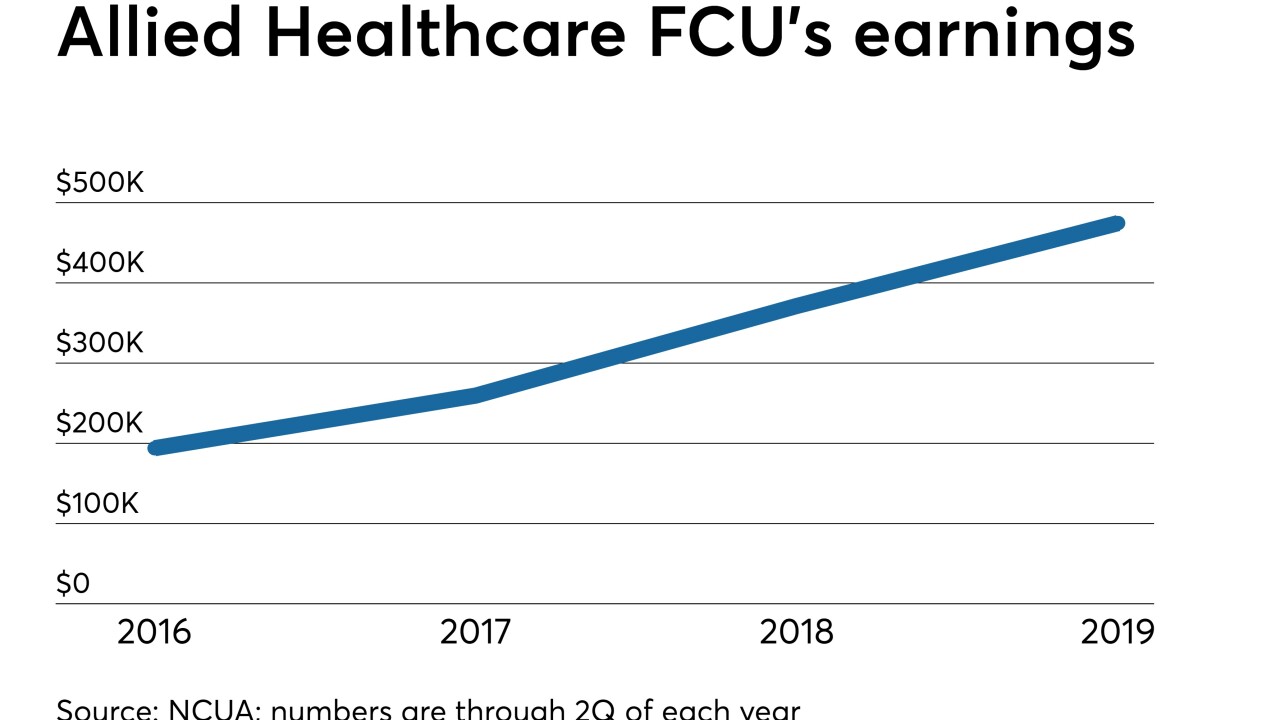

At a national level, loan growth has been on the decline for months and could still get worse. Here's how some credit unions are tackling the issue.

October 16 -

A law signed last week by Democratic Gov. Gavin Newsom caps interest rates on installment loans. But three large lenders are looking to avoid its restrictions by partnering with banks.

October 15 -

The deal was announced in August and would have created a $1.3 billion-asset institution.

October 11 -

The Long Beach, Calif.-based institution can now serve workers from the healthcare industry in six counties.

October 10 -

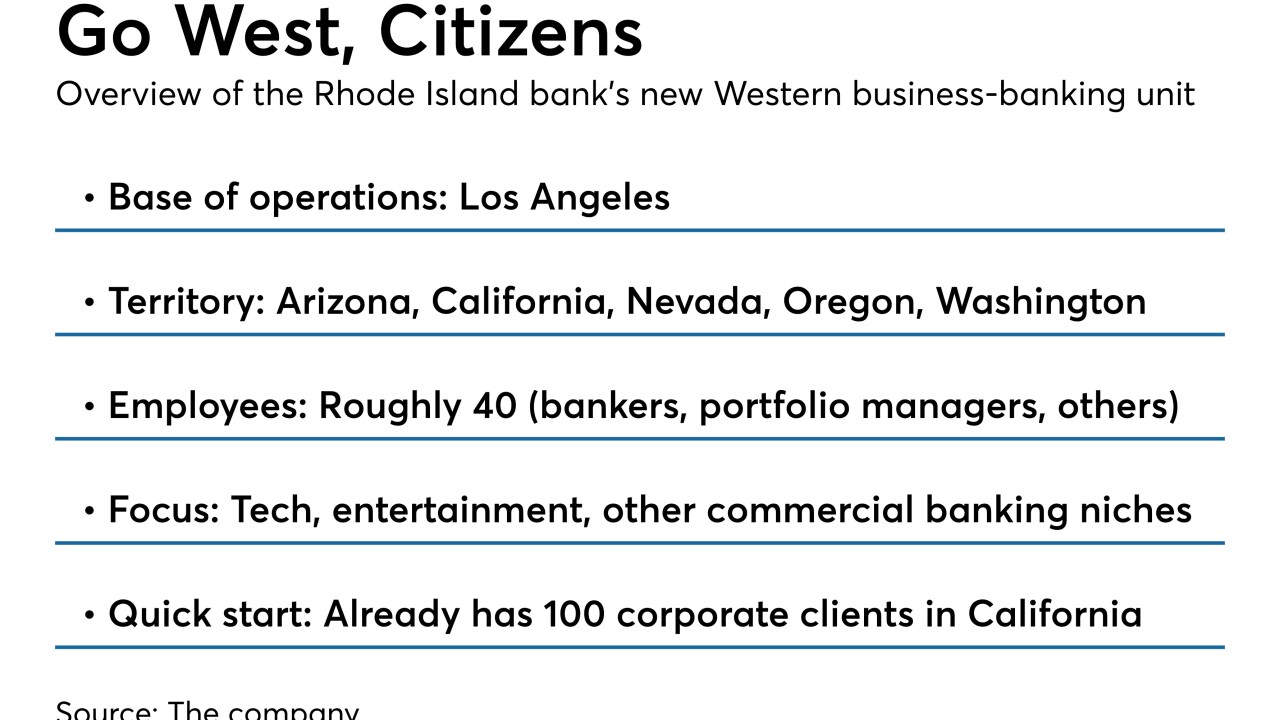

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

The state's Democratic-controlled Legislature has enacted laws establishing data privacy rights, giving municipalities the ability to set up public banks, and requiring standardized disclosures on small-business loans, among other issues. Lawmakers elsewhere are taking notice.

October 8 American Banker

American Banker