-

The Department of Financial Protection and Innovation has tapped Christina Tetreault as the head of the newly created Office of Financial Technology and Innovation.

May 17 -

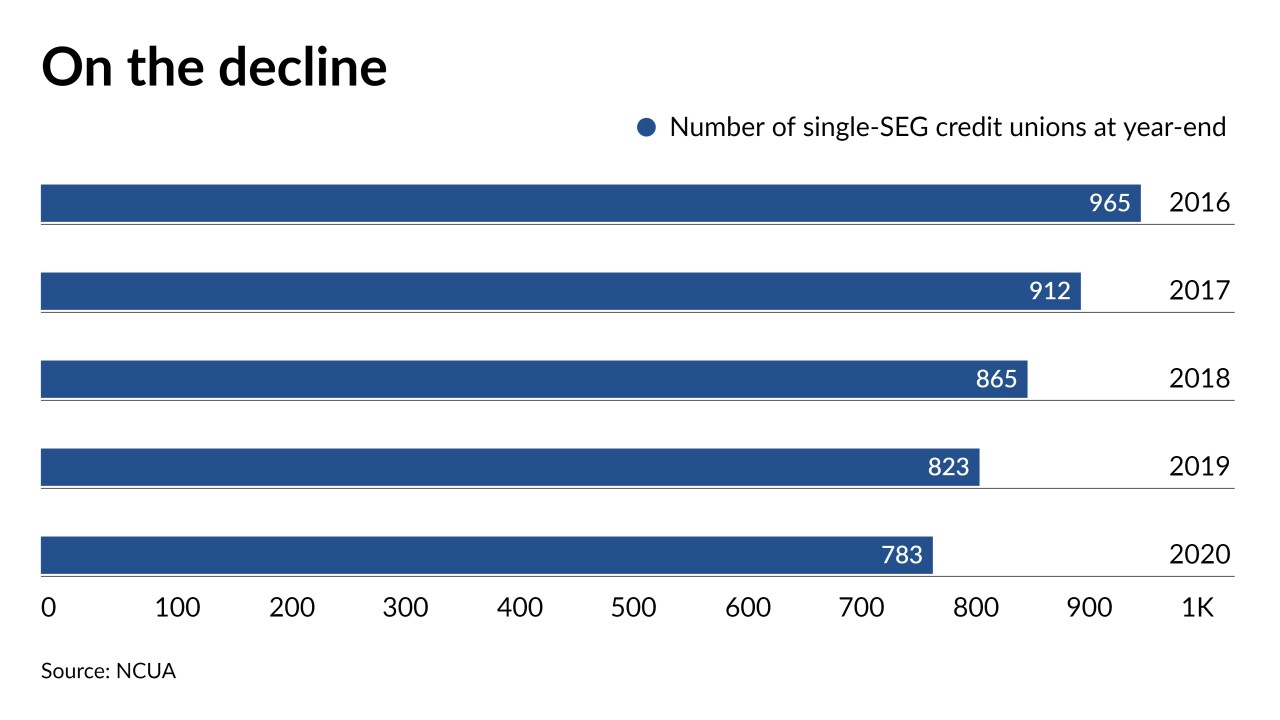

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

While many institutions are part of nationwide shared-branch networks, three Southern California credit unions have agreed to share one facility. The arrangement is believed to be the only one of its kind.

March 26 -

The fintech, which has applied for a California banking license and federal deposit insurance, aims to become a full-service online bank for 1 million Americans by year-end, says Ron Oliveira, its U.S. chief executive.

March 22 -

The deal, subject to approval from regulators and members, will add to Valley Strong's existing branch network and comes after several years of losses at Solano First.

March 4 -

The companies pledged to share data with regulators, abide by certain restrictions on pricing and submit to regular examinations. But the voluntary pacts stop short of placing restrictions on existing revenue models.

January 27 -

A recent agreement with the California Cannabis Industry Association will make it easier for legal cannabis businesses across the state to join the $92 million-asset credit union.

January 22 -

The state's Department of Financial Protection and Innovation alleged potential violations of “unlawful, unfair, deceptive or abusive” practices by a dozen companies.

January 19 -

With many impacted businesses still not ready to comply with the now enforceable CCPA, CPRA affected payment processors should start preparing for this new piece of legislation, says Abine CEO Rob Shavell.

December 31 Abine

Abine -

Organizers of the proposed Legacy Bank must raise $25 million before opening.

December 24 -

In 25 years at the helm, Brian Hall helped the Southern California credit union grow from $48 million of assets to nearly $600 million.

December 22 -

Irene Oberbauer spent 12 years in the credit union movement and was SDCCU's first female CEO, serving from 2007 until her retirement in 2010.

December 10 -

Kathie Kasper spent 24 years at the Livermore, Calif.-based institution, having started as a teller in 1976 and ultimately rising to the level of chief executive.

November 13 -

Referendums that legalized marijuana and sports wagering in several states could incentivize banks to do business with companies in these sectors. Payday loan and privacy measures that passed Tuesday also have implications for the industry.

November 4 -

Earlier this year, the Southern California credit union was criticized for its directors not representing the demographics of the communities it serves.

October 30 -

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

The California-based institution joins a small group of CUs that represent only about 7% of institutions but hold about 70% of industry assets.

October 13 -

New Enterprise Bank would focus on venture capital and private equity firms that are involved in investment between China and the San Francisco area.

September 24 -

The state's financial regulator sent a subpoena to an auto-title lender seeking information about its partnership with a Utah bank, marking the first public disclosure of an investigation into efforts to evade a 2019 law capping interest rates on many consumer loans.

September 3 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31