-

The company, which counts veteran banker Jay Sidhu among its investors, is selling to Ameris for $145 million in cash and stock.

November 17 -

Credit unions based in California, Michigan, Illinois and South Carolina have rejoined the CUSO’s fold.

November 15 -

The company, which recently bought Sabadell United in Miami, is pledging to make billions of dollars in mortgages and small business loans in low- and moderate-income communities.

November 6 -

Eight leagues/associations now are part of class action response to massive hack, with two leagues – representing CUs in Nebraska, Arizona, Colorado and Wyoming – joining on Halloween.

November 1 -

Strong loan growth at the Miami Lakes, Fla., company more than offset an increased loan-loss provision tied to Hurricane Irma and continued weakness in taxi medallion lending.

October 31 -

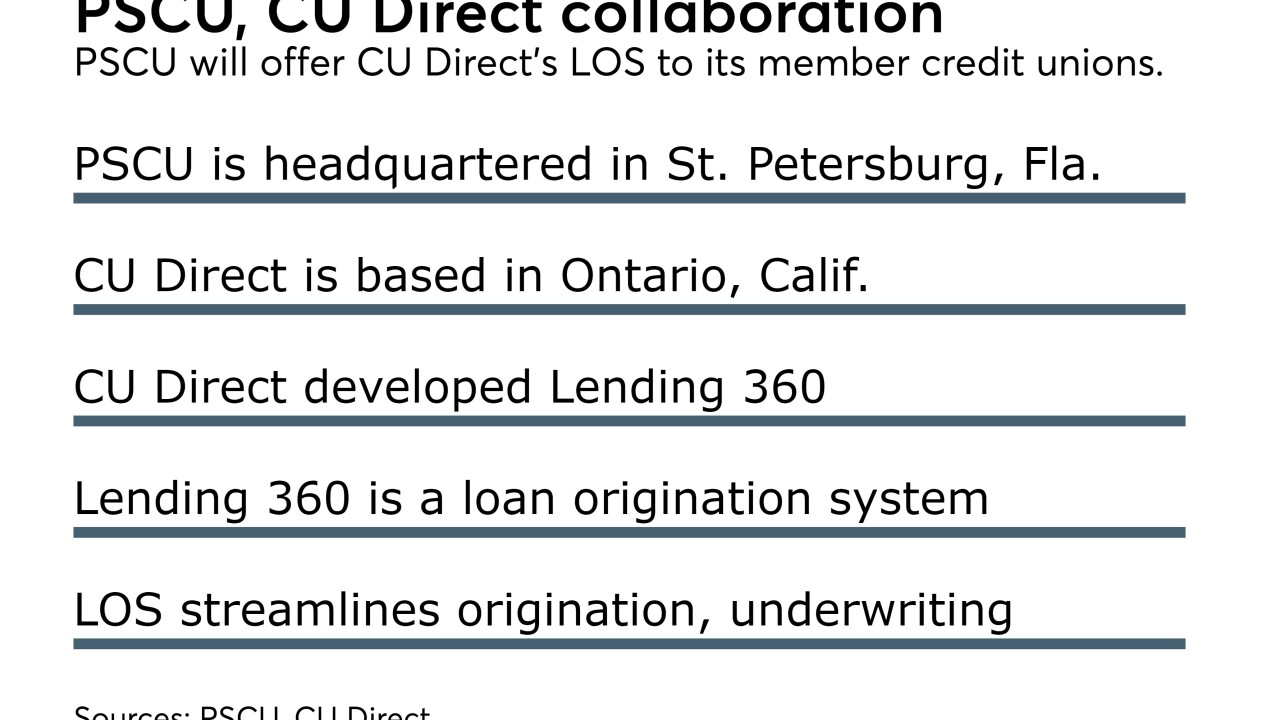

A new partnership from two of the nation's largest CUSOs will give more credit unions the opportunity to use the Lending 360 loan origination system.

October 27 -

A planned spinoff, combined with several new ventures, should help BankMobile turn the corner, says Luvleen Sidhu, the digital-only bank's president.

October 25 -

The Louisiana company also set aside funds to cover efforts to settle litigation tied to its mortgage business.

October 5 -

You thought love triangles were complicated. The CEO of Sunshine Bancorp in Florida spoke with nine banks about buying the converted mutual while eyeing three possible acquisitions. The company sold to a buyer that bought another bank at the same time.

October 3 -

Mark Thompson had previously been a CenterState regional president overseeing the South Florida market.

September 26 -

First Green Bank in Florida started researching the business after its chairman saw how medical marijuana had helped his wife cope with a severe injury. The bank is now turning a profit a year after adding its first pot-related client -- and there could be lessons there for credit unions.

September 21 -

The Florida bank started researching the business after Ken LaRoe, its chairman, saw how medical marijuana had helped his wife cope with a severe injury. First Green is now turning a profit on this business a year after adding its first pot-related client.

September 21 -

Florida and Texas are normally major sources of mergers, but bankers in those states likely will take a break to assess damage from the hurricanes before returning to dealmaking.

September 18 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

Banks could be busy supplying credit to manufacturers, hotels, multifamily developers and other businesses that will be helping residents get their lives back on track after two fierce storms.

September 14 -

The hurricane was expected by many to deliver catastrophe. Instead, bankers are largely looking to restore power and confirm the status of employees.

September 11 -

The agency has earmarked all funds from a Hurricane Harvey recovery package for direct relief, despite calls to get more bankers involved in the process. It remains to be seen how the agency will handle the cleanup for Hurricane Irma.

September 11 -

First Data is one of many payments companies working to get its customers back up and running in the wake of the severe storms, but it's also a victim — its center in Sugar Land, Texas, suffered flooding, causing the Atlanta-based company to set up operations at a hotel in Houston for 400 staff.

September 11 -

Texas bankers recovering from Hurricane Harvey are reflecting on their experiences, identifying what went right and what they could do better. Their views could prove useful to Florida bankers hurriedly preparing for the nation's next big hurricane.

September 8 -

Messaging services, mobile banking and remote deposit capture are expected to help Florida FIs that aim to keep up with employees and offer uninterrupted service to consumers.

September 6