-

The companies say they're working hard to complete their deal this year — including spending millions on retention payments and other items — but there's no guarantee how quickly regulators will make their decisions.

October 17 -

MetroCity Bankshares has said it could use the proceeds to open branches or pursue acquisitions.

October 10 -

A strong economy, low-cost deposits and disruption from M&A are presenting opportunities.

October 8 -

Associated Credit Union became the latest institution to provide cancer screenings to employees when it organized mammograms at its headquarters this week.

October 8 -

The North Carolina company agreed to buy the much-smaller Community Financial Holding.

September 24 -

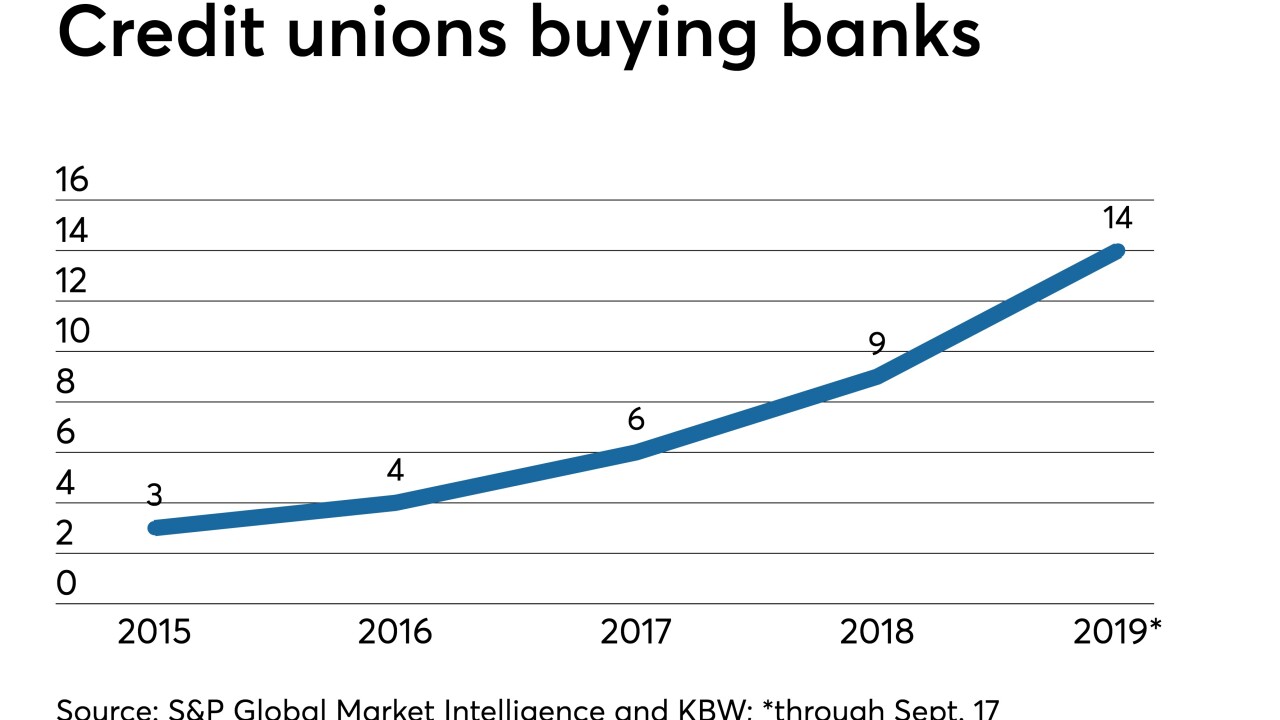

First Commerce Credit Union's agreement to buy Citizens Bank brings to 14 the number of deals this year in which a credit union is buying a bank.

September 17 -

First Commerce Credit Union's agreement to buy Citizens Bank is the 14th credit union-bank deal of the year.

September 17 -

Loyal Trust Bank is the seventh proposed bank in 2019 to secure the agency's approval for deposit insurance.

August 29 -

An appeals court said that Marietta, Ga.-based institution's overdraft agreements were "ambiguous" and now the case might be settled at a trial.

August 29 -

When H. Lynn Harton joined United Community Bank seven years ago, he knew he was on track to eventually become CEO. But he still felt he had to earn it.

August 28 -

Executives at Atlantic Capital Bank had to take a hard look at its strategy and culture after the acquisition of First Security Group dampened employee morale.

August 28 -

Community First will pay $40 million in cash for the parent of Affinity Bank.

August 20 -

Palmer Proctor, who took over at Ameris after it bought Fidelity Southern, where he was also CEO, says more deals would be a "distraction."

August 8 -

Lending at credit unions in the Peach State increased by just 0.2%, down from 0.8% growth recorded a quarter earlier.

July 26 -

With the industry continuing to consolidate, credit unions must address mergers in their strategic planning sessions so they are ready to be on either side of the deal when the opportunity arises.

July 23 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

The Georgia regional plans to open more branches in the state as it looks to loan growth and fees as a way to offset intense competition for deposits.

July 16 -

The Tucker, Ga.-based institution said the new name reflected its ties to electric cooperatives while affirming its commitment to member service.

July 8 -

Dennis Zember Jr. stepped down as the Georgia bank's CEO, citing personal matters. Palmer Proctor, an executive at the recently acquired Fidelity Southern, succeeded Zember.

July 1 -

Members of the Georgia Credit Union Affiliates have voted to join the League of Southeastern CUs, the second such merger this year. Analysts say there could be more to come – and soon.

June 21