-

The company will pay $195 million for its first retail operations in the city.

August 28 -

The company has agreed to buy Albany Bancshares, which has four branches near the Iowa border.

August 20 -

North Side Community FCU served the underbanked before it joined Great Lakes earlier this month.

August 16 -

The Iowa company will pay QCR Holdings about $59 million for Rockland Bank and Trust.

August 13 -

Andigo CU said it would merge into Consumers CU, creating the fifth-largest credit union in Illinois.

August 12 -

Once the merger between Infinity FCU and Vibrant CU is completed, the combined institution will have 17 branches across five states.

August 1 -

Byline Bancorp is in discussions to buy Parkway Bank and Trust, according to a local publication.

July 26 -

The company agreed to buy the parent of Countryside Bank for $90.5 million.

July 25 -

The Wisconsin regional agreed to buy the parent of First National Bank in Staunton for $76 million in cash.

July 25 -

The former mutual, which had faced pressure from an activist investor, agreed to be sold to Corporate America Family Credit Union.

July 17 -

The purchase of Ben Franklin Bank is the latest deal in a year that has seen a record number of CUs buying out the competition.

July 17 -

The bench upheld a lower court's ruling that the plaintiff did not suffer an "injury-in-fact." Several judges previously made similar rulings.

July 17 -

Credit unions can usually limit attrition of consumer accounts after a bank acquisition, but maintaining relationships with business customers is the bigger challenge.

June 25 -

Kelly McDonough will take over next month, nine months after the $289 million-asset shop's former CEO left to lead a CUSO.

June 24 -

A Wisconsin credit union's agreement to acquire a small Chicago bank, the eighth credit union-bank deal this year, led bankers to once again call for policymakers to slow the trend. A credit union trade group complained that banks are trying to stifle competition.

June 18 -

The company will pick up five branches as part of the $48 million deal.

June 5 -

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

May 23 -

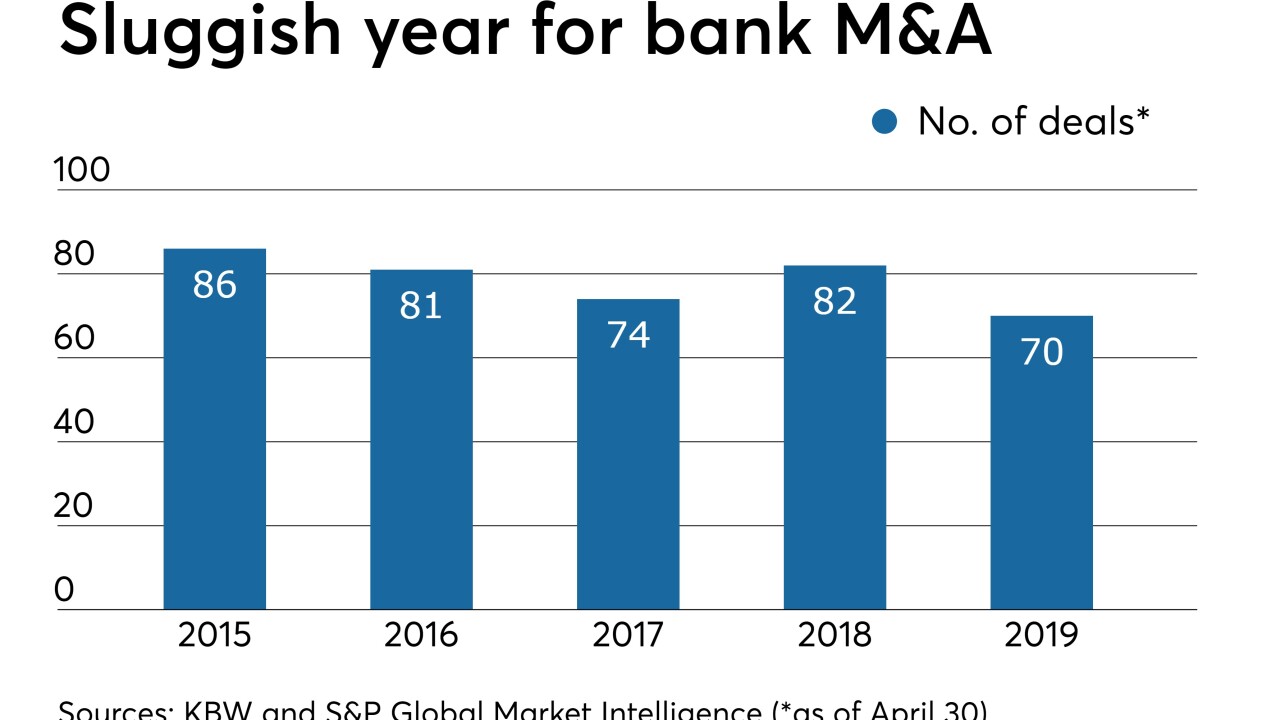

Consolidation activity was ho-hum for most of April before a burst of transactions — and notable ones at that — were announced in the month's final week.

May 8 -

Shelley Seifert had been the bank's chief operating officer.

May 1 -

Luis A. Reyes Jr. takes over for the Rev. Arnold O. Pierson, who served as president since the institution opened in June 2016.

April 26