-

The company created by the BB&T-SunTrust merger said that Truliant Federal Credit Union does not own the trademark rights to names beginning with the prefix "tru."

December 19 -

The company created by the BB&T-SunTrust merger said that Truliant Federal Credit Union does not own the trademark rights to names beginning with the prefix "tru."

December 18 -

The $7.6 million-asset shop is the latest postal credit union to be absorbed by a larger institution.

November 25 -

The smooth and relatively short process should be encouraging to other big banks that are eyeing deals. But their window of opportunity may not last long.

November 20 -

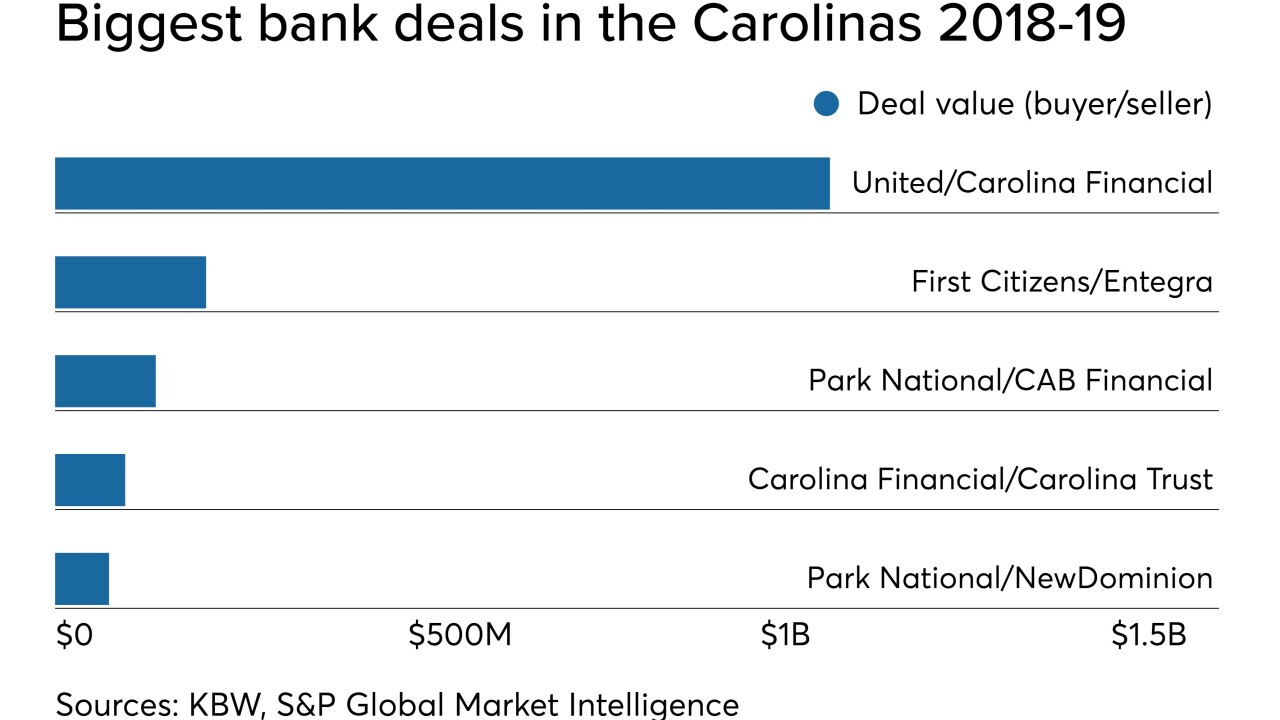

United Bankshares in West Virginia was willing to pay a healthy premium for Carolina Financial, one of a dwindling number of available banks with more than $4 billion in assets.

November 18 -

The company will pay $1.1 billion for Carolina Financial in Charleston, S.C., in a deal that will add nearly $5 billion in assets.

November 18 -

BB&T and SunTrust had to sell the branches to get Justice Department approval of their merger, a key step toward closing the deal.

November 8 -

The North Carolina-based credit union is doubling down on claims of trademark infringement following the biggest bank merger in decades.

November 4 -

The Raleigh-based credit union hit its latest milestone just three years after reaching 200,000 members.

October 25 -

The companies say they're working hard to complete their deal this year — including spending millions on retention payments and other items — but there's no guarantee how quickly regulators will make their decisions.

October 17 -

Sound Bank is now Dogwood State Bank after its sale to an investor group. The buyers also moved Dogwoods State's corporate offices from eastern North Carolina to the state's capital.

October 2 -

The North Carolina company agreed to buy the much-smaller Community Financial Holding.

September 24 -

Forget Facebook and Twitter. For Coastal FCU and others, social media is happening inside the credit union.

September 23 -

Skip Brown, an executive with Winston-Salem Banking Group, says it has signed a letter of intent to buy a community bank three months after withdrawing a charter application.

September 6 -

The 2020 election is shaping up to be a key yardstick for legislation expanding cannabis firms’ financial services access.

August 14 -

Marc Schaefer, who has led the credit union since 1995, has announced plans to retire. President Todd Hall will take the helm on Jan. 1, 2020.

July 22 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

The company, based in Charleston, S.C., will buy Carolina Trust in western North Carolina for $100 million.

July 15 -

The Pittsburgh regional, once among the most industry’s most active acquirers, hasn’t bought a bank in more than two years — and it’s in no rush to do so.

July 1 -

Organizers of Community Bank of the Carolinas in Winston-Salem said that they will return capital to investors and pursue other alternatives, including buying an existing bank.

June 28