-

Incenta Federal Credit Union in Englewood, Ohio, will merge into Pathways Financial in Columbus next week.

March 26 -

Events at local breweries can be a fun way to educate younger members about getting their first mortgage but credit unions must walk a fine line at such events.

March 20 -

A number of credit unions have faced lawsuits alleging their websites failed to meet the standards of the Americans with Disabilities Act.

March 18 -

Vince Liuzzi previously served as chief banking officer at DNB First in Pennsylvania.

March 5 -

Superior is the latest credit union to announce an acquisition involving a bank.

February 5 -

Superior is the latest credit union to announce an acquisition involving a bank.

February 4 -

Gary Moritz will leave the credit union on Feb. 1 following 30 years at the helm of the Ohio credit union.

January 30 -

Executives at Key pushed back against doubts over a deal for Laurel Road Bank’s digital lending platform so late in the credit cycle, arguing that its customers are prime borrowers with high incomes.

January 17 -

The online platform, created by Laurel Road Bank in 2013, allows users to refinance student loans and originate mortgages.

January 17 -

David Fearing will take over at Accolade Asset/Liability Advisory Services as Joe Ghammashi retires.

December 14 -

Organizers of Community Bank of the Carolinas still need to raise $25 million and secure approval from the state's banking commissioner.

December 6 -

Last week the car manufacturer said it would cut jobs and close factories. Now credit unions in the affected areas are considering how the news will affect their members and themselves.

December 3 -

Heartland BancCorp received the funds through a private placement to invest in several possible expansion options.

November 21 -

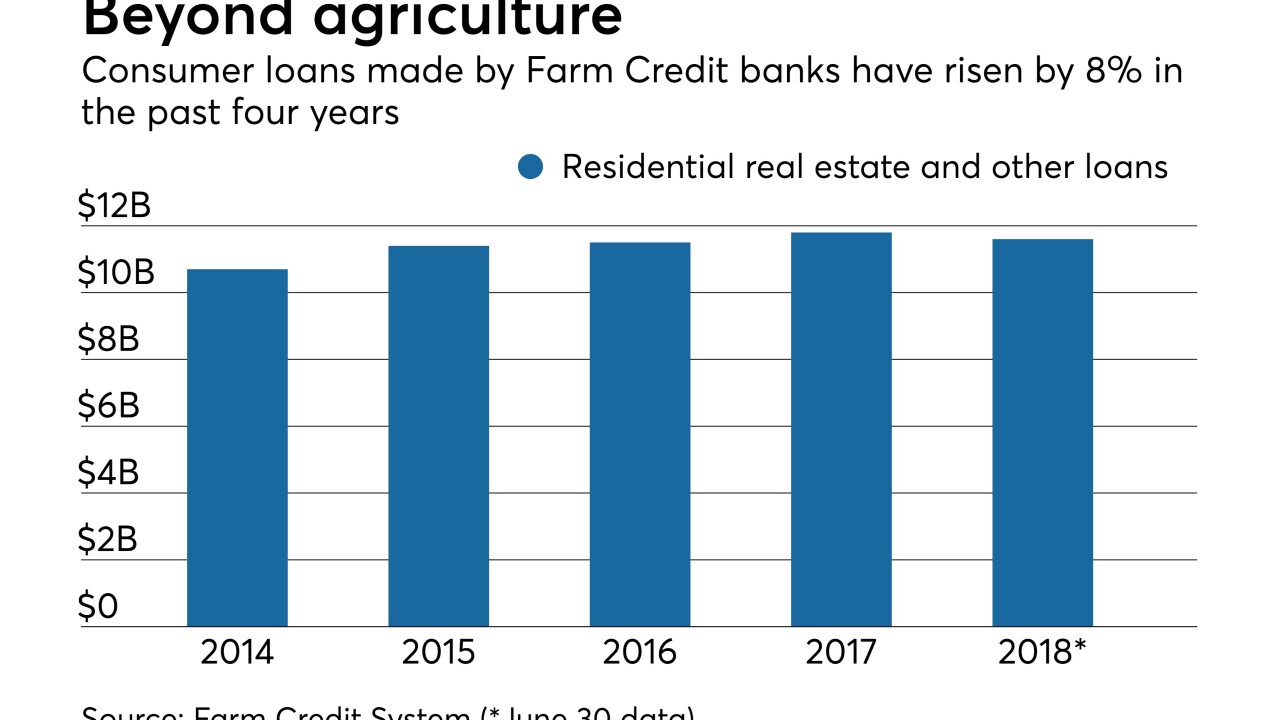

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

The $45 million purchase will provide Peoples with eight branches and $244 million in deposits.

October 30 -

The Ohio company touted a strong pipeline for loans but warned that noninterest costs will likely rise in the fourth quarter when it records charges tied to branch closings.

October 23 -

Mark Decello will take over for Gerald Guy, who has served as president and CEO at KEMBA for 30 years.

October 17 -

ABA Insurance Services, which is owned American Bankers Mutual Insurance, offers a range of services to banks, small businesses and nonprofits.

October 12 -

The $25 million-asset credit union has already seen new efficiencies since moving to the new platform.

October 5 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3