-

More than 20 banks have been sold to credit unions. A prominent banking lawyer made the case at this year's ICBA convention that banks can become more aggressive acquirers.

March 19 -

Congress granted banks significant reg relief last year, but incoming ICBA Chairman Preston Kennedy says a lighter touch is needed with Bank Secrecy Act rules, loan-loss modeling and call reports.

March 18 -

Joseph Nowland will take over at the Jacksonville, Fla.-based institution after Gerri Sexsion retires later this month.

March 15 -

Franklin Financial, which was recently freed from a memorandum of understanding, has installed interim leaders after its founding CEO's retirement and his son's resignation.

March 9 -

The Tennessee company is pleased with loan growth. It has also been able to reduce its dependence on brokered deposits as it brings in new customers following its purchase of Capital Bank.

January 18 -

The Tennessee company will have $4 billion in assets and 47 branches in six states when it buys Entegra Financial.

January 15 -

The Gray, Tenn.-based institution has named Kelly Smith as its temporary leader after Ron Scott resigned to move closer to family. He subsequently passed away.

January 14 -

In a push to be on the leading edge of technology, Tennessee-based Enrichment Federal Credit Union launched a service through Amazon's Alexa by first making sure employees knew what to do.

November 21 -

The company is selling 14 branches, including several around Chattanooga, Tenn., and its mortgage business to FB Financial so it can focus on its Atlanta operations and national lending businesses.

November 14 -

The Memphis-based CUSO, known for its NewSolutions system, signed six credit unions, all with assets under $140 million.

November 13 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

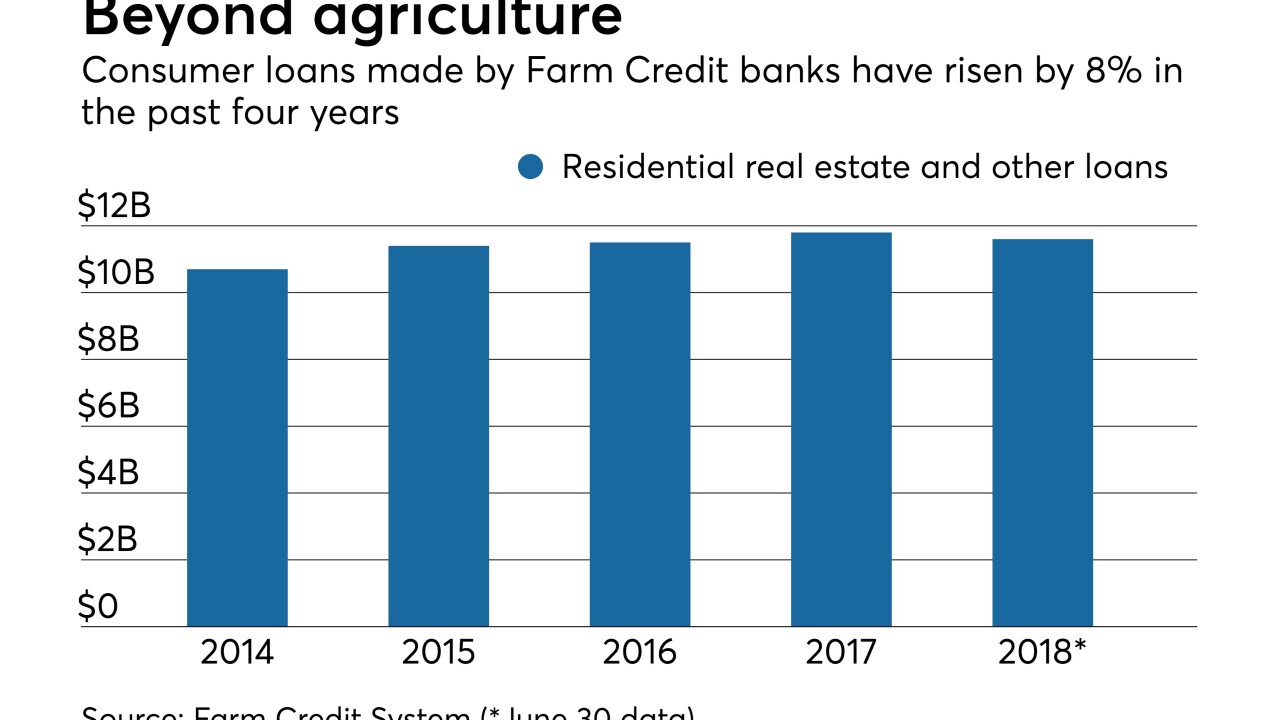

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

This is the first special dividend the Oak Ridge, Tenn., credit union has given out since 2005.

October 22 -

The Tennessee regional said the sale should boost quarterly profit by $160 million.

September 12 -

The Tennessee-based CU is issuing a $3 million special dividend and plans to make donations to local nonprofits in celebration of its 70th anniversary.

August 22 -

One-time items included $43.2 million of second-quarter expenses related to the Capital Bank acquisition, but First Horizon executives forecast sizable savings from the deal.

July 17 -

P. Byron DeFoor, who already has majority stakes in two community banks, is planning to buy First Columbia Bancorp.

July 16 -

FNS Bancshares has agreed to buy Catoosa Bancshares in Fort Oglethorpe, Ga., in all-cash deal.

June 28 -

SmartFinancial has agreed to buy Foothills Bancorp for $36 million. It would be SmartFinancial's fifth bank acquisition since 2012.

June 28 -

The company will pay $114 million to gain 10 branches and $482 million in assets.

June 11