-

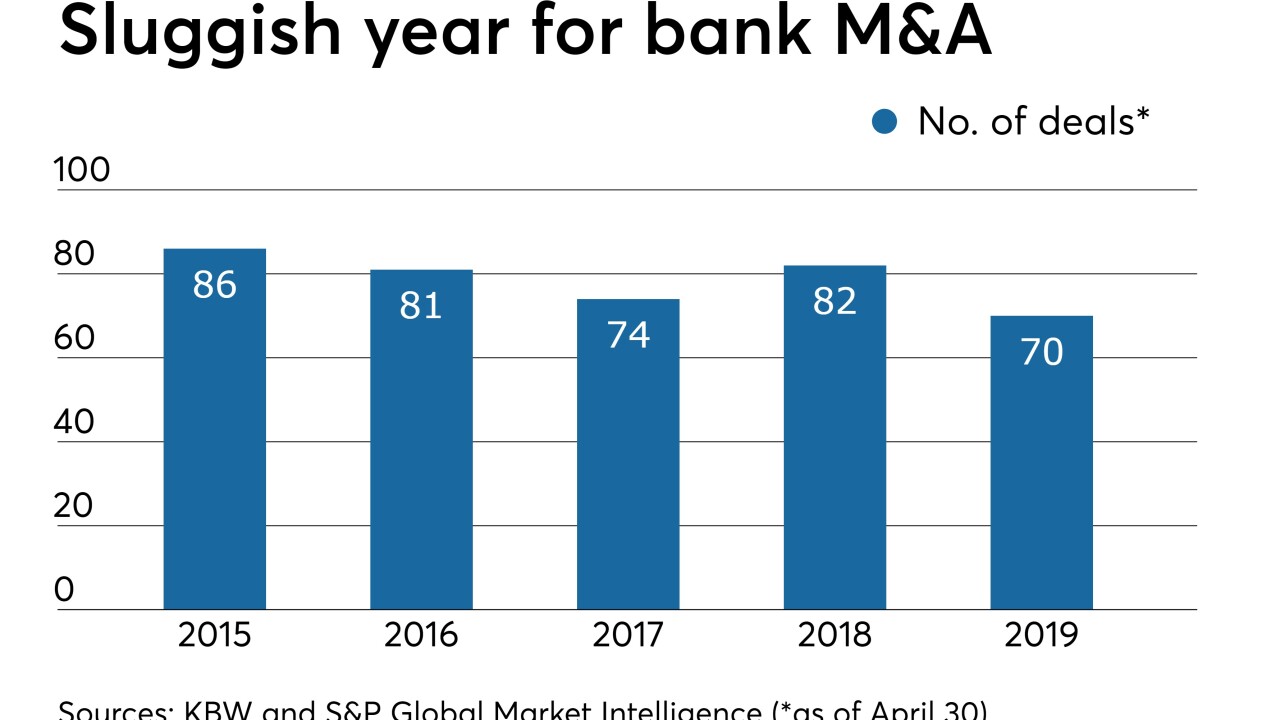

Consolidation activity was ho-hum for most of April before a burst of transactions — and notable ones at that — were announced in the month's final week.

May 8 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

The Houston company has already converted the systems and brand from January's acquisition, allowing it to focus more on bringing in business.

April 29 -

The San Antonio bank reported 6.8% growth in loans, but Phil Green said he was unwilling to match overly generous prices and underwriting terms that he is seeing in the market.

April 25 -

The Oklahoma company will pay $122 million for a bank with three branches in Dallas.

April 25 -

Investors seem to be betting that a long-rumored sale of the Dallas company is on hold now that it has named a new CEO, but analysts say it remains an attractive takeover target for a larger regional bank.

April 24 -

A surcharge-free ATM network among credit unions based in Central Texas has helped raise the profile of small CUs there – and some say it’s a strategy institutions in other cities could easily adopt.

April 18 -

The Dallas regional assured analysts that it has ample sources of liquidity to fund its expected loan growth.

April 16 -

Credit unions in the Lone Star State have been working with lawmakers on a series of bills but the clock is ticking since the legislative session ends in May and won't restart until 2021.

April 16 -

The Houston-based institution said investments in financial technology have led to operational efficiencies that enabled it to return more than $263,000 to members.

April 4 -

Alliance Bank Central Texas may have found a way around National Credit Union Administration regulations that make it difficult for banks to buy credit unions.

April 4 -

National Credit Union Administration regulations make it difficult for banks to buy credit unions, but one Texas bank may have found a partial way around that.

April 4 -

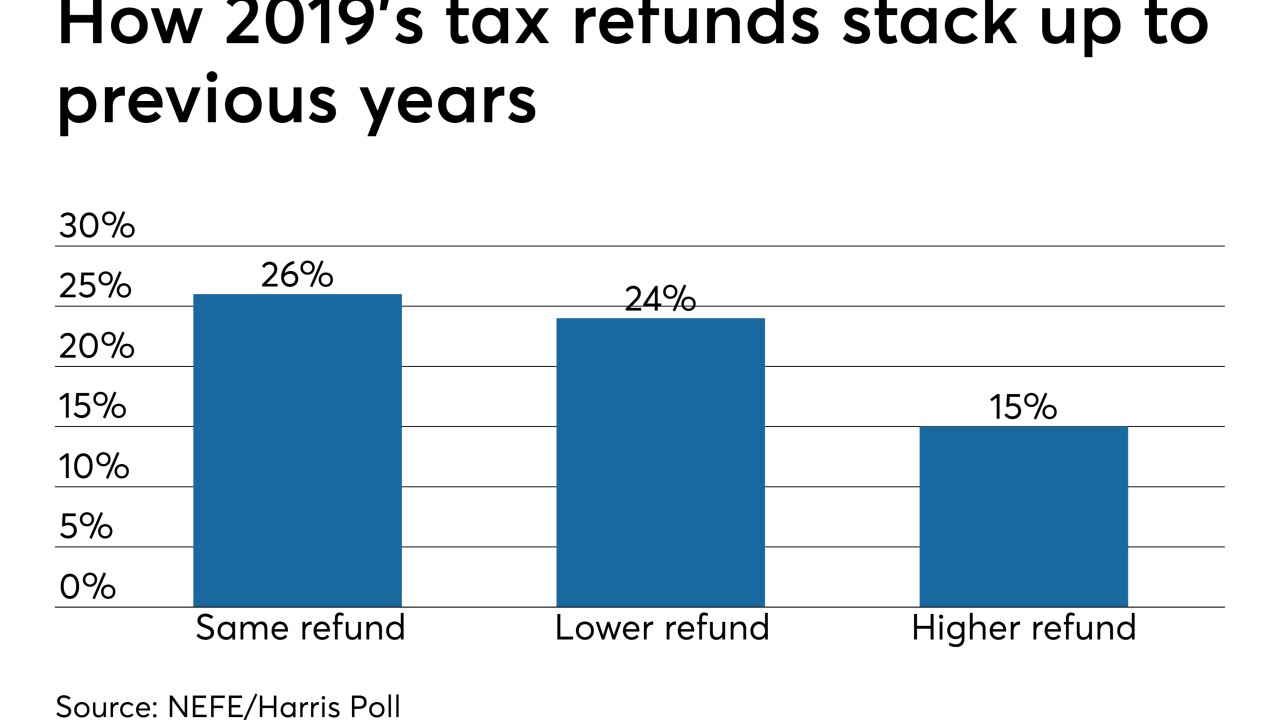

Volunteer Income Tax Assistance is reportedly bringing an influx of consumers to credit unions this tax season, but those institutions are hamstrung on the extent to which they can turn that opportunity into new business.

April 2 -

Andy Reed, who currently leads Texas People Federal Credit Union, will become president and CEO of the Dallas-based institution in May.

March 27 -

Speakers at the Credit Union Summit during the 2019 Retail Banking conference offered a host of best practices for embracing new technologies while maintaining high levels of member service.

March 27 -

Low unemployment and the promise of millions of new jobs have some in the industry seeing a chance to increase membership and lending in the Lone Star State.

March 26 -

A partnership between TDECU and a Texas-based fintech will help provide payment plans for consumers struggling to pay legal fees.

March 15 -

Joseph Nowland will take over at the Jacksonville, Fla.-based institution after Gerri Sexsion retires later this month.

March 15 -

Barbara Vitolo will leave Wyrope Williamsport Federal Credit Union this summer once a successor is in place.

March 14 -

East Windsor, N.J.-based McGraw Hill Federal Credit Union will merge into PenFed, the latest in a series of growth moves from the nation's third-largest credit union.

March 13