-

The regulator's governing body has been short-handed since former chairman Debbie Matz stepped down in April 2016.

March 14 -

J. Mark McWatters, chairman of NCUA, and Rick Metsger, a board member, also said that Congress should give the agency more authority over field of membership for underserved areas.

March 13 -

Credit union executives are hitting the Hill on Wednesday to discuss their concerns with lawmakers as CUNA's Governmental Affairs Conference ends.

March 13 -

The trade association met with the Justice Department to reiterate credit union concerns about how the Americans with Disabilities Act applies to websites.

March 11 -

A new regulation in the Golden State could provide a de facto national standard as Congress continues to stall on data breach legislation.

March 11 -

The agency wants to increase the maximum SBA Express loan to $1 million from $350,000 to pump up volume.

February 26 -

Todd Harper and Rodney Hood's nominations to the National Credit Union Administration board are not expected to face significant opposition.

February 22 -

Bankers are eager to expand there through M&A, de novos or other means, encouraged by strong employment and disruption created by recent consolidation.

February 21 -

A Senate confirmation hearing for Todd Harper and Rodney Hood focused on a recent scandal at the National Credit Union Administration, a controversial appraisal rule, regulatory consistency and more.

February 14 -

A MAPS Credit Union executive told the House Financial Services Committee her institution is proof credit unions and banks can safely serve the legal weed space.

February 13 -

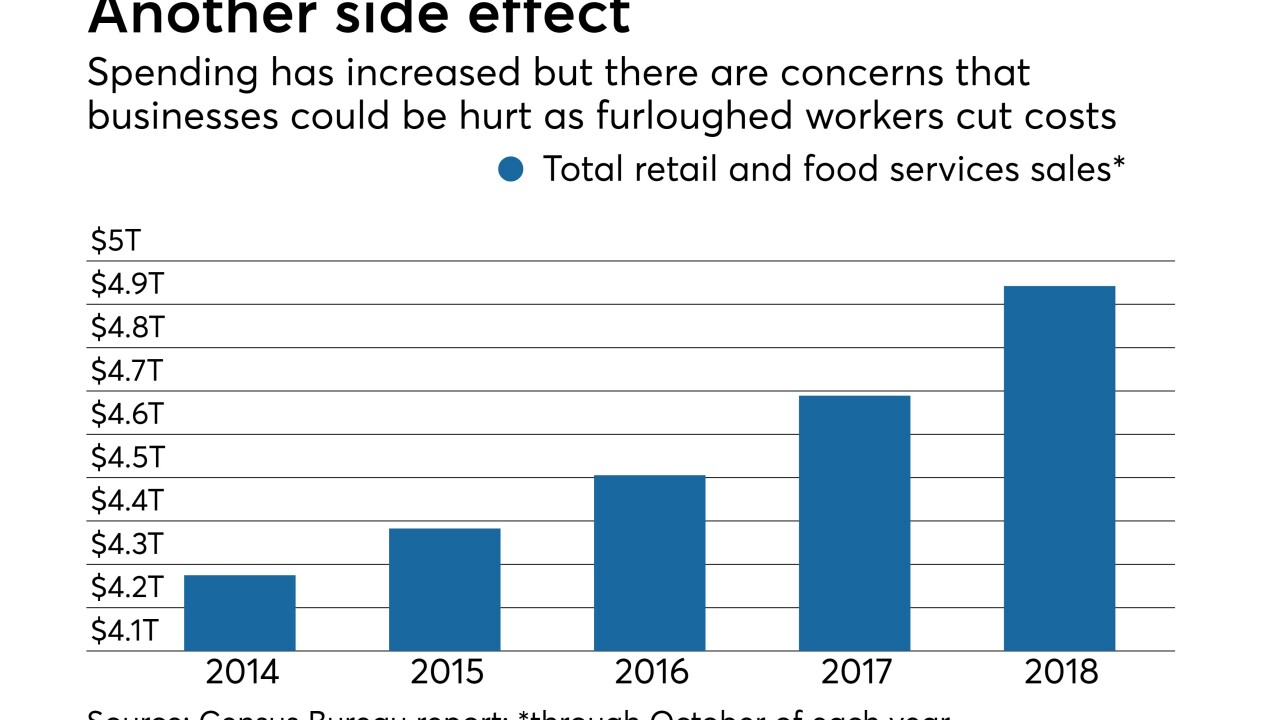

If the government insists on forcing another shutdown, business owners are intent on letting Congress know how much the last one hurt.

February 11 -

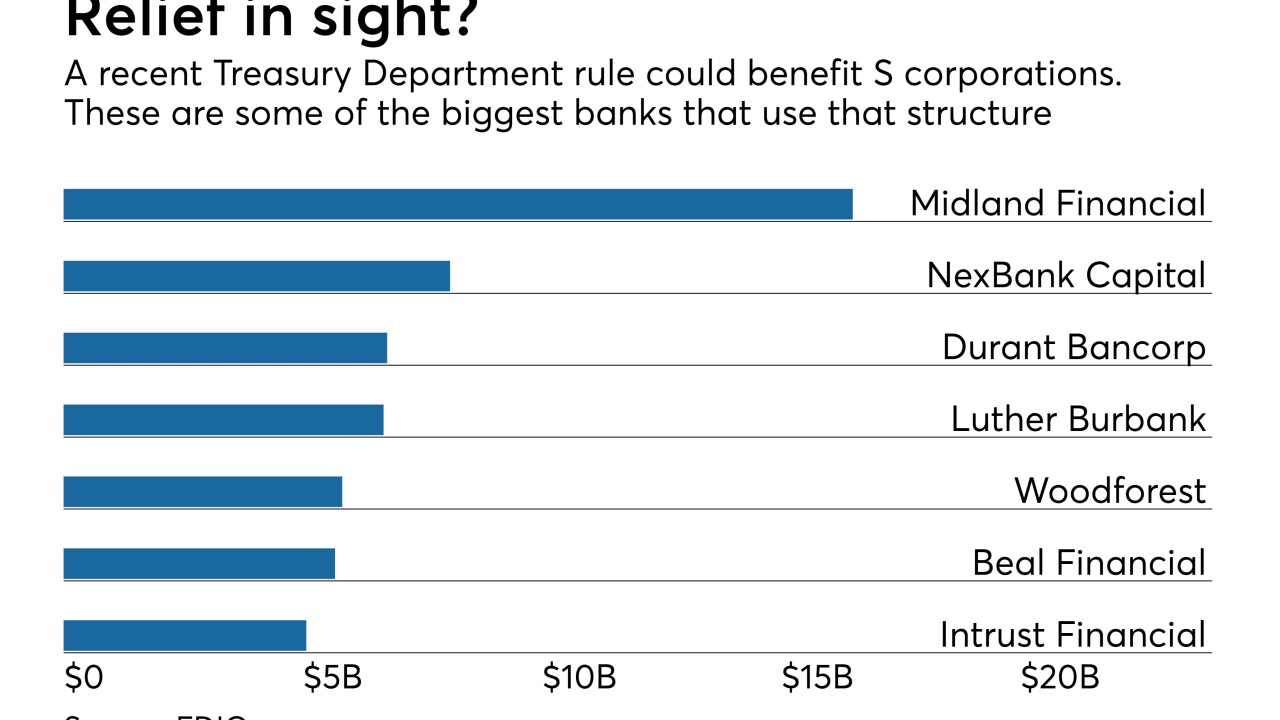

Shareholders in Subchapter S corporations will get some tax relief of their own under a new Treasury Department rule that will let them take a 20% deduction on qualified business income, which includes loan originations and sales.

February 5 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

Though it would be based in the nation's capital, MOXY Bank would also have significant operations in Charlotte, N.C.

January 14 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

Despite the ongoing federal work stoppage, some scheduled activities are still taking place this week in Washington.

January 14 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

President Trump has threatened that the closure may go on for a prolonged period. This could lead to higher loan delinquencies at credit unions that serve federal workers.

January 10