-

The 10 startups will receive initial investments, mentoring and training as part of the ICBA ThinkTECH Accelerator.

January 9 -

The agency is unable to process loan applications and faces a daunting backlog once Washington returns to work.

January 8 -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

Industry trade groups, which have been active in fighting lawsuits that allege violations of the Americans with Disabilities Act, hailed the decision.

January 3 -

As the federal budget dispute shoves an increasing number of government workers to the sidelines, there’s a window to provide payments relief that’s superior to options such as payday lending and bartering.

January 2 -

The directory, which will debut next year, should help community banks find potential fintech partners.

December 14 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

Dozens of House members and four senators agree with arguments by farmers and lenders that a proposed change to the 7(a) program would disqualify worthy borrowers.

December 5 -

Through a new partnership with the Military Spouse Advocacy Network, the trade group will help provide training, videos and classes to the spouses of service members.

December 5 -

Tepid loan and deposit growth has been a persistent theme in 2018, but that could soon change for community and regional banks in the New York and Washington markets.

November 14 -

As he weighs a possible presidential bid, Sen. Sherrod Brown, D-Ohio, touched on a likely campaign theme Tuesday, saying both political parties have done a poor job dealing with rural concerns.

November 13 -

Amazon’s transit-friendly posture should provide momentum for digital ticketing and other subway improvements in Queens, N.Y., and northern Virginia — and if recent history is any indication, Amazon may take an active role in improving that infrastructure.

November 13 -

The Financial Accounting Standards Board is considering a plan to have banks break out charge-offs and recoveries on a year-by-year basis. Bankers fear new systems would be needed to comply.

November 9 -

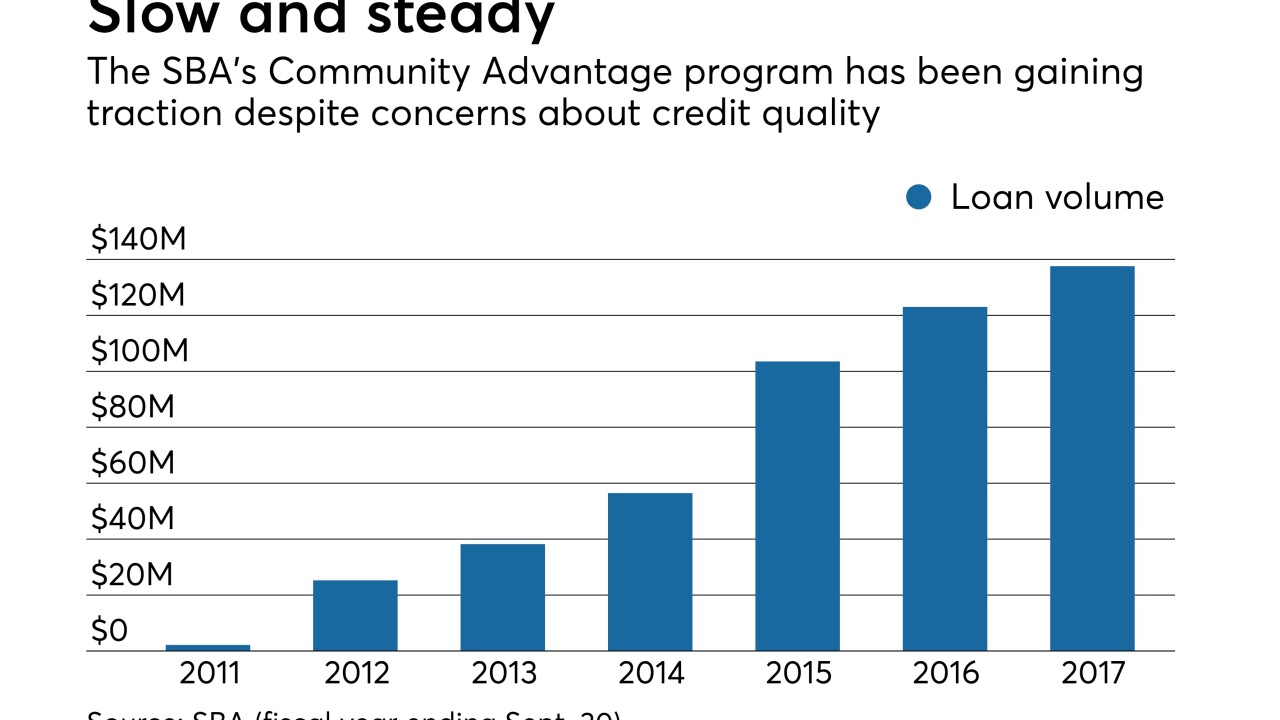

The agency says lenders lacked the risk appetite, while bankers point to concerns over turnaround times and strict loan terms.

October 25 -

Organizers plan to raise $25 million to $35 million in initial capital to focus on small and midsize businesses in northern Virginia.

October 24 -

Through the "Where We Live" program, the bank will direct philanthropic giving to two wards in the nation's capital and provide financing for affordable housing.

October 23 -

The awards will be handed out in March in conjunction with CUNA's Governmental Affairs Conference.

October 9 -

Union Bankshares will gain 15 branches and $2 billion in loans in northern Virginia after it buys Access National.

October 5 -

As NCUA Chairman Mark McWatters heads to Capitol Hill, credit unions are facing new threats at the ATM and CU trade groups are writing big checks in advance of midterm elections.

October 1 -

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26