-

As banks begin to use artificial intelligence in their businesses, they’ll need to consider the potential for bias as well as the impact new technologies will have on workers.

December 31 CCG Catalyst

CCG Catalyst -

The software, which was developed by Feedzai, will eventually block payments that appear to be fraudulent or mistaken.

December 21 -

Rich Baich, Wells Fargo's security chief and newly appointed security advisor to the White House, shares attack types he’s worried about and top defenses.

December 18 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

In a push to be on the leading edge of technology, Tennessee-based Enrichment Federal Credit Union launched a service through Amazon's Alexa by first making sure employees knew what to do.

November 21 -

In a bid to help younger consumers, CommunityAmerica Credit Union’s new FAFSA chatbot can answer more than 400 questions about applying for federal student aid.

November 20 -

The Federal Reserve is paying close attention to how it might regulate artificial intelligence and machine learning, Fed Gov. Lael Brainard said in a speech Tuesday.

November 13 -

Consolidation across the financial space isn't going to slow down, but one analyst says credit unions have a significant advantage over the competition.

November 12 -

Striking the right balance between personalization and privacy is just one challenge the startup Finn AI is grappling with as it refines the artificial intelligence behind banking through Alexa and other devices.

October 24 -

Banks should work to shield some customers who may otherwise be flagged or blocked by AI-powered safeguards, and consider using alternative data to expand services to the underbanked.

October 17 -

The regtech firm Arachnys, which recently raised $10 million from QED Investors and others, draws from a collection of 23,000 data sources to help banks protect themselves from money launderers and other criminals.

October 15 -

Some mortgage lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 5 -

To personalize products and services, banks are now tracking all sorts of alternative data sources, even the manner in which customers type in mobile banking apps.

October 3 -

Executives at Wells Fargo, BBVA Compass, ATB and Banco Popular share some of the pain points they've encountered as they've implemented artificial intelligence, and how they overcame them.

October 2 -

AI-powered assistants will change the customer experience for the better, but first they must achieve a more human level of service, executives said during a discussion at Finovate.

September 28 -

An all-virtual future remains far off, as conversational programs still aren’t capturing the nuance of speech and chatbots have disappointed many customers.

September 27 -

The subprime auto lender Prestige Financial Services used machine learning to make more effective lending decisions than its former model.

September 27 -

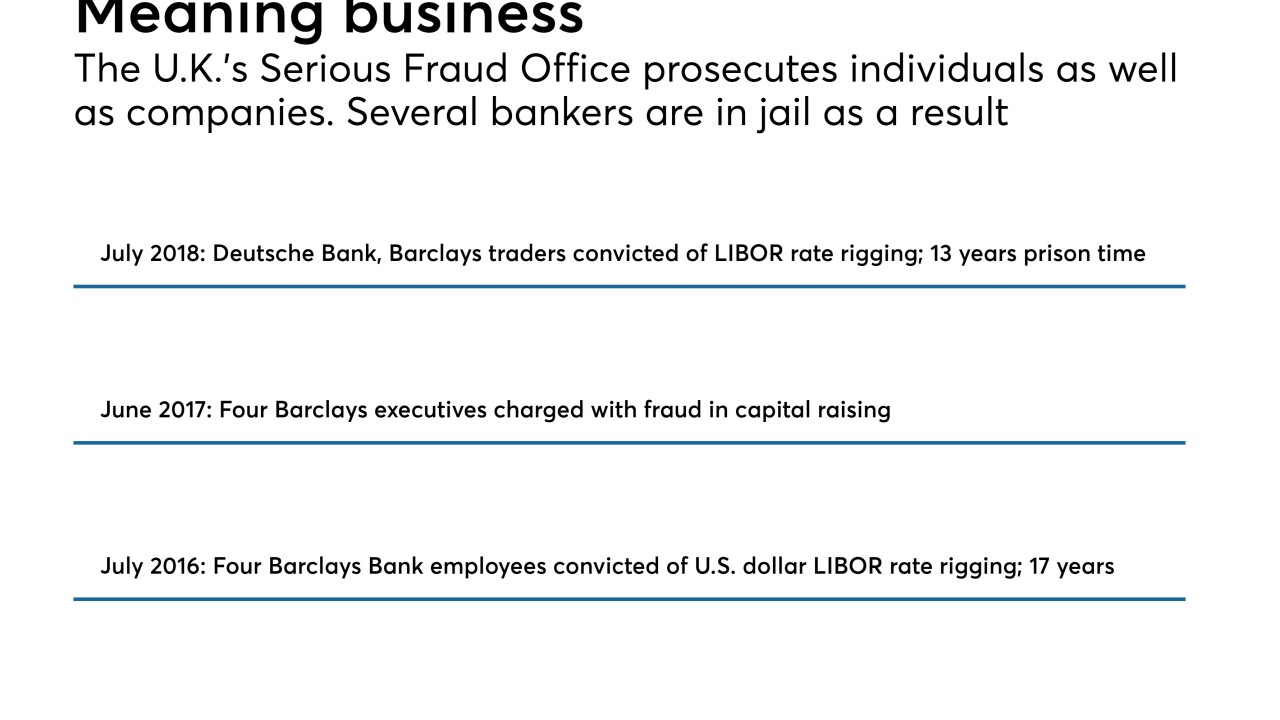

The U.K.'s Serious Fraud Office employs software that can read discovery documents about 2,000 times faster than human lawyers and can find previously unknown patterns between people, enabling quicker investigations and penalties.

September 17 -

A recent editing snafu illustrates an important lesson for credit unions using AI and machine learning.

August 27 Credit Union Journal

Credit Union Journal -

The forum, which is best known for its annual Davos economic conference, offers insights on what many get wrong about artificial intelligence and how banks should be thinking about using it.

August 26