-

The agreement between Colorado authorities, marketplace lenders and banks offers a way to structure partnerships without triggering the wrath of state regulators.

August 31 Hunton Andrews Kurth LLP

Hunton Andrews Kurth LLP -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 19 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18 -

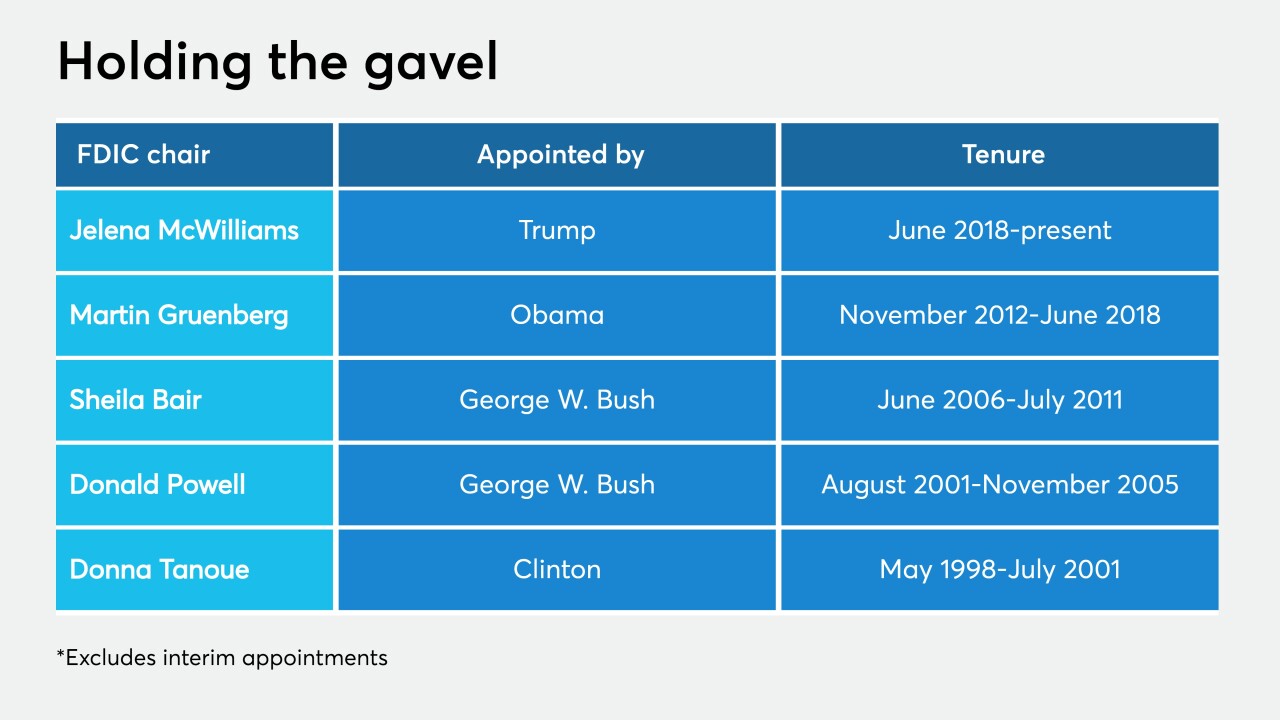

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Theorem is marketing its first-ever securitization of unsecured loans. It uses machine-learning technology to gauge the risk of default, a growing concern during the pandemic recession.

August 11 -

The e-commerce site and online lender have teamed up to let eBay sellers borrow up to $25,000.

August 5 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31 -

The pioneering online lender had long struggled to live up to the hype that drove its early growth, even before the pandemic pushed it to the brink.

July 29 -

Similar to a law passed two years ago in California, legislation headed to the New York governor’s desk would require fintech and other nonbank lenders to uniformly disclose total cost of capital, APR and other metrics to potential borrowers.

July 24 -

The online lender has already branched out into facilitating payments and analyzing cash flow for small-business customers. Its new checking account is meant to round out those services.

July 22 -

The OCC is proposing steps for determining which party is the "true lender," which affects how the agency oversees such arrangements.

July 20 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

The 2008 financial crisis transformed banking regulation. But how have those changes held up in the current recession, and what might be coming next?

July 1 -

Upstart, which specializes in the use of alternative data and AI in credit decisions, will make car loans directly and sell its technology to banks and other lenders.

June 24 -

With credit quality suffering due to the coronavirus outbreak, the online business lender faces onerous loan repayments if it can't renegotiate a corporate debt facility.

June 24 -

Former Comptroller of the Currency Gene Ludwig says making online lenders, credit unions and other nonbanks comply with the Community Reinvestment Act would be a powerful tool in addressing racial and economic injustices.

June 22 -

Other challenger banks focused on personal loans have struggled since the onset of the coronavirus pandemic.

June 17 -

The online lender quickly built an app for ride-share drivers with much of their information already filled in.

June 16