M&A

M&A

-

The sale to the Florida-based insurer Brown & Brown would give Berkshire Hills Bancorp an infusion of capital that it intends to invest in more profitable businesses, executives said.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

Seacoast Banking Corp. of Florida, which has bought 10 banks over the past decade, has agreed to acquire community banks in Sarasota and Melbourne.

August 23 -

Scott Credit Union of Edwardsville said it is acquiring Tempo Bank in Trenton, Illinois. It is the fifth such transaction announced since Aug. 5 and the 10th of the year.

August 20 -

Critics of consolidation say the Federal Reserve and other agencies are too quick to greenlight bank deals. But the truth is banks face many hurdles to merger approval, and they don’t bother to apply — or take a hint and withdraw their applications — if they can’t clear them all.

August 20 -

It would be the second bank acquisition for Fairwinds, which bought Friends Bank in Florida in 2019.

August 19 -

Goldman Sachs Group agreed to buy the asset-management arm of the Dutch insurer NN Group NV as the bank grabs a toehold in the fast-growing sustainable-investing industry and boosts its European ties.

August 19 -

Credijusto, the first fintech in Mexico to buy a bank, plans to cater to a market that traditional banks often overlook: smaller businesses engaged in commerce between the two countries.

August 17 -

Minnwest Bank, which focuses largely on agriculture lending, said it will “become more sophisticated" with its mortgage and consumer lending services by acquiring Roundbank.

August 16 -

M&T in New York, which is seeking regulatory approval to buy People’s United Financial, recently disclosed plans for around 1,000 layoffs. The backlash — focused on job cuts in the seller’s hometown of Bridgeport — has been stronger than in other recent deals.

August 15 -

The deal will help the bank serve small-business customers that are shifting to digital payments.

August 12 -

Three credit unions have announced deals to acquire community banks in the past week. The latest is the Wisconsin-based Royal, which is buying the $441 million-asset Lake Area Bank.

August 12 -

The combination of Orion Federal Credit Union and Financial Federal Bank is the seventh credit union-bank merger announced this year.

August 11 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

August 10 -

The combination of American Express and its fintech subsidiary Kabbage is starting to bear fruit at an opportune time, as credit card companies increasingly expand their range of products to boost revenue.

August 10 -

Ann Arbor Bancorp had agreed to buy FNBH in February 2020 but backed off four months later amid economic uncertainty. The two sides have reunited, though the price tag rose.

August 9 -

The $1.5 billion-asset SAFE FCU in Sumter, South Carolina, is combining with the $3 million-asset Sumter City Credit Union.

August 9 -

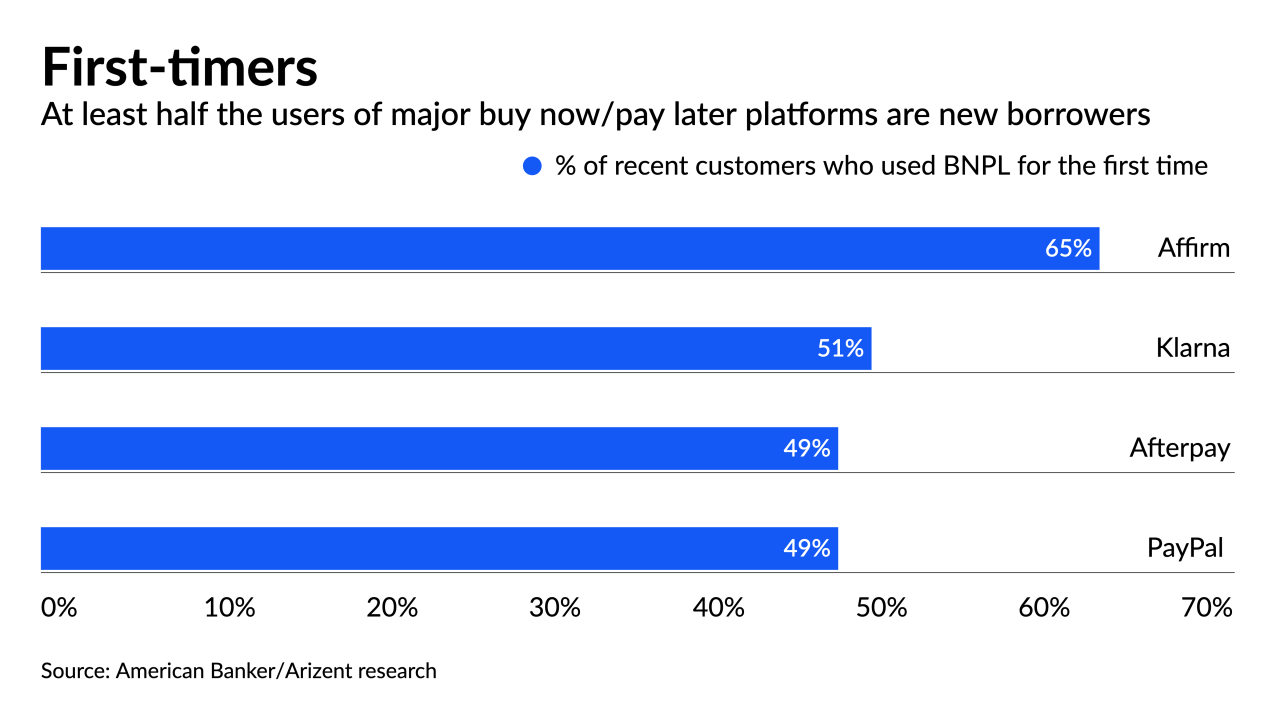

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

The deal would mark a first step in Chief Executive Jane Fraser’s plan to exit 13 retail markets across the Asia-Pacific region, Europe and the Middle East.

August 9 -

Chabot Federal Credit Union is combining with University Credit Union, which was founded on the UCLA campus.

August 6