-

Borrowers and financial institutions may be feeling the strain from reduced operations at the FHA and IRS, which has suspended the release of certain income documentation during the budget impasse.

January 4 -

The Consumer Financial Protection Bureau issued guidance late Friday that will shield some new mortgage data from the public that lenders are required to report.

December 21 -

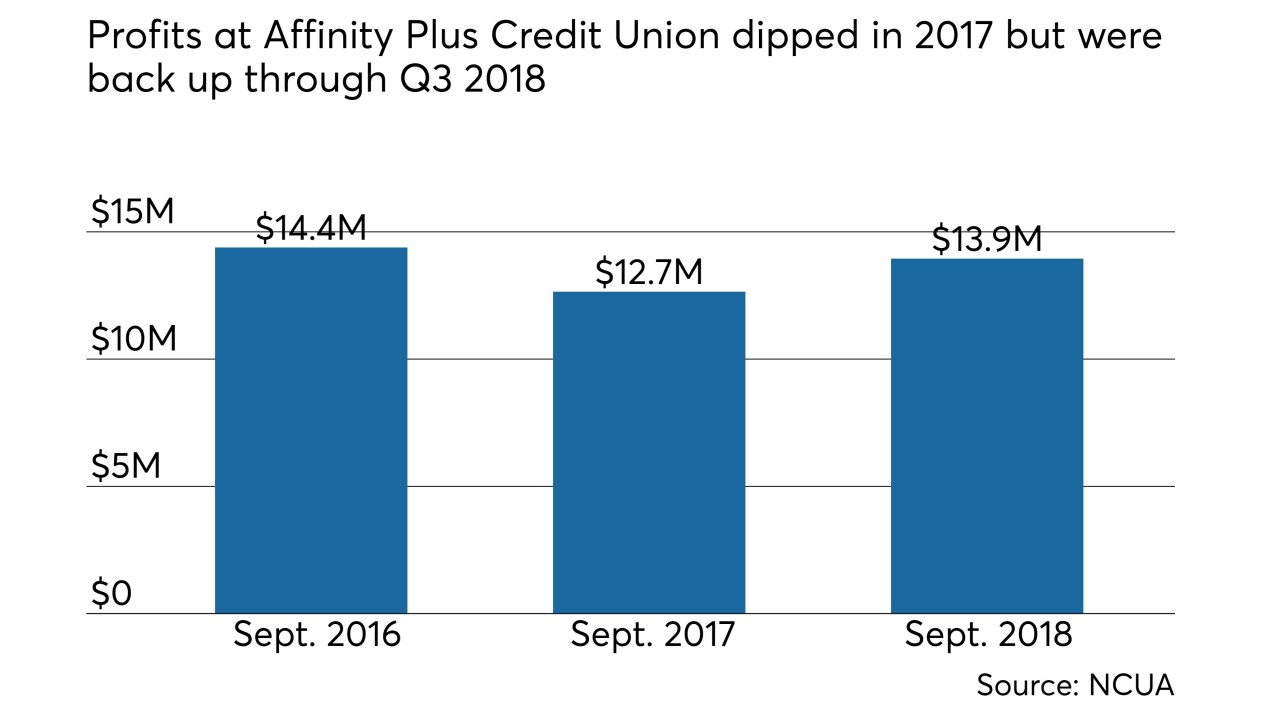

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

While JPM won't by the first to offer tap to pay, others may follow; cryptocurrency drops to lowest level of the year.

November 15 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5 -

USAA will be eliminating 265 home sales and lending positions, but it already has offered nearly 100 of the affected workers different jobs within its mortgage unit.

September 24 -

The CEOs of Fannie Mae and Freddie Mac are stepping down because the job they were hired to do — return the GSEs to profitability — is done. But attracting top-flight candidates to lead the mortgage giants into a new phase may not be easy.

September 24 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

The bank pared down its application to 50 questions and allows customers to do the easy work before turning it to the loan officer.

September 18 -

The migration to digital may change the way loan officers work, but it won't make them less essential: BofA Consumer Lending SVP John Schleck.

September 18 -

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

Agency’s first supervisory report under Mulvaney finds little change; the nonbank lender surpasses Citigroup and Bank of America in home loans.

September 7 -

A deceleration in mortgage balances ends CIBC's three-year streak of outpacing Canada's other large lenders on mortgage growth. Royal Bank of Canada said this week that mortgage balances were 5.9% higher than a year earlier.

August 23 -

Debates on the issue often focus on how lending decisions affect certain demographic groups, but those analyses tend to ignore an important factor: default rates.

July 19

-

Mortgage fees at the nation’s biggest home lender declined by a third in the three months ended June 30 to the lowest in more than five years.

July 13