The third quarter was a challenging one all around for community banks.

Banks in many parts of the country were saddled not only with continued margin contraction, but also slowing loan growth and a slight but noticeable deterioration of credit quality.

An analysis released Tuesday of third-quarter results from 232 banking and thrift companies with assets of $1 billion to $20 billion showed the median core earnings per share growth slipped to 1.55% in the third quarter, from 4% a year earlier. Returns on equity and assets also dipped, according to the report by Friedman, Billings, Ramsey Group Inc.

Analysts predict that the road will remain bumpy for several more quarters, until funding costs stabilize and margins begin expanding. Still, if nonperforming assets rise, earnings will suffer as loan-loss reserves rise.

The biggest drag on the earnings was margin pressure.

Net interest margins have been contracting for a number of quarters, but banking companies were hit hard in the third quarter by a sharp rise in deposit costs - mainly because customers rushed to buy up certificates of deposit now that rates have reached 5%.

"This seemed to be the inflection point for many customers, causing them to put more of their money in CDs," said James Abbott, a Friedman Billings analyst in Arlington, Va. "For the first time the industry as a whole experienced negative core deposit growth, and that negatively impacted earnings."

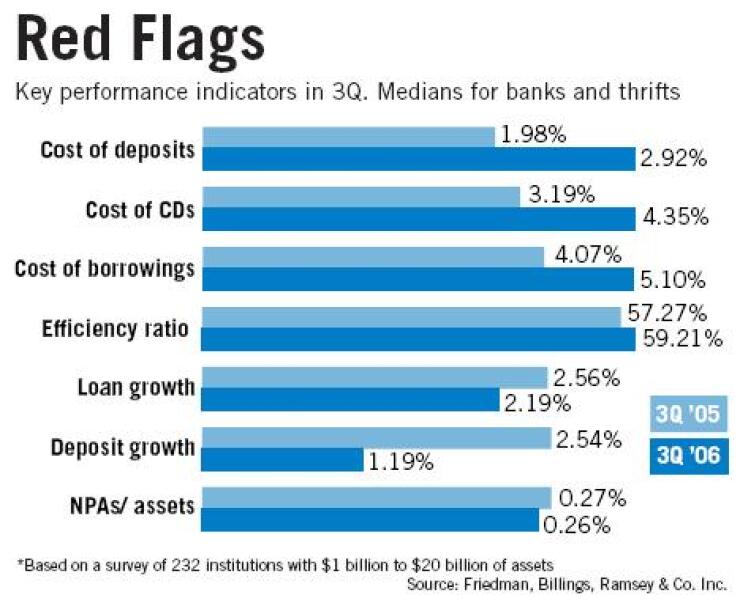

The Friedman Billings report found that the median cost of deposits at the 232 banking and thrift companies jumped 2.92% in the third quarter, versus the 1.98% median increase in the same quarter last year. Likewise, the cost of CDs jumped 4.35%, versus 3.19%.

The net interest margin at the $4.6 billion-asset PFF Bancorp in Rancho Cucamonga, Calif., dropped 24 basis points, to 4.16%. Its core deposits fell while CD balances rose. As a result, net income rose just 4.4%, to $14 million, or 56 cents a share - 2 cents below the average estimate of analysts.

After its earnings announcement, the average estimate for PFF's 2007 earnings per share dropped 32 cents, to $2.43, mainly because of the severe margin contraction, Mr. Abbott said.

Margins will continue to contract for the next two to three quarters, before deposit costs stabilize, Mr. Abbott said. He predicted flat earnings for next year before margins begin to expand in 2008.

Jared Shaw, an analyst in Hartford, Conn., for Keefe, Bruyette & Woods Inc., said that many banking and thrift companies responded to increased margin pressure by selling poor-performing securities and putting the money into higher-yielding instruments or paying off borrowings to lower funding costs.

The $2.2 billion-asset Berkshire Hills Bancorp in Pittsfield, Mass., sold $167 million of securities to boost its margin 20 to 25 basis points over the next year. Its third-quarter margin contracted 17 basis points from a year earlier, to 3.14% (excluding an outsized dividend from the Federal Home Loan Bank of Boston).

Berkshire recorded an after-tax charge of $3.5 million for its restructuring. Earnings were also lowered by a 42.2% increase in its loan-loss provision from the second quarter, to $19.2 million, as a result of a rise in nonperforming assets.

For the quarter, Berkshire recorded a loss of $2.1 million, compared with net income of $4.7 million for the third quarter of last year.

Banks' loan growth also ebbed, mainly because of the housing market's cooling. Friedman Billings' analysis pegged the median loan growth at 2.19% for the third quarter, compared with 2.56% a year earlier.

"There's been more competition on both pricing and structure - higher loan-to-value ratios, banks being less stringent on loan guarantees," said Kevin Timmons, an analyst at CL King & Associates Inc. in Albany, N.Y. But even with the relaxing of underwriting standards, many companies still could not keep pace with former growth, he said.

Take the $4.3 billion-asset Sterling Bancshares Inc. in Houston as an example. It posted organic loan growth of 9% from the second quarter, to $3 billion, excluding $151 million of loans added after Sterling bought Bank of the Hills in Kerrville, Tex.

That's off from double-digit increases in each of the last five years, said Brett Rabatin, an analyst at First Horizon National Corp.'s FTN Midwest Research Securities Corp. in Nashville.

Sterling has faced increasingly stiff competition from other lenders for small commercial and industrial loans, as well as a slowdown in commercial real estate lending as borrowers pay off their loans to refinance into lower, fixed-rate loans from conduits and other sources, he said.

Some companies in California - one of the country's most vibrant markets - continued to post strong loan growth for the third quarter, Mr. Rabatin said.

So did a number of Pacific Northwest banks, particularly those north of Seattle. James Bradshaw, an analyst at D.A. Davidson & Co. in Portland, Ore., said the economy in that area is benefiting from Boeing Co.'s expansion of its airplane manufacturing operations.

The $1 billion-asset City Bank in Lynnwood, Wash., posted total loan growth of 26.2% from the second quarter, to $922 million. The bank also beefed up its impressive net interest margin, which grew 147 basis points from a year earlier, to 7.99%. Variable-rate loans made up more than 97% of its portfolio, and they reprice faster than its deposits, the company said. Third-quarter earnings rose 56.55%, to $9.9 million.

Friedman Billings' analysis also found nonperforming assets as a percentage of total assets rose 3 basis points, to a median of 0.26%. Net chargeoffs were stable at 0.08% of average loans.

Jeff Davis, another FTN Midwest analyst, said he expects chargeoffs and other credit costs to rise next year, leading banking companies to bolster their loan-loss reserves. Earnings may be dampened by the provision increases, and many companies could post single-digit earnings increases over the next year, he said.

Still, chargeoffs should remain well below the expected long-term loan-loss rates for the industry, which range from 0.35% to 0.45% of total loans, he said.

"Credit costs will continue to be very low, and so banks will continue to be very profitable in spite of lower earnings," Mr. Davis said.