WesBanco in Wheeling, W.Va., had a strong advocate as it pursued Farmers Capital in Frankfort, Ky. — the former CEO of one of its recent acquisitions.

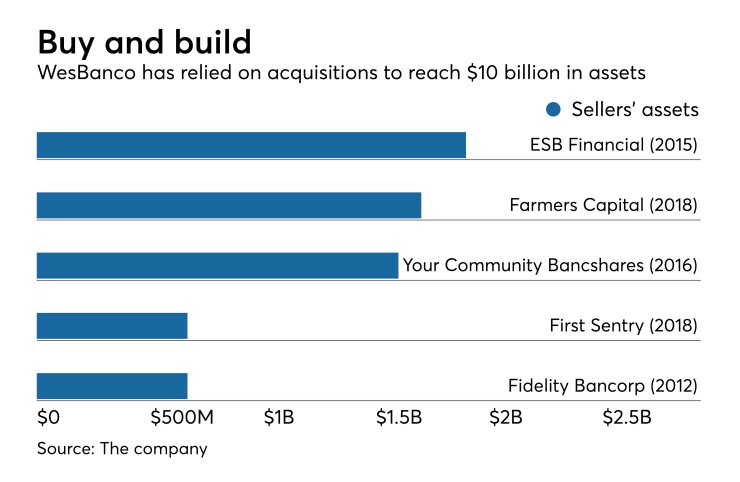

That person was Jim Rickard, a regional president and former CEO of Your Community Bankshares. The $10 billion-asset WesBanco bought his bank in 2016.

He already knew the CEO of Farmers Capital, Lloyd Hillard. Their August meeting, an annual tradition between the two business acquaintances, gave Rickard a chance to tout his new employer as a good bank to sell to, according to a

While Hillard initially demurred, telling Rickard that Farmers Capital viewed itself as an acquirer, the conversation set the stage for a

The behind-the-scenes view provided by the filing shows the importance of personal relationships in bank M&A — and more specifically, the strategic value of keeping leaders of acquired institutions in the fold.

Rickard would arrange an Oct. 11 dinner with Hillard and Todd Clossin, WesBanco’s president and CEO. Hillard reiterated during that meeting that the $1.7 billion-asset Farmers Capital wanted to buy banks instead of being sold to one.

However, Farmers Capital, which had recently resolved an enforcement action taken by regulators, had been less successful at making acquisitions, the filing said. It effort to buy an unnamed institution failed in December after the target told Farmers Capital that it was unwilling to sell.

By that time, Farmers Capital had received an initial all-stock offer from WesBanco valued at $361 million to $391 million, or roughly 183% to 198% of its tangible book value. That led to another meeting between Hillard and Clossin, where Clossin revealed that WesBanco, using publicly available information, “had already performed limited due diligence on Farmers Capital."

WesBanco in mid-January raised the low end of its offer range to $376 million, keeping the $391 million maximum. Farmers Capital’s board then authorized Hillard, with the assistance of an investment bank and legal counsel, to try to negotiate with WesBanco.

The companies in mid-February agreed on a nondisclosure agreement and a revised nonbinding indication of interest. That allowed each bank to create virtual data rooms and conduct more in-depth due diligence, the filing said. Several meetings and on-site visits followed.

Clossin met with Farmers Capital’s board on March 12, engaging “in a lengthy question-and-answer session,” though the filing did not disclose any of the topics that were discussed.

The offer was tweaked on April 8, at Farmers Capital’s request, to include a 10% cash consideration.

Directors at WesBanco and Farmers Capital unanimously approved the merger during separate meetings on April 19. The deal, which ended up near the low end of WesBanco’s range, priced Farmers Capital at 195% of its tangible book value. Closing is expected in the second half of this year.

The deal “significantly expands” WesBanco’s operations in Kentucky and bridges a gap it has between Louisville, Ky., and Huntington, W.Va., Clossin said in a release announcing the deal. The acquisition would also give WesBanco its first branches in Frankfort.

Excluding $22.3 million in merger-related charges, the deal should be about 3% accretive to WesBanco’s 2019 earnings and 5% accretive the next year. WesBanco said it expects to cut Farmers’ annual noninterest expense by about 35%.

WesBanco also plans to keep Hillard, who is set to become chairman of the company’s central and southern Kentucky market. In addition to a $1.7 million buyout of his Farmers Capital employment agreement, Hillard would receive a $275,000 annual salary in his new position. He would eligible for a $250,000 bonus if he stays with WesBanco through Sept. 30, 2020.

Hillard will also have a one-year noncompete agreement with WesBanco, which is far shorter than the three-year arrangement he has with Farmers Capital.