- PH

American Express and Discover Financial Services are eliminating overlimit fees on consumer credit cards, in one of the first concrete examples of how a new law will restrict issuers' abilities to turn a profit.

August 7 -

A key measure of profitability at banks' credit card operations plummeted last year to its lowest level in more than two decades, though these units continued to outperform the rest of the industry, according to the Federal Reserve.

June 30 -

In reaction to legislation enacted last week, credit card issuers are expected to retool their operations in a host of ways — not all of them obvious.

May 26 -

A major credit card issuer has found a certain risk prevention measure not worth the trouble.

March 30

Citigroup Inc. has started adding annual fees to some of its existing credit card accounts in one of the first such attempts by a major issuer to offset the effects of the government's crackdown.

Card executives and industry members have predicted a widespread return of the annual fee, currently reserved for rewards-rich cards, since President Obama signed the Credit Card Accountability, Responsibility and Disclosure Act in May.

Citi's new charge, which kicks in if a cardholder does not spend enough, is one of many different annual fee experiments that industry members anticipate in the next six months.

Now that Citi has taken the plunge, "I expect testing of annual fees to accelerate," said John Grund, a partner at First Annapolis Consulting Inc. "It will be gradual, and they will become more prevalent, but they might not be on every product."

Samuel Wang, a Citi spokesman, said by e-mail on Wednesday that the company has "adjusted pricing and card terms for some customers as part of our regular account reviews. … As part of this change in terms, a small number of Citi customers may be notified of an annual fee."

Wang, who cited "the dramatically higher cost of doing business in our industry," would not provide further details.

But according to posts on several different consumer blogs and online discussion boards this month, including

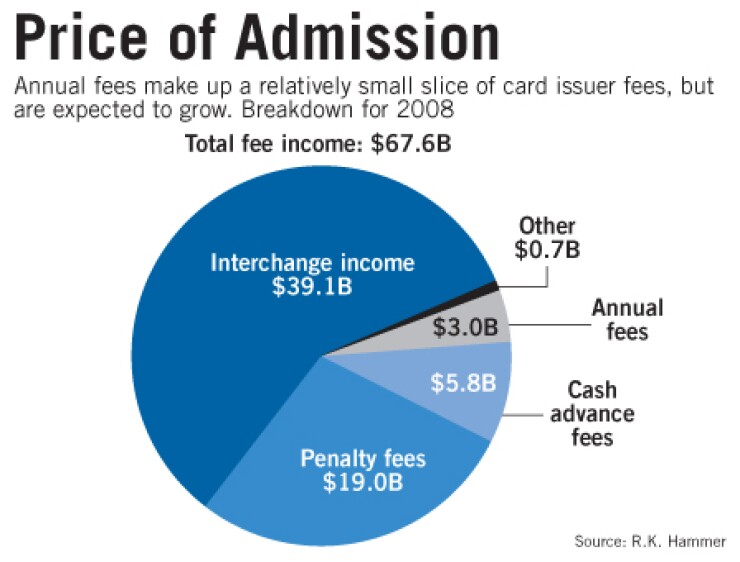

Annual fees, once common, largely disappeared in the 1990s, and last year accounted for only 4%, or $3 billion, of issuers' total fee income, according to the card advisory firm R.K. Hammer.

But Robert Hammer, the Thousand Oaks, Calif., firm's chief executive, said Thursday that he expects that number to "rise substantially" in the next six months, and predicted that by 2010 issuers will earn at least $9 billion from annual fees.

"It's a necessary cost of doing business" in light of the law's restrictions on interest rates and other pricing, he said. "The old business model's been pretty much decimated."

But as more issuers look to introduce annual fees, Grund cautioned that "not everyone's going to be able to get away with it."

"There's a punitive use of annual fees — 'I'm only going to retain you as a customer if it's under profitable terms' — and then there's a discriminatory use of annual fees — 'To achieve certain rewards, you're going to have to pay up,' " he said.

"On the most profitable segments, you don't want to spur attrition and you don't want to 'fire' the customers, so that annual fee had better come with better rewards."

JPMorgan Chase & Co. has already tested both the carrot and stick methods to some extent.

It restructured its rewards program this year, giving its Freedom cardholders the choice between fewer rewards (on more types of transactions) or paying a $30 annual fee for an "upgraded" program.

Last year, before the law was enacted, JPMorgan Chase attempted to add a $10 monthly fee to some accounts, but after cardholder protests and lawsuits, it reversed course in March and refunded the fees. (A spokeswoman did not return calls about its current annual fee plans.)

Bank of America Corp., Discover Financial Services and American Express Co., which already charges annual fees on many of its credit and charge cards, all said they had not added any annual fees to their cards or existing accounts since May, but would not comment on future plans.

Pam Girardo, a spokeswoman for Capital One Financial Corp., said by e-mail that it has "not made any adjustments to our fees for existing cardholders.

Industry experts predicted that more issuers will follow Citi's lead, especially in the next six months, before the law's February deadline for full compliance, which could complicate the process of introducing annual fees.

The law "does not generally prohibit card issuers from imposing new annual fees on existing credit card accounts after the Act's February 22, 2010, general effective date (or at any other time)," Duncan Douglass, a partner at the law firm Alston & Bird LLP, wrote in an e-mail.

But "annual fees that apply to one or more subsets of the issuer's credit card accounts may carry greater risk of being covered by the outstanding balance limitations, particularly if the affected accounts are those carrying outstanding balances."

Under the new law, after Aug. 20, issuers will have to give cardholders a 45-day prior notice of any new or increased fees, including annual fees.

Douglass said that requirement should not create "too great a barrier to an issuer's implementation of annual fees after February 22, 2010," but "that being said, there's less legal risk to doing it now than after February 22."