Emergency savings are up. Travel goals are down. People are stepping up their home improvements and doting on pets.

Those are some of the trends on banks’ budgeting apps since the coronavirus pandemic was declared in March.

User activity in budgeting tools from Cincinnati-based Fifth Third Bancorp, Radius Bank in Boston, Simple (which offers accounts in partnership with BBVA USA) and others shows that customers are becoming more scrupulous savers and rethinking how they allocate their discretionary income. By examining customers’ behaviors as well as which features have gotten more play during the pandemic, banks can glean insights into what consumers are looking for in their budgeting apps.

“People are more conscious of where their money is going, thinking more medium- and long-term than before and being more vigilant in terms of keeping on top of finances,” said Chris Tremont, executive vice president of virtual banking at Radius Bank. The online bank, which has more than $1.4 billion in assets, saw a 13% increase from February to April in users linking external accounts in its personal finance management tool.

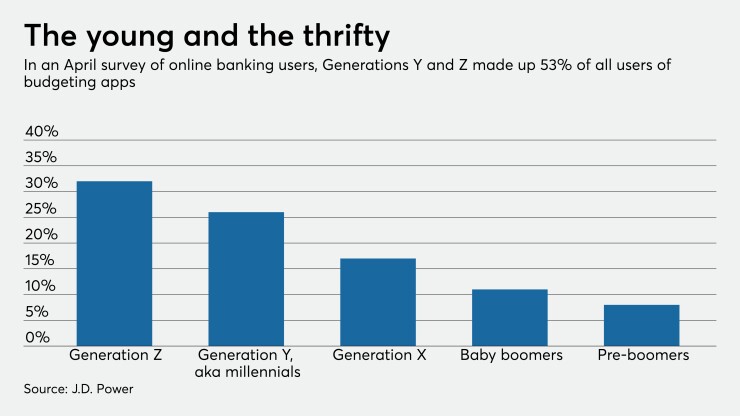

In a May survey of consumers regarding the impacts of COVID-19, J.D. Power found that 17% of bank customers in Generations Y and Z specifically stated that they would like to receive information from their bank about financial planning or budgeting tools. Age was the most important factor in determining who uses these tools, and J.D. Power also found that household income or total deposit balance had little impact on whether a customer would use their bank’s budgeting features.

“With COVID-19, expense tracking and budgeting is an important financial need for Generation Y and Z consumers,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power.

The pandemic seems to be a good time for all consumers to focus on budgeting tools that are available to them, especially for those who find they have more time on their hands.

“Most consumers who need budgeting help don’t have the time or bandwidth to focus on it,” said Rob Levy, vice president of research and measurement at the Financial Health Network. “Banks should be promoting their available tools widely and increasing the functionality and ease of use of their tools so that customers will keep using them as things slowly return to some semblance of normal.”

Goals and savings

Savings are way up among budgeting app users — especially those earmarked for emergencies.

“This might seem counterintuitive given the high levels of unemployment, but the combination of stimulus payments, increased unemployment insurance and reduced expenses have resulted in a net financial surplus in the short-term for many people,” Levy said. “Plus, the saliency of the current crisis can encourage people to save for the next one.”

By analyzing activity in its budgeting app Dobot (pronounced DOUGH-bot), the $185-billion Fifth Third has seen savings increase while withdrawals decrease.

“The big thing we were wondering about during the crisis was, would people start withdrawing en masse or would they double down?” said Mike Crawford, vice president, senior manager of digital-first product development at Fifth Third. “We’ve definitely seen people double down in their behavior around saving.”

Simple customers' emergency fund balances rose 25% from the pre-pandemic period of Jan. 1 to March 15 to the March 15-to-May 31 period. Balances in “protected goal” checking accounts, which are high-yield accounts meant to shield funds from routine spending, increased 15% in the same time frame.

Among Qapital's nearly 2 million users, the number of savings goals for emergencies rose more than four times from March to May. And in a survey of its users in May, the budgeting app You Need a Budget, or YNAB, found that the most popular use of stimulus money was to add it to an emergency fund.

At the same time, many consumers have seen their income fall or they struggled to access government benefits, Levy said. But budgeting tools can still help users save more, even if they can’t achieve the optimal six months’ worth of emergency funds.

“Research shows that even four to six weeks of savings can be enough to weather most common emergencies, and smaller goals are often more motivating,” Levy said. “Budgeting apps should help users set these types of achievable goals and celebrate progress along the way.”

Dobot lets users schedule their savings themselves or delegate the task of determining and transferring appropriate amounts to Dobot’s algorithm. The team behind Dobot has noticed that the percentage of people who automated their savings has declined slightly, suggesting that users want more control over money right now, Crawford said.

Simple has its own tactic to encourage saving: Users can enable a feature called Round-up Rules, which rounds up what a customer spends to the next whole dollar amount, and transfers that additional amount to any customer-designated account. Simple saw the number of Round-up Rules sign-ups nearly double when people received their stimulus checks.

More discretionary goals have not always fared as well as emergency funds. Simple, for example, saw a 45% decrease in the creation of travel goals between the periods of Jan. 1 to March 15 and March 15 to May 31, while discretionary goals related to home furnishings doubled.

“To be more sensitive to the economic situation of our customers, we have muted positioning more aspirational goals such as ‘trip to Hawaii’ and focused instead on the needs of the current situation such as ‘establish an emergency fund,’” said David Hijirida, CEO at Simple.

Dobot noted a 30% decrease in travel goals (including a 50% decrease in cruise trips), but a 600% increase in pet-related goals and 45% increase in goals related to debt and credit card payments, all roughly between the pre-pandemic months of January and February and the three months since as the crisis intensified.

Other ways to engage

The team at Radius has noticed more users actively categorizing their expenses, “whereas before, they maybe wanted to calculate their net worth or were looking at overall spending, but not categorizing,” said Kathleen Barrett, vice president of marketing at Radius.

The data company MX categorizes transactions in Radius Bank’s personal finance management tool based on merchant codes, such as “auto and transport” or “food and dining.” Within the budgeting portion of the tool, customers can drill down further into more specific categories, such as “gas” and “parking.” More customers have also been adding their own tags on top of preset categories, such as vehicle type under the auto insurance category.

Recently, customers have been requesting a “business/work expense” category, which is not currently available from MX.

Pandemic or not, Fifth Third has been trying to make the entire Dobot experience more engaging — and fun.

Dobot (which is available nationwide, including to those without Fifth Third accounts) has long offered a joke or tip to users on Tuesdays, but has recast those right now; for example, the Tuesday tip may recommend saving for post-pandemic meetups or vacations.

And the app has changed the way users can fill out their profiles, interviewing them in a conversational tone about themselves and their habits to better tailor its advice, and offering reassurances when customers express worries about their finances — “Most people worry about finances, and I’m here to help."

“This area feels very form-driven, but we’re trying to make it more approachable, akin to more of a BuzzFeed quiz,” Crawford said.

To ease people in, the first question — who is your favorite robot? — has nothing to do with finance. The options are R2D2, Wall-E, Hal 9000 and Baymax.