Chief executives at the biggest U.S. regional banks are asking U.S. lawmakers to consider easing capital requirements and repeal part of the Dodd-Frank financial overhaul that caps fees banks charge retailers on debit-card transactions.

Regional banks don’t pose risks to the financial system that have caused concern among policymakers, executives of 18 banks said in a Feb. 13 letter to the top Republican and Democratic lawmakers in Congress. The banks include U.S. Bancorp, PNC Financial Services Group, and Capital One Financial.

Financial regulations should be "appropriately tailored" to regional banks and Congress should review the impact regulations adopted after the 2008 financial crisis have had on the industry and U.S. economy, according to the letter.

President Donald Trump has directed regulators to review financial rules and report back on suggested changes within 120 days, one of the first steps his administration has taken to do "a big number" on Dodd-Frank. Major changes to the law would need to be made by Congress.

The bank CEOs’ top priorities in Washington also include a corporate tax rewrite and requiring regulators to do a cost-benefit analysis for all new rules.

Congress should also eliminate a controversial provision, known as the Durbin Amendment, that capped swipe fees on debit cards. Banks have been fighting to repeal the provision for years, arguing that their costs have increased and the government shouldn’t set prices. Retailers say the cap helps maintain lower prices for consumers at the register.

The banks said lawmakers should consider simplifying various requirements about how much capital banks should hold as mandated by the 2010 Dodd-Frank Act and international standards adopted after the financial crisis.

Last year, the U.S. House passed legislation that would free regional banks from some of the stringent capital requirements and tough oversight that is now applied to all firms with more than $50 billion of assets. Steven Mnuchin, Trump’s nominee for Treasury secretary, has touted his credentials as a former regional banker and said it’s a priority for the incoming administration to tweak parts of Dodd-Frank that apply to smaller lenders.

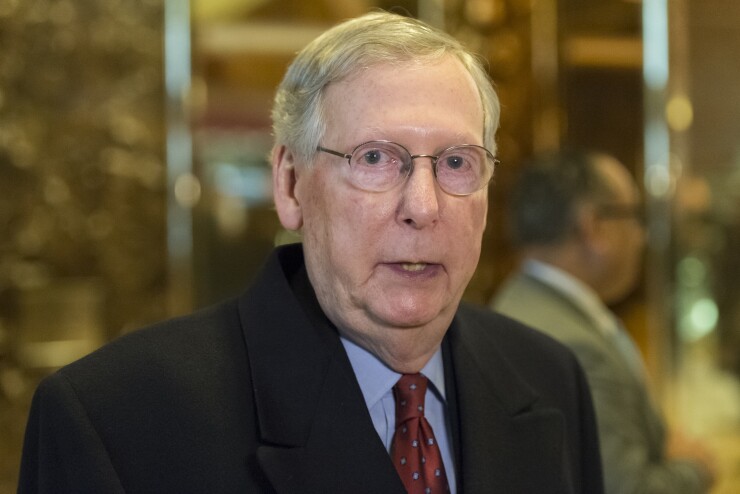

Leaders of SunTrust Banks, BB&T, and Discover Financial Services also signed the letter. It was addressed to: Senators Mitch McConnell, a Republican Kentucky who serves as majority leader; Chuck Schumer of New York, the top Democrat in the Senate; as well as House Speaker Paul Ryan, a Republican from Wisconsin; and Minority Leader Nancy Pelosi, a Democrat from California.