Skeptical investors and unpredictable market conditions have made life-cycle funds a popular investment option that is gaining assets rapidly while other mutual funds remain flat.

Analysts and executives say the popularity of these ready-made funds that focus on asset allocation is good news for banks but may be bad news for advisers.

"These products are not great news for advisers who feel that, perhaps justifiably, they can add more value to asset allocation and that they can tailor investments a little closer to the needs and goals of their clients rather than just buying an allocation off of the shelf," said Michael Porter, a senior research analyst at Lipper Inc., a Reuters company.

"This is good news for banks," he said. "This a product in great demand, and banks can sell it over the counter and gather a lot of assets with it through their branches."

Executives at CitiStreet - the retirement savings business jointly owned by Citigroup Inc. and State Street Corp. - and Wells Fargo & Co. said their life-cycle funds have enjoyed strong demand. And an executive at Bank of America Corp.'s asset management arm, noted that his company keeps advisers involved by offering asset allocation products rather than life-cycle funds that automatically rebalance.

Lipper's Mr. Porter said ever more banks are opening life-cycle funds as the product gains momentum. Since the end of 2003, he said, the life-cycle fund total has grown to 78, from 60, and he expects it to reach 100 by yearend.

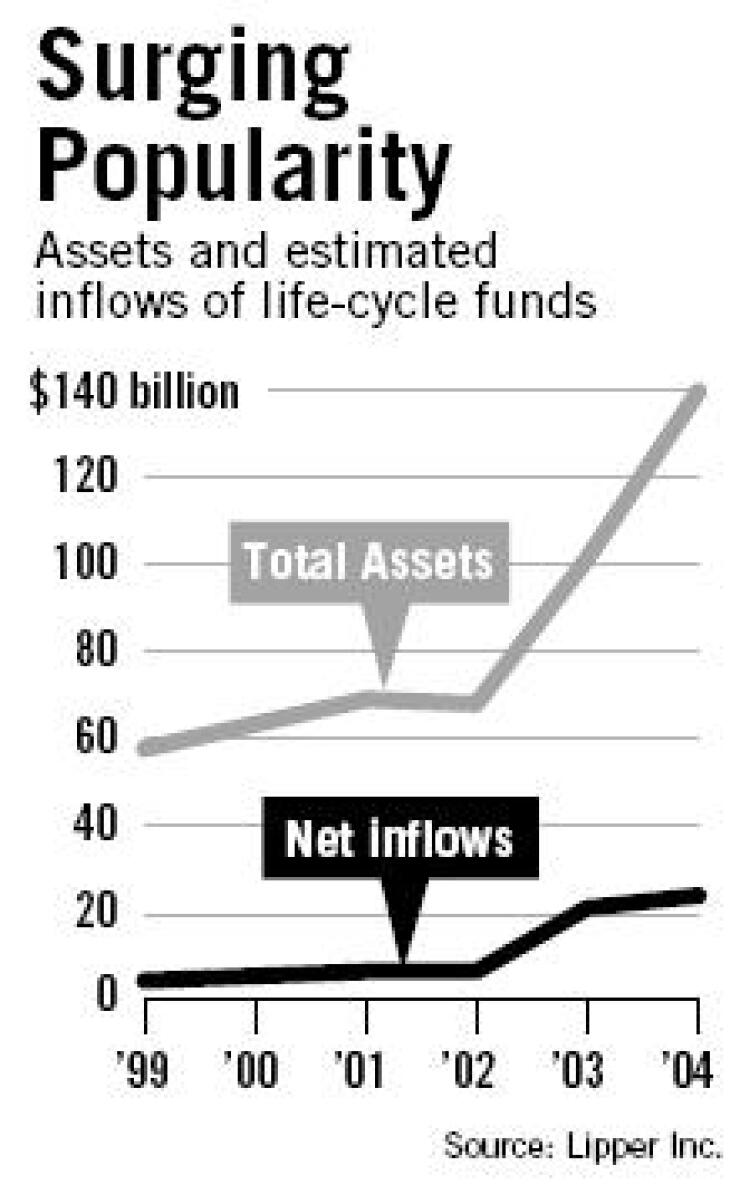

Assets in life-cycle funds rose 37.8% last year, to $139.7 billion, Lipper reported in March.

Mr. Porter said the funds have grown quickly in the past three years because investors know they need to be investing but are wary about accepting investment guidance from advisers. The two types of life-cycle portfolios, lifestyle funds and target-date funds, make predetermined asset allocation decisions based on a customer's time horizon and aversion to risk. These funds are very popular in retirement plans, he said.

"Americans are very underfunded in terms of retirement, and I think a growing number of Americans are recognizing that," he said. "These funds address a lot of the problems and concerns people have. They are a one-stop shop."

Marianne Sullivan, a senior vice president for investment client services at CitiStreet in Quincy, Mass., said 70% to 80% of requests for proposals to supply retirement plans require provider companies to offer target-date funds as an option in a 401(k) program.

Companies like Barclays, Vanguard, Fidelity, and T. Rowe Price are the top providers of life-cycle funds, Ms. Sullivan said, but others are joining the fray.

"These types of funds are gaining a lot of steam and momentum right now," she said. "They have really caught a tailwind as everyone wants to get into this market."

Andrew Owen, a Wells Fargo senior vice president in the product management group, said the San Francisco banking company has been offering life-cycle funds since 1994. It has five target-date portfolios called the Outlook Funds. These funds - Outlook 2040, Outlook 2030, Outlook 2020, Outlook 2010, and Outlook Today - alter their allocations as they get closer to maturity.

The five funds have $1 billion of assets, he said, and the 20 asset allocation and life-cycle portfolios in the Wells Fargo Advantage fund families have $7 billion. These funds have grown considerably in the past two years because of sustained market doldrums, concerns about Social Security, and an increase in life expectancy, he said.

Mr. Owen said he expects this growth to continue, though the life-cycle fund market remains dominated by a few large players. Two companies, for example - Fidelity Investments with a 33% share, and Vanguard with 16.6% -have nearly half the market, according to Lipper.

Banks and other smaller providers are well positioned to gather share, Mr. Owen said.

"There is a tremendous opportunity for Wells Fargo's Outlook Funds in the 401(k) market and with individual investors, and we are always looking for ways to enhance the funds and provide a better risk profile and total return," he said.

CitiStreet's Ms. Sullivan said she believes there is room for both life-cycle funds and advisers to grow.

"In my mind, the major detriment with life-cycle funds is that they don't account for investments people have outside of the funds," she said. "It is nice to set it and forget it, but as people age they get more investments and they need an adviser to balance everything. I think that one can supplement the other."

Dave Feldman, a national sales manager in the financial institutions division at Bank of America's Columbia Asset Management, said Columbia offers asset allocation funds in order to keep advisers involved in rebalancing.

Columbia's four Nations LifeGoal Funds are rebalanced by advisers at appropriate times, he said. The family has $1.3 billion of assets, and it will have grown 43% in the first half of this year compared with the preceding six months, he said.

Mr. Feldman said that incorporating an adviser with these funds enables Columbia to gather assets and develop relationships before people become wealthy.

"Historically, advisers work with high-net-worth clients, and smaller clients use mutual funds," he said. "These asset allocation funds allow advisers to work with smaller clients. These smaller clients get the diversification they are seeking, and advisers are getting access to customers earlier."