Sports fans entering stadiums and arenas are being introduced to an increasingly crowded field of fintech and crypto logos, prompting incumbent banks to rethink their sponsorship strategies.

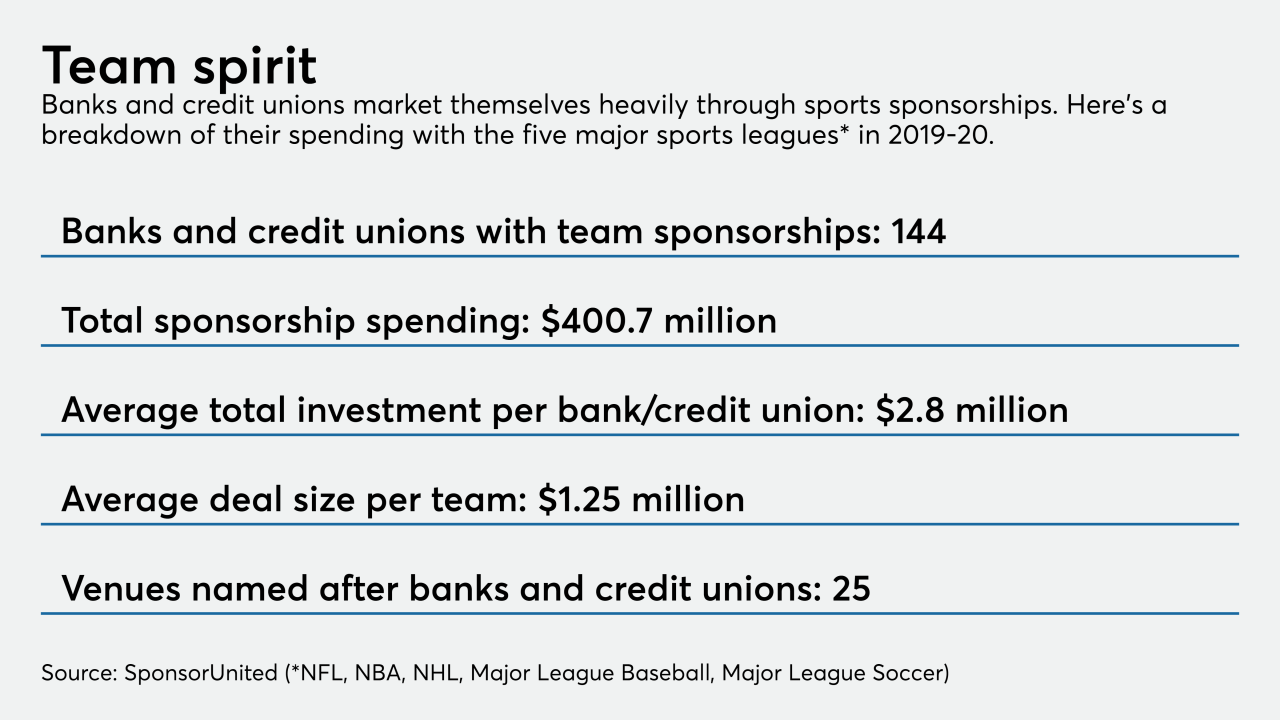

The sports marketing market offers a way for corporations to place their brands in front of large and engaged audiences. Financial services companies spent over $770 million last year among the 151 major professional sports teams, according to a new report from the data provider SponsorUnited. The market has traditionally been dominated by banks, which accounted for 58% of sponsorship deals with North American sports and athletes in 2021.

But as the fintech and cryptocurrency markets surge, companies offering those products are using sports marketing to build brand recognition.

Banks, in turn, are looking for ways to differentiate themselves, often by producing content that tells a story about their connections to local communities, said SponsorUnited President Bob Lynch.

“How much more brand exposure do you need from a sign on a stadium?” Lynch asked during a recent interview. “That might not be as valuable as the other ways in which you can get people engaged.”

Kevin Rochlitz, chief sales officer for the NFL’s Baltimore Ravens, said he’s seen greater interest from the team’s sponsors in creating “storytelling content” that highlights how a company impacts the fan base’s community.

“They see it as a great way to connect with the consumer,” Rochlitz said, adding that M&T Bank, the Ravens’ top sponsor, has produced video features about working with the team on Baltimore-area community initiatives.

For Buffalo, New York-based M&T, sponsoring the Ravens is “not about name recognition, it’s about connecting,” said Francesco Lagutaine, the bank’s chief marketing, communications and digital officer.

The $155.1 billion-asset bank has sponsored the Ravens since 2003. In addition to owning the naming rights at the Ravens’ home stadium, M&T has worked closely with the Ravens to create “community-based initiatives” near Baltimore, including a program that supports local schools, Lagutaine said.

M&T Bank’s logo appears alongside the Ravens’ logo in television commercials, online videos and in-stadium videos highlighting those initiatives.

“Engagement is created through storytelling,” Lagutaine said. “The reason why storytelling is important is because it creates compassion and unity in the communities where we serve.”

Crypto companies and fintechs, many of which are still not household names, generally appear to be more focused on building brand recognition.

Last year, crypto was the fastest-growing category of sports sponsorship deals, increasing from just five the previous year to 116, according to SponsorUnited. Meanwhile, fintech companies ranked third among the most-searched brands, with more interest given to brands like Block’s Cash App and Robinhood than American Express and PNC Bank.

Today, the fintechs Chime and LendingTree have sponsor patches on the jerseys of NBA teams. The Miami Heat and the Los Angeles Lakers play in arenas that are named after crypto companies. And in February, Major League Baseball’s Washington Nationals agreed to a partnership with the crypto firm Terra to develop new ways for fans to spend money at the ballpark.

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

Fintechs and crypto companies are contributing to overall growth in sports marketing by financial-services brands. The number of such brands that buy sports sponsorship and media deals has increased by 20% since 2018, and the number of deals has increased by 46%, according to the SponsorUnited report.

SoFi, a digital banking company, owns the naming rights for the 70,000-seat football stadium in Inglewood, California, where the Super Bowl was played in February. The 20-year naming rights deal offered a way to “increase our footprint” and bring “the opportunity to experience the SoFi brand in-person,” said Lauren Stafford Webb, the company’s chief marketing officer.

“We’ve been able to build momentum with our sports marketing initiatives from lighter sponsorships and advertising efforts to enduring platforms that support relationship-building with audiences at scale,” Webb said in an email.

Sports sponsorships provide an opportunity for fintechs and crypto companies to show that digital commerce is “not a flash in the pan,” Lynch said. “Sports have a unique ability to provide a large platform to engage.”